Image source: Getty Images

He Lloyd's (LSE:LLOY) share price has been rising virtually non-stop since mid-February, recently closing higher for six consecutive weeks. It is now just a few pence away from hitting a new four-year high above 56p.

The last time it traded above that level was in February 2020, when the pandemic hit, causing the price to fall from a high of 58p to 32p in less than a month. Lloyds came close to surpassing this level in February last year but ultimately failed, so I wonder if this time will be different.

Let's see what the graphs say.

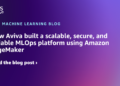

UK Market Comparison

Lloyds recently surpassed the FTSE 100 in percentage price increases, something it achieved briefly in January but hasn't done since April of last year. This indicates that it is performing better than the average of the top 100 UK stocks. Whether or not this can continue is the question I hope to answer today.

Price-to-book value ratio

The price-to-book (P/B) ratio is calculated by dividing the current market price by the company's book value per share. A high P/B ratio is typical for a bank with high expected earnings growth and high returns on equity.

Lloyds' P/B ratio has been rising along with the share price since mid-February. Although it is still in a good range, it is approaching a value of 1, at which point the price could be considered overvalued. For now, however, the P/B ratio of 0.84 suggests Lloyds shares could still rise further.

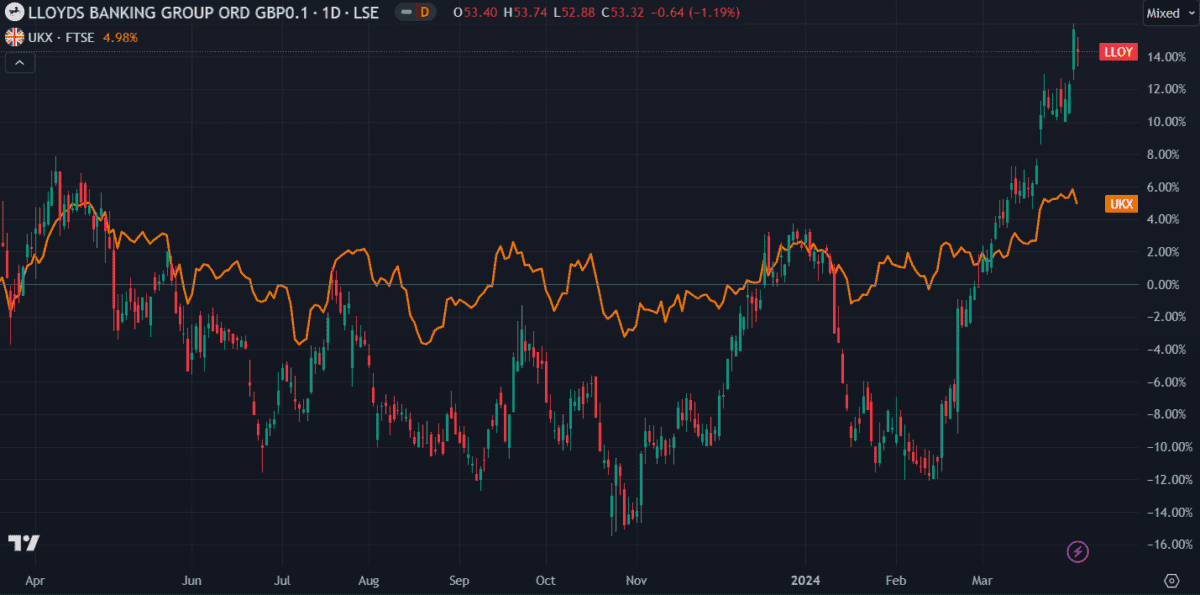

Return on equity

Return on equity (ROE) is a good indication of how well a company is performing based on its capital. In other words, how much profit it generates compared to the level of investment shareholders have put into the business. While ROE does not directly correlate with price, it is a reassuring indicator of a company's operational strength.

ROE is calculated by dividing the company's net income by shareholders' equity. Lloyds reported a decent ROE of 12.34% in its 2023 annual results report. Any figure below 10% would be worrying.

Relative Strength Index

The relative strength index (RSI) is an oscillator used to measure the volatility of an asset's price movements. It can be used to forecast price targets by measuring the price trend of a stock.

The oscillator ranges between zero and 100, with 30 and 70 being key levels that dictate whether an asset is overbought or oversold. A prolonged move above 70 is usually a sign that the asset is overbought and could fall soon.

Looking at a daily chart I see that the Lloyds share price declined in early 2024 after a period where the RSI exceeded 70 several times. Looking ahead to today, I see that the RSI has been above 70 for over a month. In my view, it would be difficult to argue that a correction is not imminent.

my verdict

Lloyds appears to be performing well at the moment, and the recent price gains were likely boosted by news of delays to rate cuts. Although interest rates remain high, banks generally continue to make profits.

However, several metrics indicate that the price is overbought. While the stock could still make some gains in the near term, I wouldn't buy it at this level.