Image source: Getty Images

For me, the best way to earn a second income is to put money into an ISA and follow a well-known investment strategy to build wealth. Of course, the more money an investor has, the easier it will be for them to generate great passive income.

Unfortunately, most Brits still choose to build wealth through savings accounts, which with annualized returns generally below 3%, that money is not growing very quickly.

Stock markets tend to outperform savings markets

Investing in the stock markets typically generates significantly higher returns compared to traditional savings accounts. Many people, especially beginners, opt for index tracking funds, which aim to replicate the performance of major market indices. Historical data underscores the long-term growth potential of such investments.

For example, the FTSE 100 has generated an average annual return of 6.3% over the last 20 years, with the FTSE 250 outperforming its large-cap counterpart. In the USA, the S&P 500It has averaged an impressive 10.5% annually since its inception in 1957, and rose to an even higher average of 13.3% in the decade leading up to 2024. Similarly, the Nasdaq recorded an exceptional average return of 19.8% over the past decade.

These figures are in stark contrast to the comparatively modest interest rates offered by savings accounts, emphasizing the advantage of stock market investments for building long-term wealth.

doing the math

Personally, I prefer to choose individual stocks, trusts and specific funds, rather than index tracking funds. That's because I believe I can beat the market; After all, researching stocks is essentially what I do.

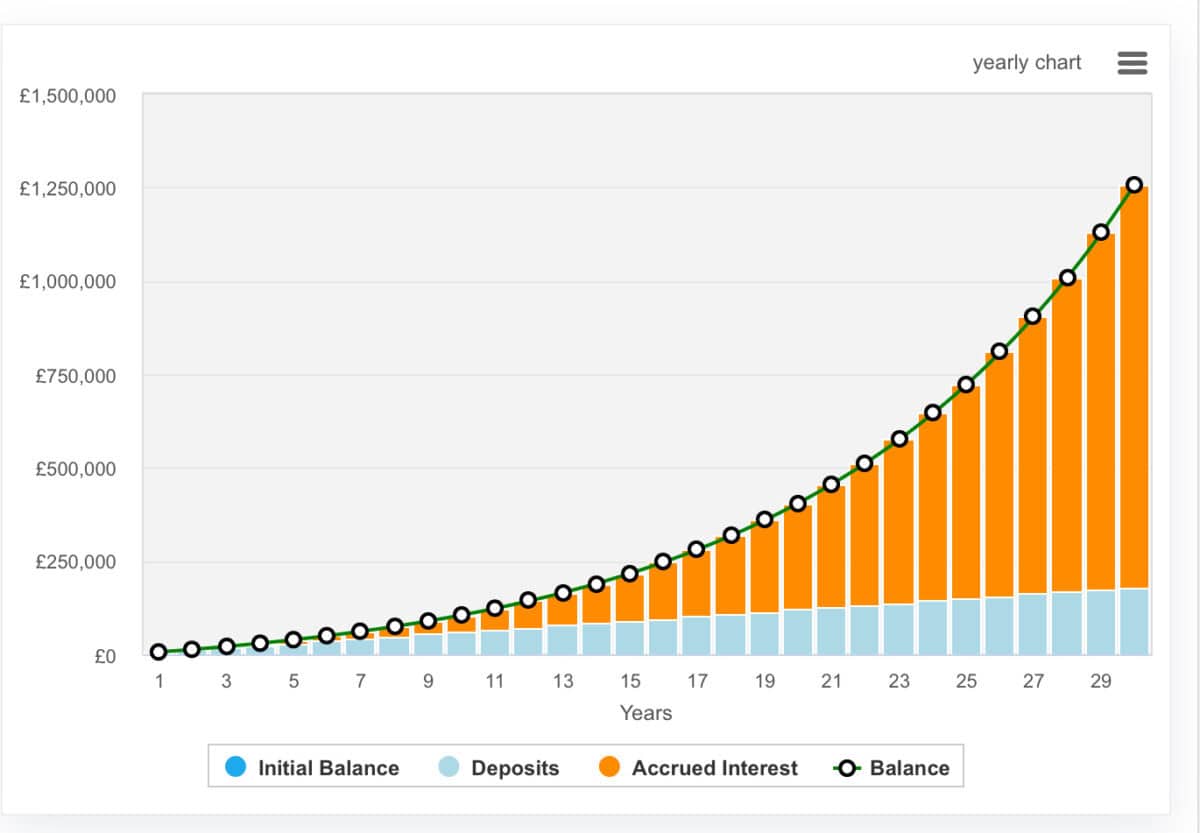

However, if an investor had chosen a tracker of any of the major indices mentioned over the past decade, they would have far exceeded the returns they could have achieved in a savings account. Let's say an investor invests £500 a month in an index tracker. This is how that money could work in a S&P 500 tracker, based on the historical growth rates mentioned above (but note that past performance is no guarantee of future success).

Why did I use S&P 500 data? Well, because it conveniently equates to just over £1.2 million over 30 years. Putting that money into shares with an average dividend yield of 5% would generate £5,000 of monthly passive income, tax-free. This is what I intend to do, but by picking stocks, I hope to grow my money faster.

Please note that tax treatment depends on each client's individual circumstances and may be subject to change in the future. The content of this article is provided for informational purposes only. It is not intended to be, nor does it constitute, any type of tax advice. Readers are responsible for conducting their own due diligence and obtaining professional advice before making any investment decisions.

One to consider for the growth phase.

While index trackers are a great way to start investing, investors may want to consider an interesting growth-oriented trust like Edinburgh Global Investment Trust (LSE: EWI). It is a fund managed by Baillie Gifford, like the well-known Scottish Mortgage Investment Trust – and it is a really interesting, although risky, proposal. The fund aims to initially invest in entrepreneurial companies when they are still in their infancy.

The trust's largest investment is SpaceX, which represents a significant 12.3% of the portfolio. It is followed by PsiQuantum with 7.5% and Alnylam Pharmacy. These are fairly high-risk investments, but given the favorable trends in artificial intelligence (ai), space exploration and even quantum computing, this could be the right time to take a diversified approach to emerging technologies.

However, some of their holdings are not publicly traded and only listed companies are required to disclose earnings reports, meaning that crucial data on these private entities is scarce, increasing uncertainty for investors.