Image source: Getty Images

He tesco (LSE:TSCO) share price has been through some tough times in recent years. It is down more than 50% from its all-time high.

However, stocks have recently experienced something of a recovery. Since October 2022, they have increased by more than 40%. But I think it's been a pretty bumpy road since 2015.

The share price has often fallen by more than 20%, such as from February to September 2022 or from August 2018 to January 2019.

But could it be different this time? Or are stocks going down again?

Well, I think they could go up in the long term, even if they go down in the short term. However, I think the price will rise slowly and steadily and could actually remain quite stable.

what i can see

I think one of the main reasons for the fluctuations in the stock price since 2015 is the changes in earnings that the company has reported.

For example, in 2015, it reported £57 billion in revenue, then dropped to £54 billion in 2016. The company's revenue then rose to £64 billion in 2019 and fell to £58 billion in 2021.

I have followed the price chart over the timing of these reports and the stock price seems to change along with the declines and increases in revenue.

Since 2021, revenue has increased from £58 billion to £67 billion today. So, I think this contributes significantly to the recent share price rally.

This doesn't surprise me, as I firmly believe that financial reporting is the most significant influence on a company's stock price over time.

Furthermore, as the organization is already so prominent in its dominant market (the UK), I would no longer call Tesco a growth company.

In my opinion, this lag in revenue growth could lead to lackluster share price gains.

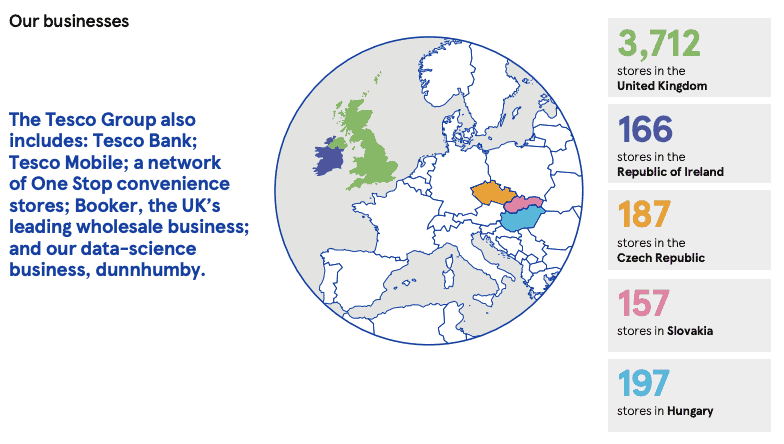

The following image describes the scale of Tesco's business very well:

Where do I think I could go from here?

I think that from now on the company's expansion will have to be largely driven by international markets.

But Tesco has had multiple failed global launches, including a failed U.S. store chain called Fresh & Easy. It was finally withdrawn from the US market in 2013, causing losses of around £1 billion.

There was also a similar story in Japan and Turkey, starting in 2003. The company finally exited Japan in 2011 and Turkey in 2016.

However, it has had some success in China. Although there were initial challenges starting in 2004, it formed a joint venture with China Resources Company in 2014. However, he sold his entire stake in 2020.

Of course, the annual report image I provided above shows four countries, in addition to the UK, where the company has been successful.

But my big takeaway from looking at Tesco's international plans is that it has struggled.

Therefore, I wonder if it will be able to grow effectively in the future as it did in the past if it cannot easily conquer foreign markets.

The bottom line

I don't think the recent 40% rally will last because I don't think the company is prepared to sustain its revenue growth. I think history could repeat itself.

Therefore, the potentially stagnant nature of the share price with slower growth prospects means I won't be buying the stock.