Image source: Getty Images

Bank stocks have erased their gains from earlier this year. This stems from the collapse of one of the largest banks in the US, Silicon Valley Bank (SVB). This sparked fears of contagion about other banks and whether they are actually safe investments. So, have I made a mistake investing in bank stocks?

losing credibility

Due to the inherently different business model of banks compared to other companies, investing in them can be quite risky. That’s because they trade with leverage. In other words, banks use their customers’ deposits to finance their assets, such as loans and investments, and make a profit on them.

This is risky because in the event that those assets lose their value and customers come asking for their money, the bank may have to sell those assets at a loss. And if enough of those assets are liquidated, the bank may collapse, as happened with SVB and Signature Bank earlier this month.

As such, banking as an industry is only as strong as customer trust. Once it is lost, banks can go under quickly and easily, no matter how strong their fundamentals.

Therefore, it is not surprising to see the recent liquidation of bank shares. Investors fear the dominoes won’t stop falling, with the biggest banks next, and swiss creditThe recent demise of ‘s has only made the sentiment worse.

High risk, low reward?

There is a notion that taking big risks has the potential to yield big rewards. However, that is not always the case, and banks are a prime example of this. Even the FTSE 100best performing bank stocks (lloyds) does not even come close to replicating the success of S&P 500 In the last five years.

This is because bank stocks tend to be cyclical in nature, meaning they only do well when certain economic and business conditions are right.

Lenders tend to do better in a prosperous economy and when interest rates are higher. But with a slow-growing economy and interest rates hovering near zero for the past decade, it’s no wonder Lloyds shares have held steady.

Therefore, if rates remain in the golden zone (2%-3%) in the medium to long term, bank shares could start to rise. This is when interest rates are high enough to generate interest income and low enough to stimulate economic growth.

Is it worth buying bank shares?

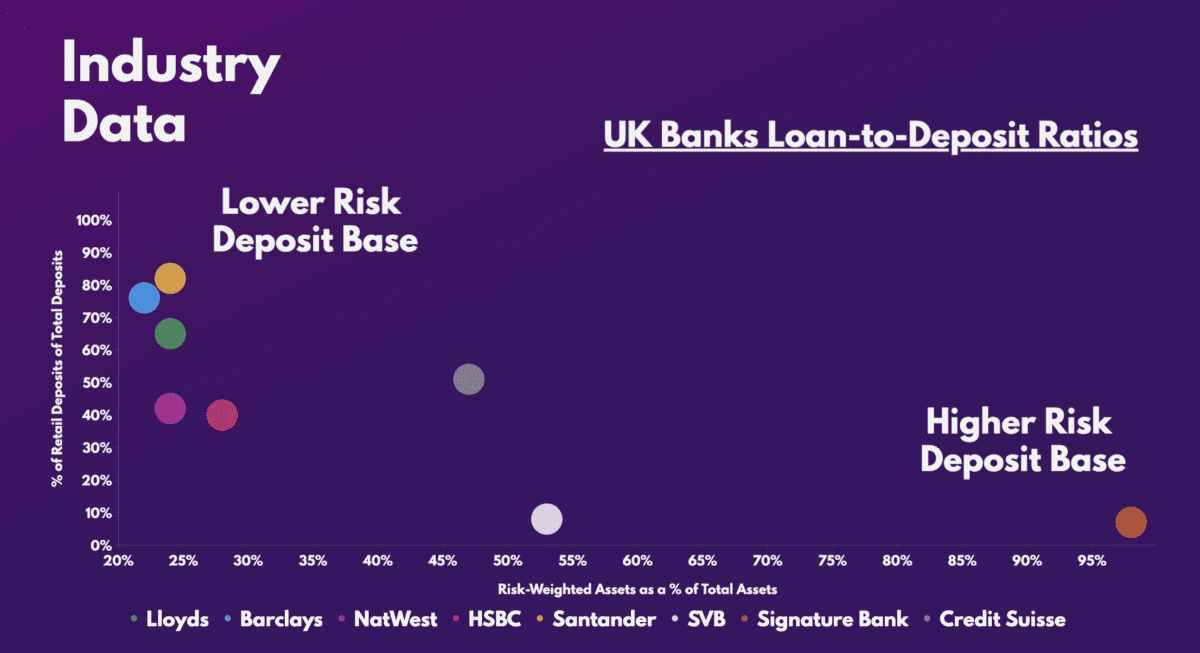

That said, it doesn’t change the fact that banks are still risky investments. Your finances are complex and your balance sheets may have many unrealized losses that are not disclosed. For that reason, it is important to invest in banks with strong liquidity and low-risk deposit bases, such as those in the UK.

This is due to the fact that UK banks are more strictly regulated. They hold significantly fewer risk-weighted assets and a larger share of customer deposits is insured by the Financial Services Compensation Scheme. This means that a bank run is less likely to occur.

Although bank stocks have not always been my cup of tea, I think the recent sell-off has presented buying opportunities that I cannot ignore.

Most of its valuation multiples are at decade lows, and given the margin of safety, the risk-reward proposition is certainly attractive. So I don’t think investing in bank shares was a mistake, at least not yet, and that’s why I’ll be looking to add more to my Lloyds position and buy names like barclays.

| Metrics | lloyds | barclays | NatWest | HSBC | Santander | industrial average |

|---|---|---|---|---|---|---|

| Price-to-book (P/B) ratio | 0.6 | 0.3 | 0.7 | 0.7 | 0.6 | 0.7 |

| Price-Earnings Ratio (P/E) | 6.1 | 4.3 | 7.0 | 8.9 | 6.0 | 9.0 |

| Forward price-earnings (FP/E) ratio | 6.5 | 4.5 | 6.0 | 5.4 | 5.7 | 5.6 |

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);