- USDCHF's short-term recovery on Friday morning stopped at the level of 0.84930

- USDJPY movement on Friday was very unpredictable

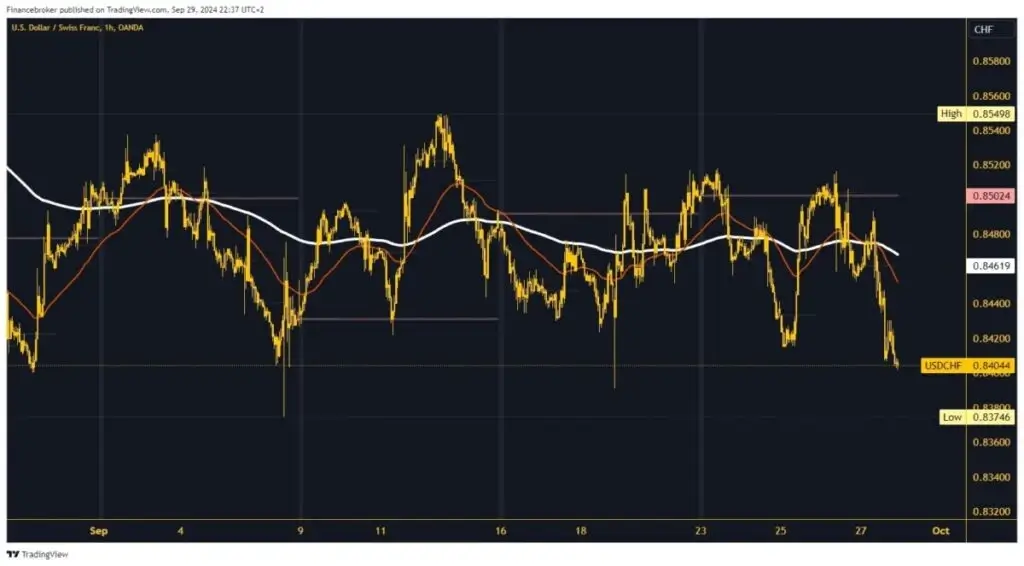

USDCHF chart analysis

USDCHF's short-term recovery on Friday morning stopped at the level of 0.84930. After stopping in that area, the pair began to retreat towards a new weekly low at 0.84000. We are in the September support zone and it could easily happen that we move to the bullish side soon. Otherwise, we will continue to pull back and form a new low. The possible lower targets are the 0.83800 and 0.83600 levels.

If the September support zone holds for USDCHF, a bullish consolidation will begin. We expect the pair to stabilize above 0.84200 and continue its recovery. With a pullback to the 0.84600 level, we are back to the 200 EMA and need a break above to get its support. After that, the chances of stabilization on the bullish side increase. The highest possible targets are the 0.84800 and 0.85000 levels.

USDJPY chart analysis

The movement of USDJPY on Friday was very unpredictable. First, we saw a stable bullish consolidation, which reached a weekly high of 146.49. After that, strong bearish momentum sent the pair down 350 pips, taking it to the 143.00 level. We then saw further bearish consolidation to a new weekly low at the 142.00 level. On the same day, the pair formed a weekly high and low.

USDJPY could find new support and start a bullish consolidation on Monday. This would take us back above 143.00 and test the 200 EMA. If the trend continues, we will see the pair reach new levels on Monday. The highest potential targets are the 143.50 and 144.00 levels. For a bearish scenario, we need a continuation of the bearish consolidation and a breakout of the 142.00 level. This would confirm that USDJPY is still on the bearish side and will continue its retreat. The lowest possible targets are the 141.50 and 141.00 levels.

!function (f, b, e, v, n, t, s) {

if (f.fbq) return;

n = f.fbq = function () {

n.callMethod ?

n.callMethod.apply(n, arguments) : n.queue.push(arguments)

};

if (!f._fbq) f._fbq = n;

n.push = n;

n.loaded = !0;

n.version = ‘2.0’;

n.queue = ();

t = b.createElement(e);

t.async = !0;

t.src = v;

s = b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t, s)

}(window, document, ‘script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘504526293689977’);

fbq(‘track’, ‘PageView’);

NEWSLETTER

NEWSLETTER