Image source: Getty Images

In March, I decided that the best stock to buy for rapid, sustainable growth was a smart infrastructure specialist. Costain Group (LSE:COST). I'm up around 68% since then, including dividends.

Investors who got in early did better. In one year, Costain's share price rose by 78.45%. In two years, it has risen by an impressive 143.82%.

That kind of performance always gets attention, but it also raises my suspicions. Surely he can't keep climbing at that speed, right?

Can the stock price continue to rise?

The stock doesn't look particularly expensive, however, trading at 8.52 times earnings, which is comfortably below the company's profits. FTSE All Share Index average of 14.6 times.

Costain also has a net cash pile of £166m, which is almost 60% of its £284m market capitalisation, adding a layer of safety. Better still, it is earning a steady stream of interest on the money, although this will taper off when the Bank of England starts cutting base interest rates further.

Its first-half results, published on August 21, revealed a “very healthy” book of £4.3bn following a series of new contract wins.

This is important because Costain's revenues are likely to rise and fall unevenly depending on the start and end of contracts. First-half revenues actually fell 3.8% to £639.3m in the six months to 30 June, after it completed major works at Gatwick station.

However, adjusted operating profits rose 8.7% to £16.3m. Operating margins rose 20 basis points to 2.5%. Obviously, that doesn't leave much room for error. The board is aware of the risk and aims to increase margins to 3.5% in 2024 and 4.5% in 2025. However, that is still a tight margin.

This FTSE stock has much more room to run

Let’s not forget that Costain has been volatile in the past. Its shares plummeted by more than 80% in 2020, as the pandemic disrupted operations and hit profitability. It also suffered a £90m loss on two major contracts, the Peterborough & Huntingdon gas compressor and the A465. Management subsequently overhauled its procurement processes, but bidding for infrastructure projects will always be fraught with risk.

Another problem is that the UK economy remains plagued by uncertainty, with inflation sticking, growth slowing and potential tax increases looming. This could impact funding for infrastructure products.

Costain shares plummeted on September 10 when Dubai-based Al Shafar General Contracting Company (ASGC) sold just over 41.6 million shares to institutional investors. That amounts to 15% of the issued share capital. However, the share price has largely recovered from that short-term hit.

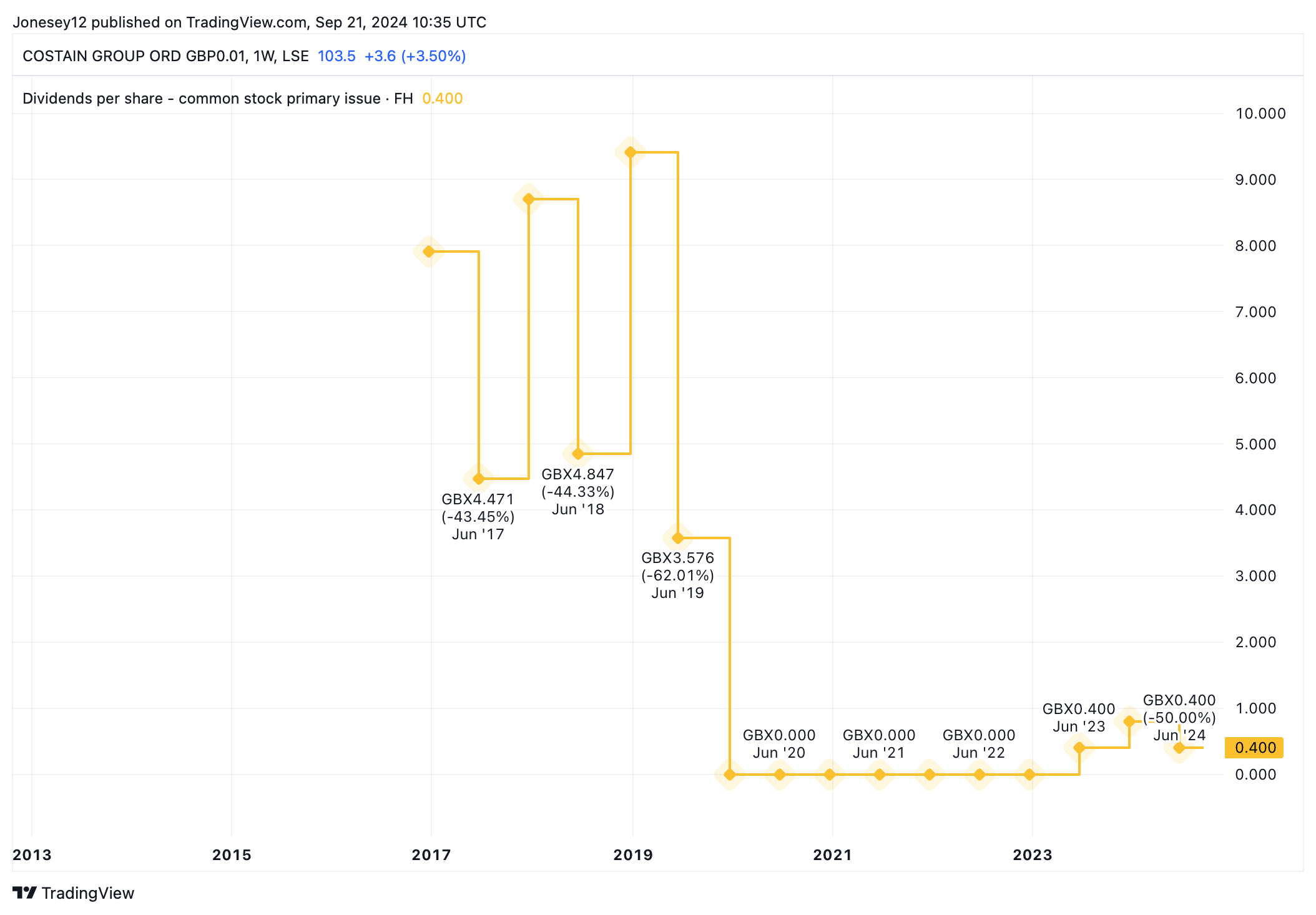

Costain eliminated its dividend during the pandemic, but reinstated it in 2023, as this table shows.

TradingView Chart

The 1.3% forecast yield isn't great, but given that it's covered 9.1 times by forward earnings, I'm optimistic that it will rise steadily over time. Costain has also just initiated a £10m share buyback.

Brokers have set an average one-year target price of 117.5p, up 13.53% today. So it's probably not the best stock to buy right now. I expect a lot more action, but at a slower pace. I already have a significant stake in what is a relatively small company, so I probably won't be buying any more.