Image source: Getty Images

When it comes to investing, one of Warren Buffett’s most famous quotes resonates with me: “Buy low, sell high”. With that in mind, here are three relatively cheap UK stocks I’ve been buying at a bargain.

1.easyJet

Having initially lagged the performance of its peers in 2022, easyJet (LSE:EZJ) is now the FTSEHighest flyer this year, jumping 45%. This is due to his stellar first-quarter update, which sent shares flying above £5, as he now anticipates a profit this year.

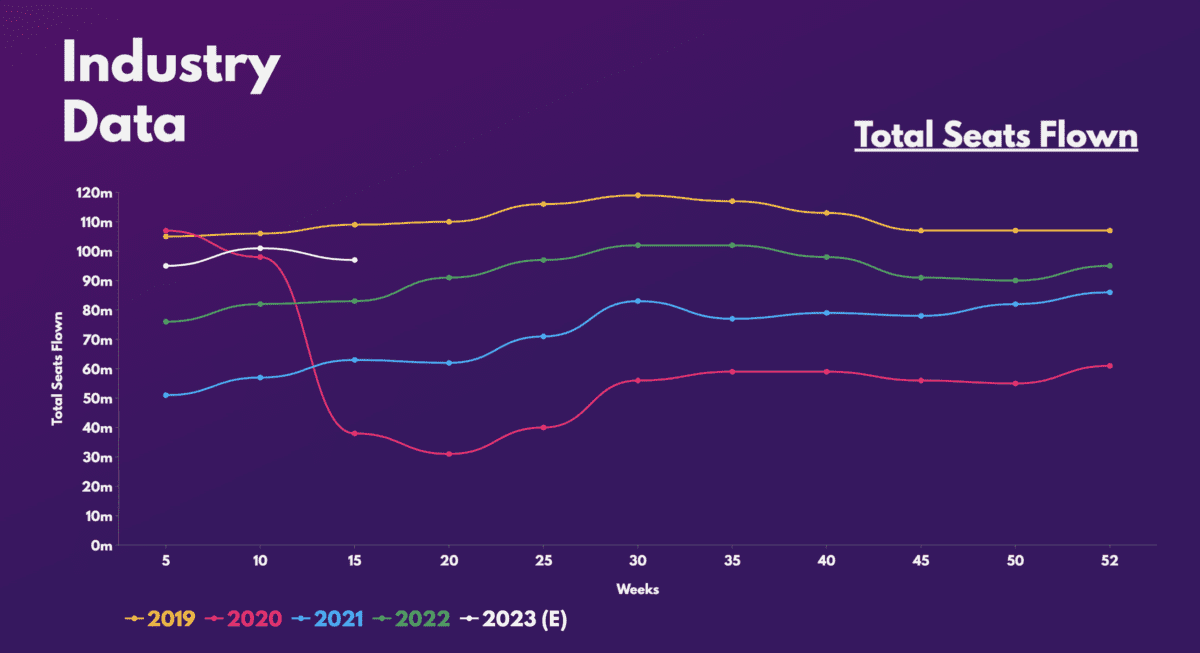

To make things sweeter, the total number of seats hasn’t even reached pre-pandemic levels. Additionally, early bookings remain strong meaning there is still plenty of room for growth for easyJet to take advantage of. Additionally, with orders for more fuel-efficient aircraft and the rapid growth of the company’s Holidays division, there is room for margin expansion as well.

These factors have resulted in several brokers improving their ratings on the stock. As such, the UK stock now has an average price target of £4.58. While this is lower than the current share price of £4.90, which could indicate an expensive buy, it’s worth noting that easyJet’s current and future valuation multiples are still relatively cheap.

| Metrics | valuation multiples | industrial average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.7 | 1.8 |

| Price-Sales Ratio (P/S) | 0.7 | 0.9 |

| Price/Forward Sales (P/S) Ratio | 0.5 | 0.9 |

| Forward price-earnings (P/E) ratio | 21.6 | 27.3 |

2. Marks and Spencer

Up to an impressive 15% this year, marks and spencer (LSE:MKS) is also on my list. As with easyJet, the UK retailer shared the joy with its investors last month and announced an excellent Christmas update.

In addition to posting much healthier growth than Tesco Y Sainsbury’s, M&S also posted record sales figures over Christmas. As a result, CEO Stuart Manchin reported market share increases in his grocery and clothing businesses.

However, higher energy and labor costs will surely affect the company’s bottom line in the short term. However, I am invested for the long term, and the future certainly looks bright for the long-forgotten business.

Management has chosen to accelerate its store rotation program, which has proven to be much more efficient in driving revenue and margins. In addition, the state of M&S’s finances is slowly improving, as are analyst price targets. And with cheap valuation multiples, I’ll gobble up as many shares as I can in February.

| Metrics | valuation multiples | industrial average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.1 | 1.3 |

| Price-Sales Ratio (P/S) | 0.3 | 0.3 |

| Price-Earnings Ratio (P/E) | 9.5 | 14.0 |

| Price/Forward Sales (P/S) Ratio | 0.2 | 0.5 |

| Forward price-earnings (P/E) ratio | 10.2 | 12.1 |

3.Burberry

Unlike the other two UK stocks I have listed, Burberry (LSE:BRBY) posted a lackluster update in January. However, his guidance was enough to send the stock higher, ending the month up nearly 20%.

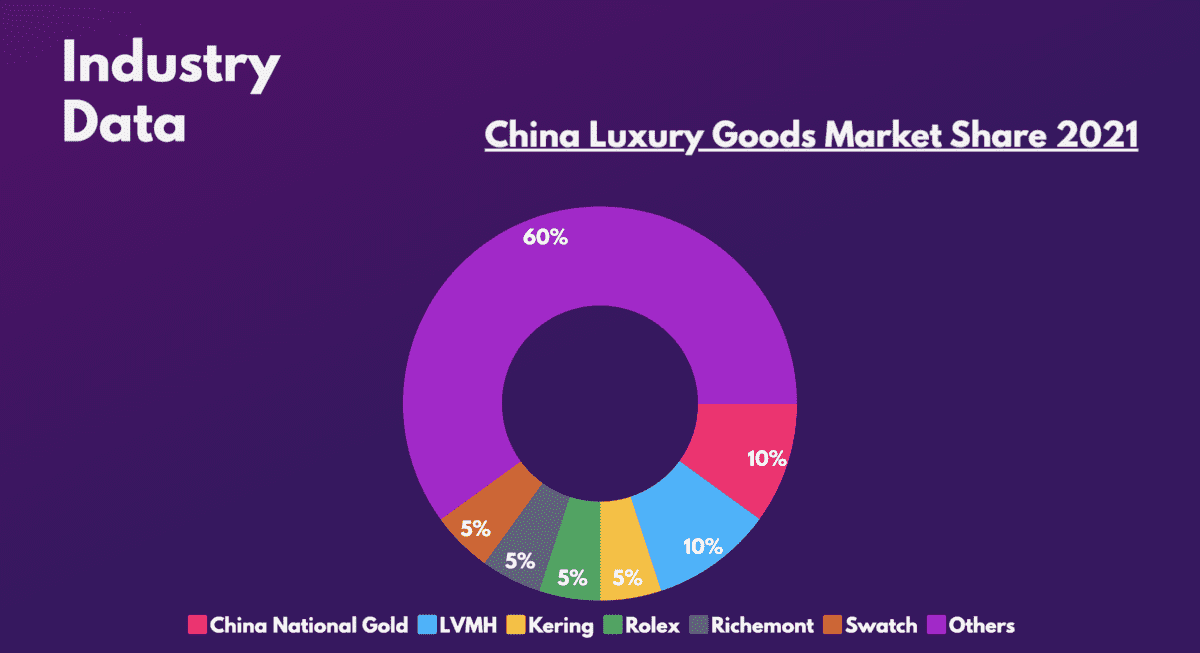

Since the group derives most of its revenue from China, revenue has been significantly reduced over the past year due to the country’s strict zero-Covid strategy. Having said that, the recent reopening, large household savings and an increasingly wealthy middle class in China present strong tailwinds for the designer.

This represents a great long-term investment opportunity for me, as Burberry plans to expand its margins and Chinese market share in the medium term.

These catalysts have boosted sentiment around the stock. So it’s no surprise to see it trading at a higher P/E of 22. But despite the more expensive multiples for UK stocks, it’s still cheaper than its French peers. The Oracle of Omaha once said: “The price is what you pay, the value is what you get”and that’s what I feel I’m getting with Burberry.

| Metrics | valuation multiples | industrial average |

|---|---|---|

| Price-to-book (P/B) ratio | 6.1 | 8.0 |

| Price-Sales Ratio (P/S) | 3.1 | 6.1 |

| Price-Earnings Ratio (P/E) | 20.9 | 29.0 |

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);