Image source: Getty Images

In today's (March 6) Budget, the Chancellor of the Exchequer said the government intends to sell part of its 31.9% stake in NatWest Cluster (LSE: NWG). I think this could be a good opportunity to generate additional passive income.

It usually makes me wary when a major investor sells. But in this case, I think the decision is based on the need to implement some pre-election tax cuts, rather than there being something fundamentally wrong with the bank.

Shareholder profitability

Indeed, NatWest recently confirmed that its dividend, for the year ending December 31, 2023 (FY23), will be 17 pence per share. This means its shares are currently yielding 6.8%, comfortably above the FTSE 100 average of 3.9%.

And analysts predict the payout will rise to 15.7p (FY24), 17.6p (FY25) and 18.3p (FY26).

If correct, this means that an investment of £10,000 today could generate £2,057 in passive income over the next three years.

Of course, dividends are never guaranteed.

But the bank is expected to generate almost £11bn in after-tax profits between 2024 and 2026. Taking into account the current number of shares outstanding, this is equivalent to 2.4 times the expected cost of the planned payments.

This suggests there is plenty of room to continue paying generous dividends even if the bank's financial performance deteriorates slightly.

And there could also be some capital growth.

This is because looking at the charts it seems to me that the bank is undervalued.

Historically low valuation

The price-to-book (P/B) ratio compares a company's stock valuation to its book value. As shown below, NatWest's P/B is currently 0.65 and has been falling for some time.

Chart by TradingView

AP/B at this level means that if it were to cease trading, sell all its assets for the amounts disclosed in its financial statements and use the proceeds to pay off its liabilities, it could return 379 pence per share to shareholders.

That's a 49% premium over its current share price.

The story is similar when it comes to its price-to-earnings (P/E) ratio. The bank currently trades at a multiple of just over five.

As the chart below illustrates, this has been falling steadily for some time. At a P/E of eight, which is what NatWest was worth 12 months ago, its share price would be 57% higher.

Chart by TradingView

A difficult industry

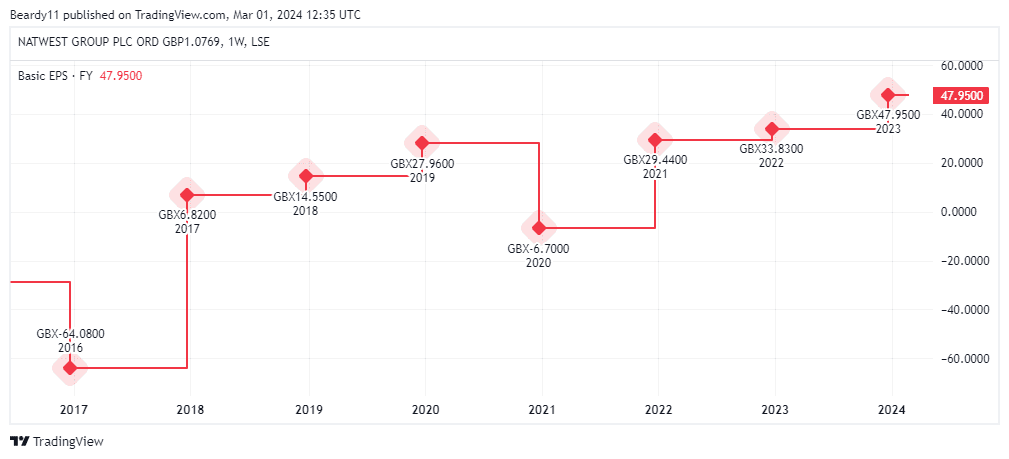

But there are a number of risks associated with the sector. In particular, earnings per share can be volatile.

Chart by TradingView

And that means dividends can be erratic. For example, in 2020, the bank only returned 3p to shareholders.

NatWest is also highly exposed to the UK economy, which is currently in a technical recession. As of December 31, 2023, 92% of its loans were made to individuals and businesses in the United Kingdom.

Despite these challenges, I think the upcoming sale is a good opportunity to buy solid passive income stocks for my portfolio.

Additionally, due to the large number of shares involved, I think they are likely selling at a discount to the current market price. That seems beneficial to everyone.

When the time comes, I will register my interest in what will likely be (in monetary terms) the largest sale of government stock in more than 30 years.

NEWSLETTER

NEWSLETTER