Image source: Getty Images

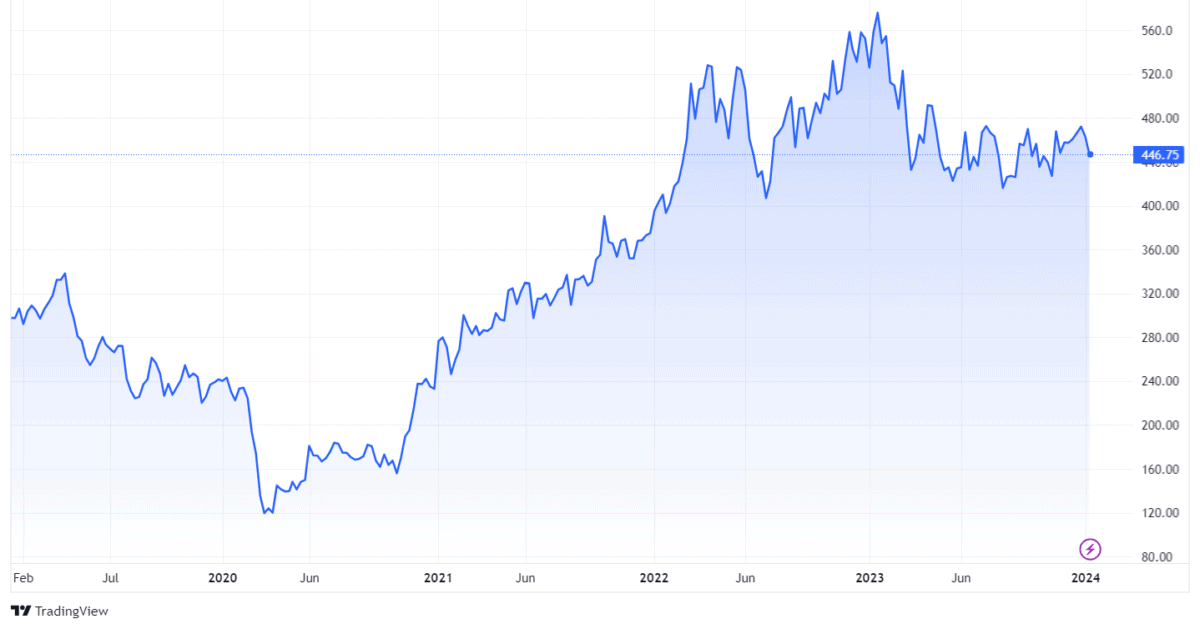

Has the stock risen by half in the last five years? Check. 7.8% dividend yield? Check. Long-term shareholders in Glencore (LSE: GLEN) are very good. But what if you had to buy it now? Can Glencore's share price continue to rise?

uncertain environment

In the first half of the company's current financial year, revenue fell by a fifth compared to the same period last year. Worse still, core earnings per share fell by three-fifths.

That may not sound very good. But the company's cash position meant it was able to announce a special dividend, as well as another share buyback, this time to the tune of about $1.2 billion.

This reflects the roller coaster that commodity markets have experienced in recent years, both in the balance of supply and demand and in prices.

Glencore's diverse range of businesses can help level out some of the rough edges that causes, but it also means that strong performance in one division can be undermined by weaker results in other parts of the company.

Reasons to invest

Still, I think there are many things I like about the company.

It operates in an industry where demand may rise and fall, but will likely remain strong, if variable, for decades to come. It has an enviable portfolio of assets that produce huge volumes. This is demonstrated by the fact that those first half revenues fell 20%, but were still equivalent to more than $4 billion. one week.

The company has shown that it has a continued focus on returning money to shareholders, and that helps explain the generous dividend. If things continue well in the future, I expect more significant dividends in the future.

Some concerns I have

Still, past performance is not necessarily a guide to future returns. This also applies to Glencore's share price.

Last year's profits were exceptional. The after-tax profit of $16.5 billion was much higher than the previous year's figure of $4.3 billion. The previous two years had seen a loss in the company's bottom line.

The cyclical nature of demand in the mining sector is largely outside the control of producers, although cutting production can sometimes help obtain a better price than when supply far exceeds demand. With the outlook for the global economy remaining uncertain, I see this as a risk to Glencore's share price.

my opinion on things

So while I like Glencore's business and think it can do well in the long term, I don't see any urgent rush to invest now.

The price-earnings ratio of four may seem very cheap, but let's remember that last year's earnings were exceptional.

So far, this year hasn't gone so well and things could still get worse if industrial demand slows. Not only could that hurt the share price, but it could also mean a lower dividend in the coming years.

For now, I don't see Glencore's share price as a bargain and so I don't plan to invest.

NEWSLETTER

NEWSLETTER