Win McNamee/Getty Images News

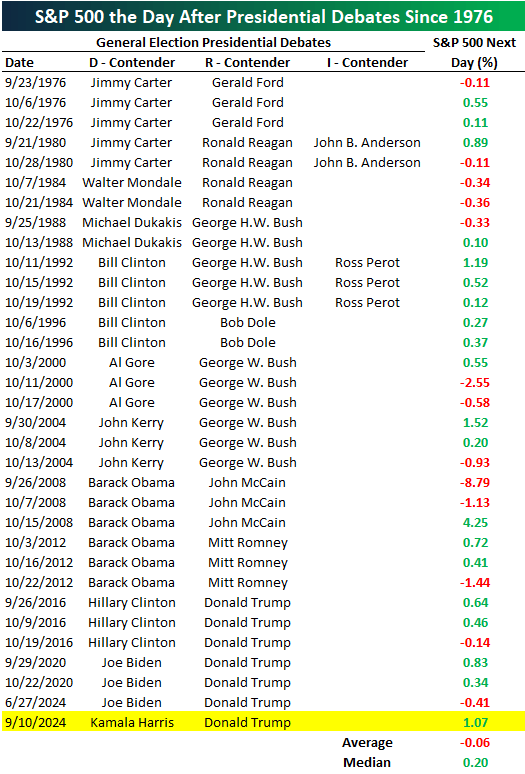

Wednesday's 1.07% rise in the S&P 500 (SP500) was the index's fourth-best gain after the debate since 1976, Bespoke Investment Group said in a statement Thursday. x.com/bespokeinvest/status/1834229106822840440″ target=”_blank”>Post on x.

Vice President Kamala Harris and the former president debated Tuesday night in Philadelphia.

Wednesday's rise was well below the S&P 500's 4.52% rise the day after then-Senator Barack Obama and Sen. John McCain debated for the third and final time on Oct. 15, 2008, according to Bespoke.

The index rose 1.52% after President George W. Bush's debate with then-Senator John Kerry on September 30, 2004, and 1.19% after the three-way debate between President George H.W. Bush, Bill Clinton and Ross Perot on October 11, 1992.

In contrast, the index fell 8.79% after the first Obama-McCain debate on September 26, 2008. It fell 1.13% after the second meeting 11 days later and plunged 1.44% after the final debate between President Obama and Mitt Romney on October 22, 2012.

See below a chart shared by Bespoke highlighting the performance of the S&P 500 (SP500) the day after a presidential debate since 1976:

For investors looking to follow the election through market instruments, here are some politically motivated Republican and Democratic ETFs:

- God Bless America (YALL) ETF

- US Conservative Equity ETF (ACVF)

- Point Bridge America First (MAGA) ETF

- Democratic Large Cap Core Value ETF (DEMZ)

- Subversive and Democratic Unusual Whale ETF (NANC)

- Unusual Whales Subversive Republican ETF (KRUZ)

NEWSLETTER

NEWSLETTER