Image source: The Motley Fool

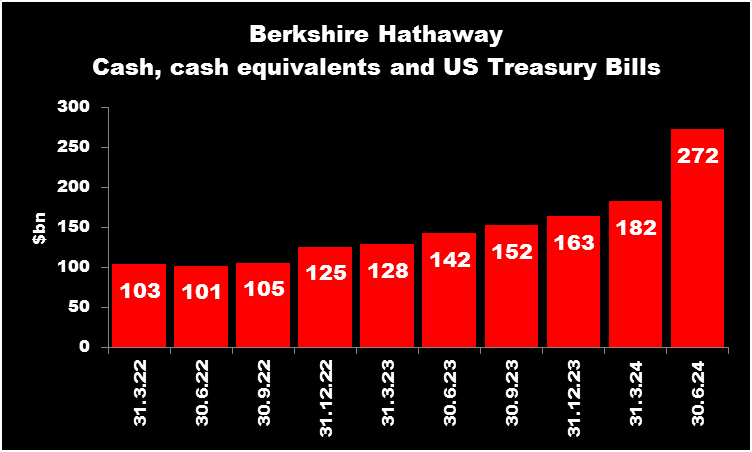

Warren Buffett, as Chairman and CEO of Berkshire Hathawayhas a cash balance of $272 billion. As the chart below shows, the company's cash, cash equivalents, and U.S. Treasury bills (which are a proxy for cash) have risen steadily since the end of 2022.

This doesn't seem to be affecting its market cap. This week (August 28), it became the first non-tech company to register a stock market valuation of $1 trillion.

From 1965 to 2023, its share price increased by 19.8%. This compares with an average annual return of 10.2% for the S&P 500 Index (with dividends reinvested).

And while some of this can be attributed to Berkshire's investment in AppleMuch of it comes from stakes in companies outside the technology sector, such as American Express and The Coca-Cola Company.

However, when arguably the world's most famous investor starts replacing stocks with cash, I think it's time to consider the implications.

What could this mean?

Most of the cash generated during the second quarter of 2024 came from the sale of about half of Berkshire's stake in Apple.

Asked about the sale at the annual shareholders meeting, Buffett hinted that it was for tax reasons. The billionaire expects the rate on capital gains to rise as the United States tries to rein in its budget deficit.

Maybe this means there is nothing to worry about?

I'm not so sure.

Buffett once told investors to be afraid when others were greedy. And many believe that U.S. stocks are currently overvalued.

Any sign of a crash is likely to affect everyone's portfolio, including mine, which predominantly contains FTSE 100 Index Actions. As the saying goes, when America sneezes, the rest of the world catches a cold.

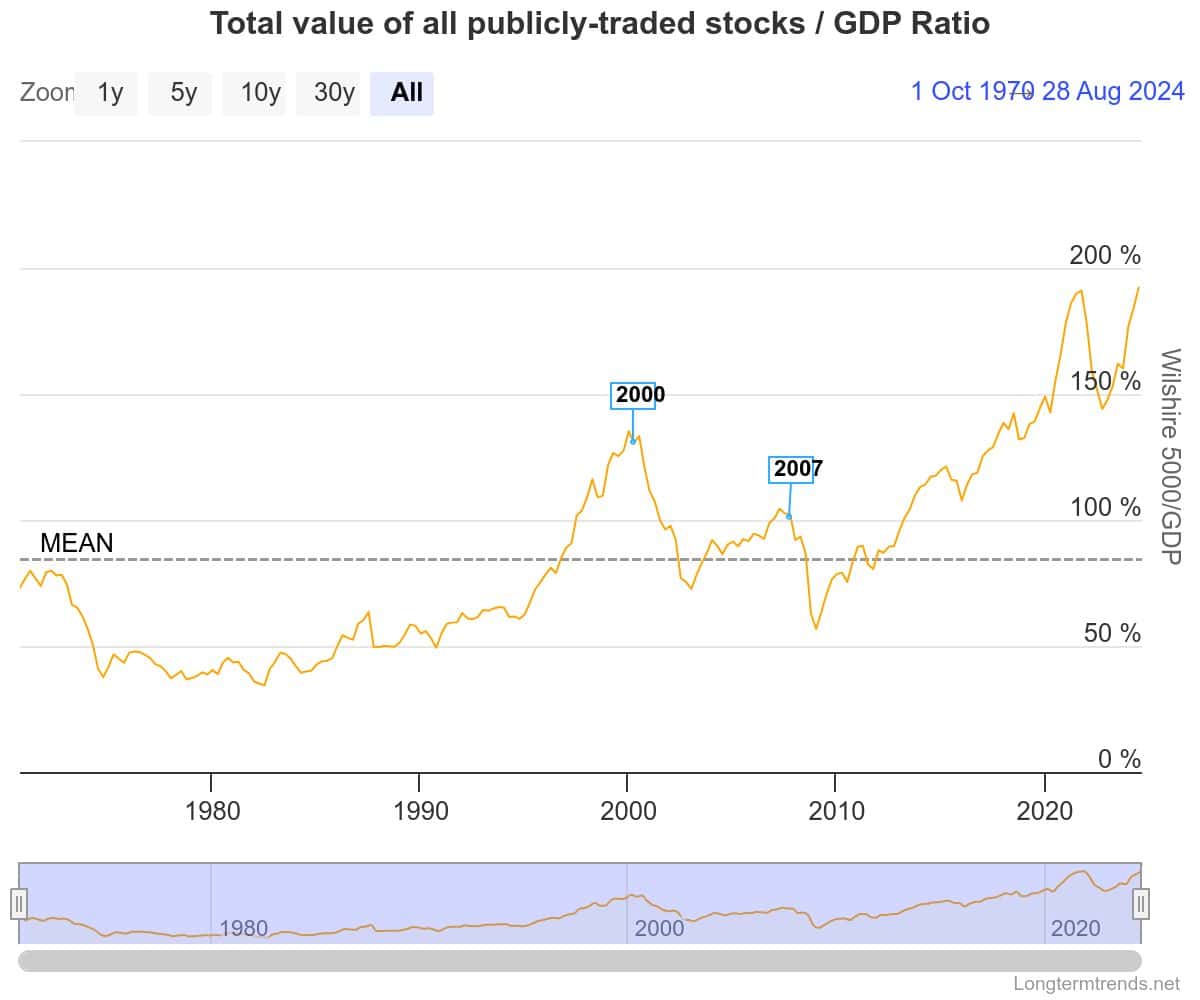

A bit like a market-wide price-earnings ratio, the chart below compares the combined value of the country's 5,000 largest publicly traded companies to their gross domestic product.

And if we look back 54 years, valuations have never been higher. Similar peaks in 2000 and 2007 were followed by significant market corrections.

My own opinion

But despite this, I'm not going to change my strategy.

I will continue to invest for the long term. I know there will be bad times ahead, but I can't predict when they will occur.

Instead, I will continue to invest in quality companies that have a greater chance of consistently growing their earnings.

That's why I recently bought some Barclays (LSE:BARC) shares.

I am impressed by the bank's chief executive, who acknowledges that its performance is behind that of its peers. For example, its statutory return on tangible equity for the six months to 30 June 2024 was 11.1%. This is lower than that of Lloyds Banking Group (13.5%) and NatWest Group (16.4%).

CS Venkatakrishnan has embarked on creating a simpler business model with an emphasis on its higher margin markets.

Analysts are forecasting earnings per share (EPS) of 30.5p (2024), 39.6p (2025) and 48.4p (2026). If these estimates prove correct, the bank will have increased its EPS by 75% in 2026 compared to 2023. These figures imply a forward (2026) price-earnings ratio of just 4.7.

However, bank stocks can be volatile. Bad loans are always a risk and margins will shrink as interest rates (as expected) begin to fall.

Nevertheless, given its long-term potential, I believe Barclays will be a good addition to my portfolio.