Image source: Getty Images

B&M European Retail Value (LSE:BME) is on my list of stocks to consider buying right now. With a drop of 29% since the beginning of the year, the dividend yield has reached 3.7%.

Additionally, I think the stock market underestimates the company's growth prospects. While there are challenges, there are also clear opportunities.

Why is the stock down?

B&M is not an obvious choice, by any means. Compared to others FTSE 100 stock, has quite significant short interest and the share price recently hit a new 52-week low.

Competition is the main reason for this. The company aims to differentiate itself with low prices, but companies like tesco and sainsbury We have been competing hard in this area.

Large supermarkets also offer a wider range of products. That means that unless B&M can significantly lower its prices, customers have an incentive to go elsewhere.

As cost of living pressures begin to ease, finding discounts has become less important to shoppers. And this has been reflected in B&M's results.

In its most recent update, the company reported a 3.5% drop in comparable sales. That means its stores generated less revenue than in 2023.

The risk of this continuing is why analysts at USB have a “sell” rating on the stock. But I think there is another important metric that investors should pay attention to.

Store expansions

Individually, B&M stores could be less profitable than a year ago. But there are many more and this has more than made up for weak comparable sales.

Adjusting for currency fluctuations, the company's total sales increased 2.4%. This was the result of new stores opening throughout the year, with another 26 expected in the next nine months.

Ultimately, B&M hopes to reach 1,200 outlets, far more than its current base of 741 stores. If it can pull this off, or something like it, I think the stock is a bargain right now.

Over time, I expect a larger number of stores to more than offset the low comparable sales growth. And with the stock at a price-to-earnings (P/E) ratio of less than 11, it doesn't need to grow much.

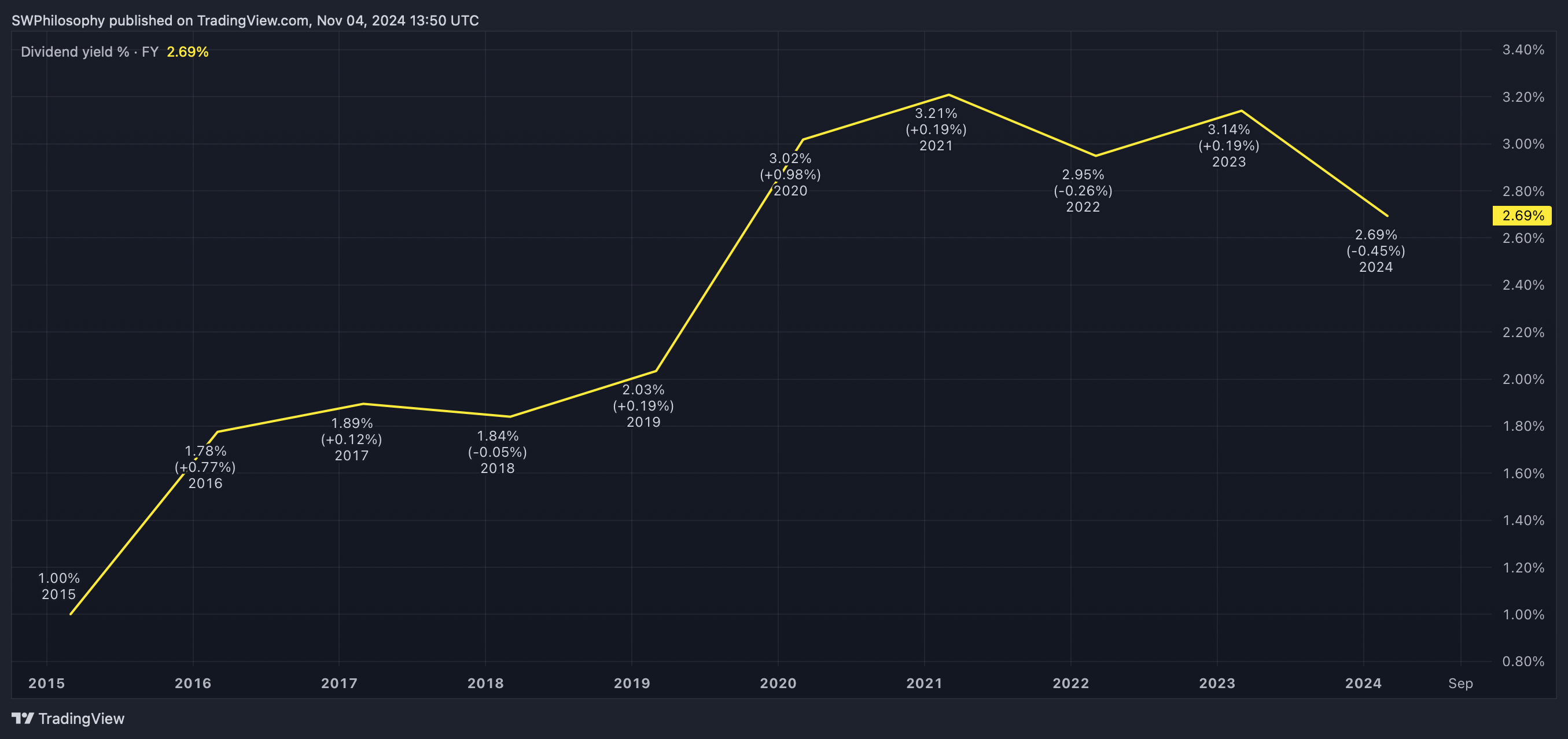

From a passive income perspective, the decline in share price has led to an increase in dividend yield. At 3.7%, the initial yield for investors is the highest in the last 10 years.

B&M Value Retail Dividend Yield 2015-24

Created in TradingView

Given that B&M retains more than 50% of its profits, I think the chances of a dividend cut are low. That means there could be growth and income ahead, a powerful combination for investors.

Is it time to buy?

I'm not sure there has ever been a better time to buy B&M shares than now. Competition in retail will always be intense, but I think the current share price more than reflects that.

The company will present its results at the end of this month. I will look at them with interest before making a decision on adding the stock to my portfolio.