Image source: Getty Images

Just because a dividend stock has an incredibly high yield doesn't automatically make it a high-income stock. The opposite is often true.

Many see ultra-high performance as a warning sign. Especially when it reaches double digits. But I bet FTSE 100 insurer Phoenix group holdings (LSE: PHNX) is an exception.

I bought the stock in both January and March because I felt its dividends were probably sustainable. Although I can't say for sure.

Very high income

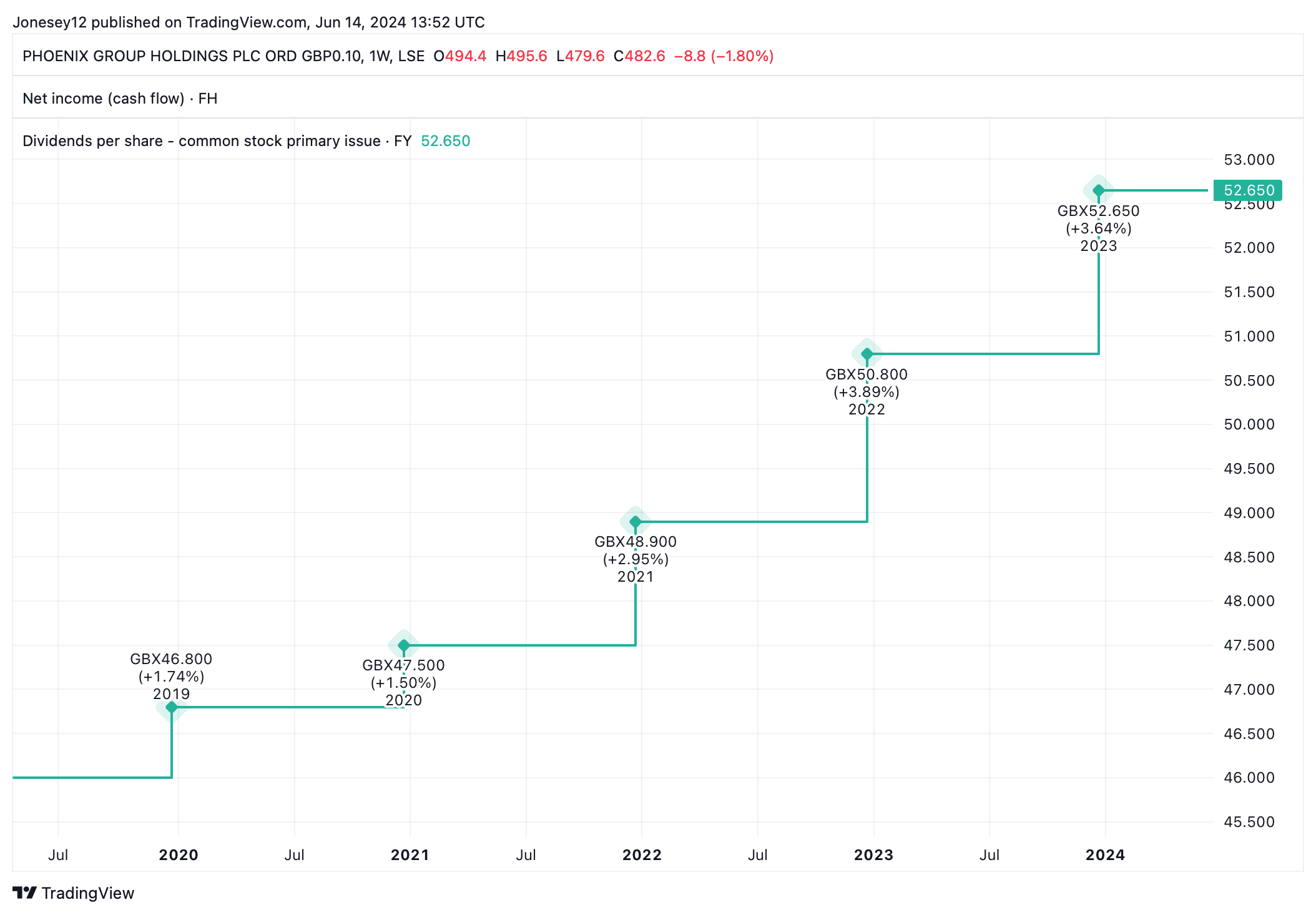

City analysts seem positive. Today, Phoenix has a trailing yield of a staggering 10.94%, but that's just the beginning. It is expected to yield 11.2% in 2024 and rise to 11.5% in 2025. One way to check if a yield is sustainable is to look at the recent dividend per share growth. This is what the graphs say.

Created with TradingView

In 2019, Phoenix increased its dividend per share by 1.74% to 46.8p. It then increased the payments in each of the next four years. In the last three, the percentage increases were notably higher: 2.95%, 3.89% and 3.64%.

So instead of nervously cutting payments, the administration has increased them at a faster pace.

Investors need some reward for holding the stock and so far it hasn't come in the form of share price growth. Phoenix's share price is down 12.6% over the last year and 30.66% in five years.

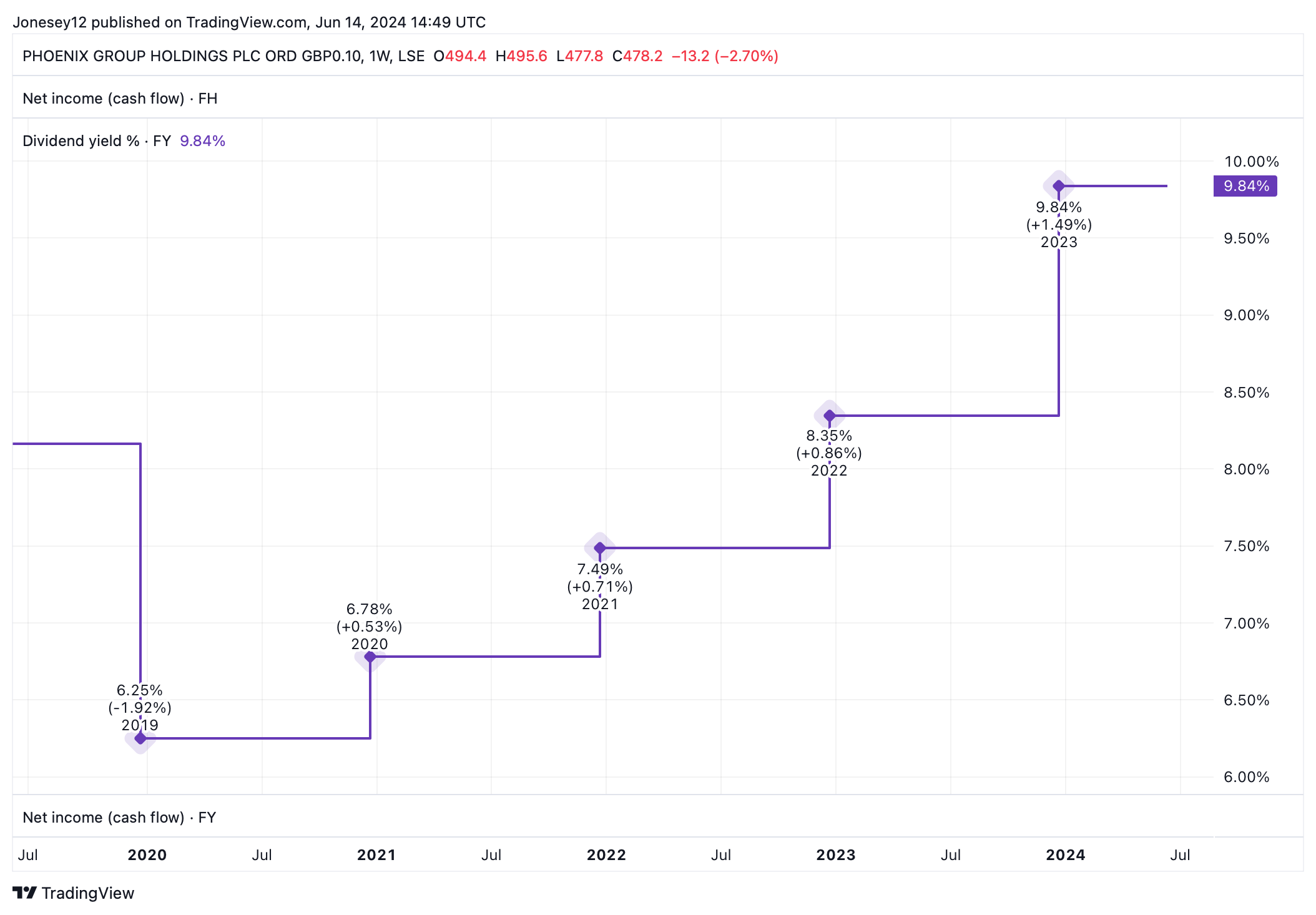

However, the board could not increase payments if it did not generate enough cash. And the good news is that it is. Again, this is what the graphs say.

Chart by TradingView

In 2019, cash flows fell by 1.92%. They have already risen at an accelerated pace, rising 1.49% in 2023.

Cash flows appear strong

In fact, last year was a banner year for Phoenix. Their target was £1.8bn in cash. He smashed it for £2bn. It also has a solid balance sheet, with a Solvency II capital ratio of 176%. That's near the upper end of its target range of 140% to 180%.

Analysts are optimistic, predicting that the 2023 dividend per share of 52.65 pence will rise to 54.3 pence in 2024, 56.1 pence in 2025 and 57.5 pence in 2026. Now I feel a little happier with the purchase of my shares.

Phoenix could get a new rating when the Bank of England finally starts cutting interest rates. This will affect savings rates and bond yields, and make your dividend look even more attractive.

I can't live on dividends alone. At some point I would also like to see the share price rise a little, but the outlook here is a little more uncertain.

JPMorgan has just cut the price target on its Phoenix shares from £5.25 to £5. Today, the shares are trading at 4.81p. There's not much room for growth there.

For now I will console myself with the income. I will reinvest every penny I receive to buy more Phoenix stock and hope that one day the market catches up with me and the stock takes off. Fingers crossed!

NEWSLETTER

NEWSLETTER