The sale of technology actions after the surprising launch of Deepseek is asking many questions about what could happen with the actions below.

They have certainly been good times for investors. The S&P 500 has delivered a consecutive 20% more annual returns, and despite a fainting in the first week of January and the sale of Deepseek this week, the reference point is still in pace to finish January with profits.

Do not miss the movement: Register in the free newspaper of Thestreet

Of course, if that trend continues throughout 2025 is an assumption of anyone, but if the story is our guide, the probabilities seem good.

Related: Tieza cement of intentors of the disticine of Fed

In general, more returns are followed when the actions are joined between election day and the inauguration. If that trend is maintained, then CFRA's investigation suggests that it makes sense to concentrate on some actions more than others.

What past performance can you tell us about the future?

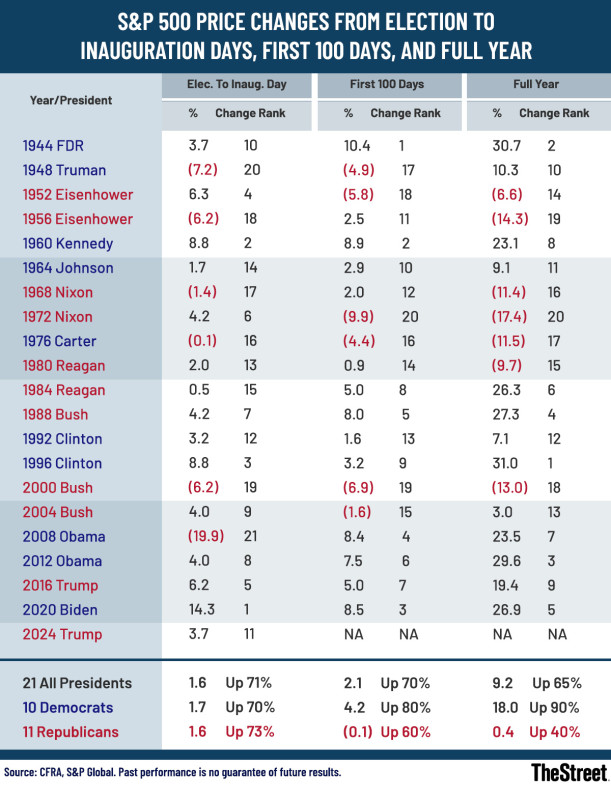

This time, from the day of the elections to the day of the inauguration, the S&P 500 won almost 4% (actually 3.7%) versus an average of 1.6% in all the years that date back to 1944.

As a result, market performance from election day to the day of inauguration occupies the 11th of 21 of 21 periods in recent decades.

Related: The upper analyst reviews the objective of Nvidia's shares in the middle of Deepseek threat

The highest performance during this period came from the Biden Administration (+14.3%), while the worst market performance came from President Obama (-19.9%) due to the financial crisis that took place between 2007 and 2009.

The good news is that, according to the past periods, when the returns were positive from the day of the elections to the day of the inauguration, which led to positive returns in the next 100 days and the rest of the year complete calendar almost 80 % of the time.

Thestreet & Sol; cfra

In addition, according to the 1993 data, the four main sectors in the S&P 500 that exceeded the market during this period exceeded the market during the rest of the year, approximately 75% of the time.

They delivered earnings of the calendar year of 17.0% on average, compared to the average performance of S&P 500 of 15.9%, according to CFRA.

The 10 main S&P 500 industries during the period had a better way, increasing by 26.8% throughout the year.

Of course, what worked in the past is not guaranteed that it works again in the future, but the data is intriguing.

Which S&P 500 sectors were overcome and had a lower performance after the choice?

This time, the four sectors that generated the best performance between the elections and the day of the inauguration were

- Discretionary consumer: UP 13.5%

- Communication Services: UP 8.7%

- Financial: UP 7.3%

- Energy: Above 4.3%

The basic consumer products, medical care, materials and real estate were recorded.

The four industries that generated the best performance between the elections and the day of the inauguration were

- Automobile manufacturers: UP 59.5%

- Retail home furniture: UP 46.9%

- Security and Alarm Services: UP 40.4%

- Drug retail: UP 30.1%

Another part of the puzzle is the perspective of corporate profits. Based on recent JP Morgan data (Source: IBES as of January 20, 2025), the 11 S&P 500 sectors are currently forecast to publish a positive EPS growth in 2025 (versus 9 of 11 sectors in 2024).

Currently, six sectors are forecast after the growth of EPS year after year of two digits in 2025 (versus 5 in 2024).

Related: These agents' actions could fly in 2025

The sectors currently predict generating the growth of EPS higher than 2025 year after year include:

- technology: UP 22.3%

- Healthcare: UP 20.2%

On the other hand, the energy, the basic products of consumers and real estate are the three sectors that predict the weakest EPS growth this year this year.

This is what could happen to these sectors now

Many factors can influence the predictions of which shares will probably exceed the market for a specific period. A list may include changes in profits, income, margins, free cash flow, profitability, management, introduction of new products, macroeconomics, balances, coins, etc.

More prognostics in the 2025 stock market:

- The veteran merchant who correctly chose Palantir as main actions in '24 reveals the best actions for '25

- 5 Quantum computing actions are addressed to investors in 2025

- Goldman Sachs chooses the best sectors they have in 2025

- The S&P 500 forecast of all Wall Street analysts for 2025

For our purposes, let's see:

1) The three main sectors that exceeded the market from the day of the elections to the day of the inauguration.

2) The greatest advantage of the average estimate of the analyst's target price in the next 12 months for the actions within these sectors, according to andcharts.

The results:

Communications Sector: Electronic Arts (EA) (30.1%), Comcast (CMCSA) (26.8%) and Warner Brothers (WBD) (23.9%).

Consumer discretionary sector: MGM Resorts (Mgm) (48.1%), Caesars Entertainment (CZR) (46.3%) and Las Vegas Sands (LVS) (36.6%)

Financial Sector: Arch Capital Group (ACGL) (26.7%), global payments (GPN) (21.2%) and Allstate (ALL) (21.3%).

RELATED: VETERAN FUND MANAGER ISSUE TOD S&P 500 WARNING FOR 2025

NEWSLETTER

NEWSLETTER