Image source: Getty Images

He FTSE 100 Index Right now, it's full of great value stocks. If I had money to invest, here are three I'd buy before the market realizes they're cheap.

Chartered standard

Asia-focused banks like it Chartered standard (LSE:STAN) faces near-term uncertainty as the Chinese economy falters. Overall, however, I think the company (like its industry rival) HSBC Bank) has supreme investment potential thanks to favorable demographic trends.

A combination of sustained population growth and booming personal wealth means demand for its wealth management and retail and investment banking services is on the rise. These factors helped revenue in constant currency to rise 20% in the first three months of 2024.

Standard Chartered shares are currently trading at a rock-bottom price-to-earnings (P/E) ratio of 6.3 times, making it one of the cheapest banks in the Footsie today.

But this isn't the only metric that suggests it could be a great value stock today.

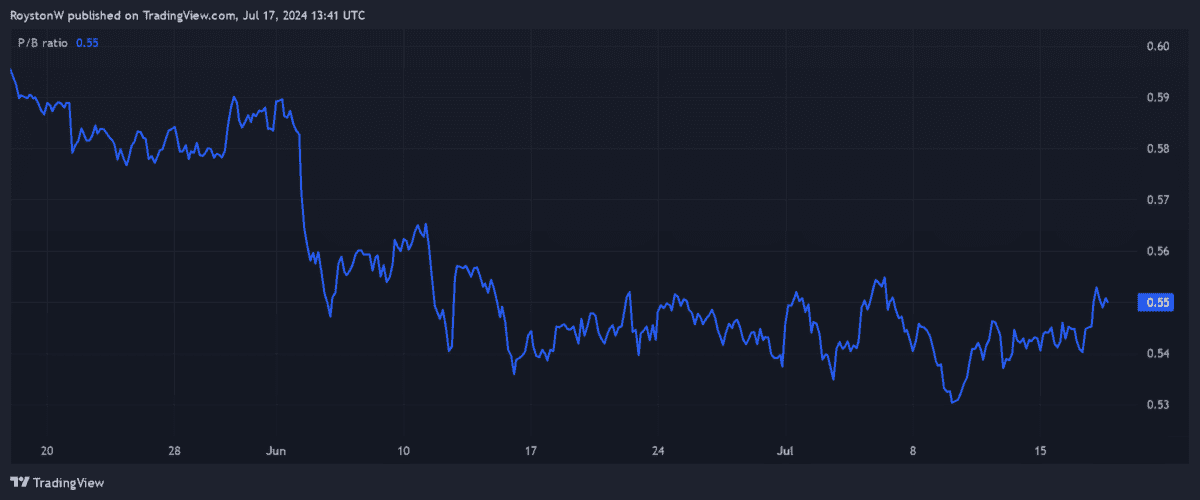

The bank also boasts an incredibly low price-to-book ratio of around 0.6, at 732.6 pence per share. If it is below one, this indicates that it is trading at a discount to the value of its assets.

PPP-Windows

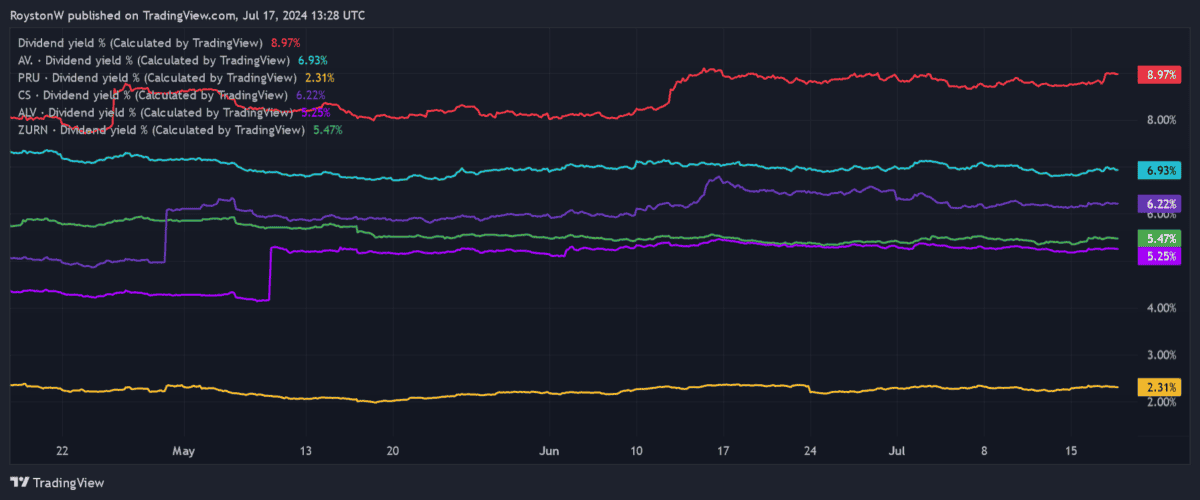

Communications giant PPP-Windows (LSE:WPP) also offers exceptional value across the board, at 725.8p per share. It is trading at a price-to-earnings ratio of 8.2 times this year. Meanwhile, its dividend yield stands at a significant 5.3%.

Advertising spending is one of the first things companies cut in tough times. The current difficulties caused WPP's net income to fall 1.6% on a like-for-like basis in the first quarter.

However, I believe these current problems are rooted in the low valuation of the FTSE 100. I also believe that earnings here could rebound strongly once the economic cycle improves, helped by its huge exposure to developing markets.

I also believe that WPP's massive investment in digital advertising and artificial intelligence will pay off handsomely.

Legal and general

Legal and general ClusterThe share price of (LSE:LGEN) is falling sharply. Investors have vehemently rejected the company's plan to increase dividends at a slower pace. In addition, concerns that interest rates may remain higher than initially anticipated have pushed its shares lower.

In my view, this represents an attractive buying opportunity. Asset managers like this may struggle in the short term if central banks fail to cut rates significantly. But Legal & General has considerable growth potential over the long term as demand for retirement and wealth products steadily increases.

I also think the market has overreacted to the company's new dividend policy. Its massive dividends are expected to continue growing by 2% between 2025 and 2027. And the Footsie firm plans to complement a rising dividend with further substantial share buybacks.

At 226.8p, Legal & General shares are trading on a forward price-to-earnings (PEG) ratio of 0.1. A reading below one indicates that a stock is undervalued.

Plus, its mammoth 9% dividend yield beats that of its FTSE 100 index rivals by a wide margin. I think it's another brilliant value stock worth considering.

NEWSLETTER

NEWSLETTER