Last year, the Warren Buffett fund, Berkshire Hathawayinvested more than 4,100 million dollars in TSMC (NYSE:TSM). The Taiwanese company’s stock price had a terrible year, but here’s why I think it could be its best-performing stock for years to come.

Energized by growth

Many chip companies saw their profits and profits decline in 2022 due to skyrocketing inflation that dampened demand for electronics. However, TSMC managed to buck this trend and post extremely strong growth.

| Metrics | 2022 | 2021 | Growth |

|---|---|---|---|

| Net income | 75.880 million dollars | $56.82 billion | 33.5% |

| Gross margin | 59.6% | 51.6% | 8.0% |

| Diluted earnings per share (EPS) | $6.57 | $4.12 | 59.5% |

In fact, since Berkshire declared its position, TSMC shares are up more than 20%. By contrast, none of Buffett’s other investments have generated a higher return in such a short time.

While analysts aren’t optimistic about TSMC’s prospects in 2023, only angling for single-digit growth, it’s worth noting that the stock market trades based on future cash flows. This means that the bad figures for 2023 have already been factored into the price. After all, CEO CC Wei expects the semiconductor slump to bottom out in the first half of 2023 before recovering in the second half.

removing the competition

Like the Oracle of Omaha, I am personally involved in the Taiwanese firm. This is for a variety of reasons, but mainly because it’s one of a kind. The group is well ahead of its competition and is looking to widen the gap by introducing more dense and energy efficient chips.

TSMC expects to invest more than $32 billion in capital expenditures (capex) to produce its innovative 3nm chips. This is expected to be its golden nugget for the foreseeable future as customers move to improve its products with better processors.

Having said that, the large amount of capex could potentially hit EPS and see it grow negatively this year. However, I’m sure TSMC will be able to navigate this given its track record of underspending. For example, TSMC led a capex of $42 billion last year, but ended up spending just $36.3 billion instead. As a result, it would not be surprising to see it spend less than the $32-36 billion forecast for this year.

Smaller chips, higher margins

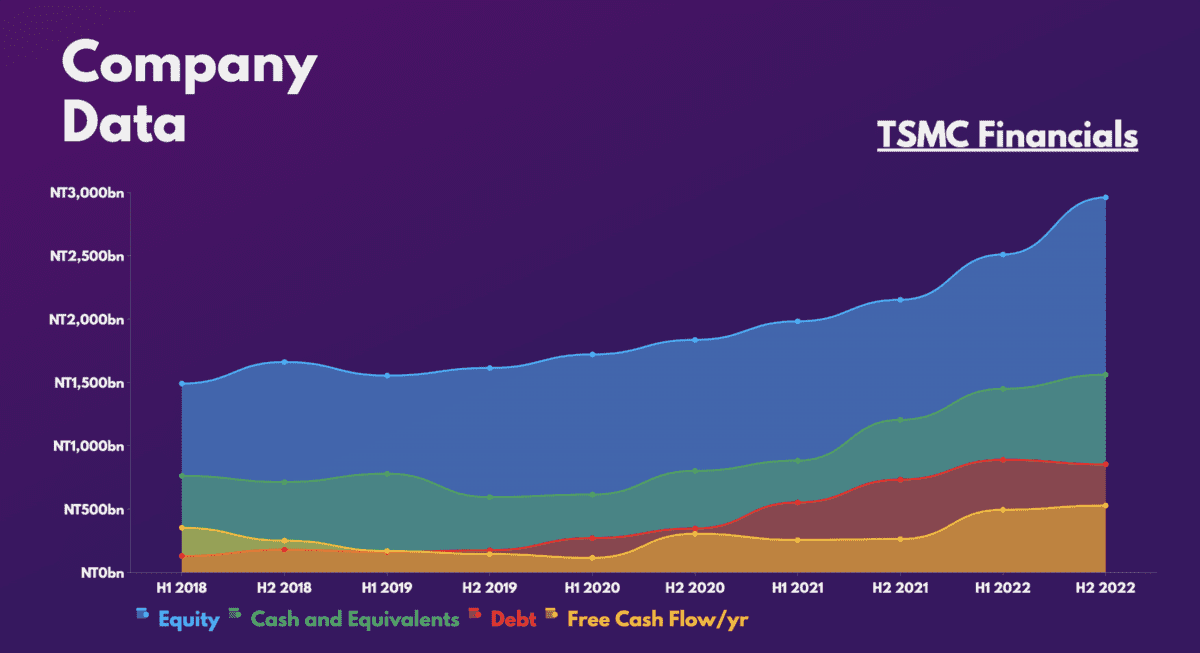

As Warren Buffett said, “look for companies with high profit margins”. And there is no better example than TSMC, which has seen its margins grow exponentially. The chip maker has managed its business very well over the years, keeping operating costs constant while increasing free cash flow and profits substantially.

Consequently, this has allowed him to build an extremely strong balance sheet, which Warren Buffett and I are huge fans of. With such a strong debt-to-equity ratio, I am confident in TSMC’s ability to navigate a prolonged slump in demand.

All of that said, it’s worth noting that TSMC shares only have a $104 average price target. This indicates just a 15% upside from its current share price, which isn’t ideal for a growth stock. . But given my intention to invest beyond a one-year time horizon, lower price targets are not a concern. The long-term upside potential of TSMC’s current stock price is large, especially considering a global economic rebound in 2024.

More lucratively, its forward valuation multiples indicate a cheap bargain for its tremendous growth potential. Therefore, I will buy more shares in due course.

| Metrics | valuation multiples | industrial average |

|---|---|---|

| Forward price-earnings (P/E) ratio | 15.5 | 28.0 |

| Price/Forward Sales (P/S) Ratio | 6.0 | 5.5 |

| Price to earnings growth (PEG) ratio | 0.2 | 1.2 |

NEWSLETTER

NEWSLETTER