Image source: Getty Images

I still think there are some excellent actions in the flagship. FTSE 100 index that are cheaper than they should be, based on the long-term prospects of the business.

Here's one of those stocks that I think investors should consider buying.

Discount retailer, discount price

The FTSE 100 business in question is B&M (LSE: BME).

It currently trades on a price-to-earnings (P/E) ratio of less than 11. That's cheaper than it has been for much of the last few years.

Created using TradingView

So what's going on? In part, the low P/E ratio reflects a falling share price. B&M this week reached the lowest price it has reached in a couple of years.

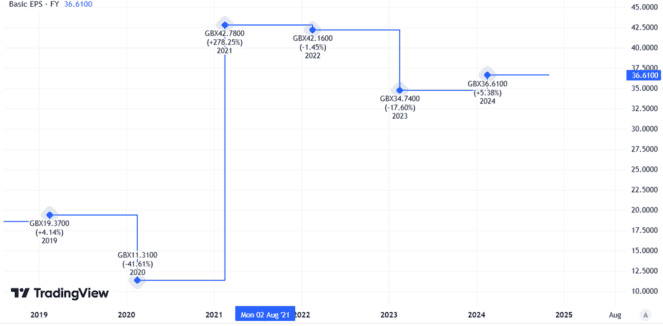

After-tax profits last year were not the highest in history, but they did exceed those of previous years. Basic earnings per share also increased from the previous year.

Created using TradingView

The retailer's most recent trading update, in July, showed sales growth in the first quarter compared to the same period last year (at a constant exchange rate).

Why has the share price fallen?

Given all that, what is happening?

B&M is well established, growing its store presence in the UK and France and its discount offering means the weak economic performance could actually improve, rather than hurt, its appeal to shoppers.

One possible clue is in the detailed breakdown of the trade report. While the company saw overall sales growth in the quarter under review, the B&M brand business in the UK saw a comparable sales decline of 3.5%. If this is a precursor to worse performance throughout the year overall, it could help explain why the City has panicked.

With interim results due to be published this month, we will soon find out how the FTSE 100 business has performed.

Still, even if B&M's UK business shows a decline this year, does that justify the 31% drop seen in the share price so far this year?

This seems exaggerated to me.

I don't believe it.

The UK retail market is very competitive and that is an ever-present risk for B&M. But it is firmly profitable, has a proven business model, is expanding its retail space so can likely generate economies of scale, and also offers a 3.8% dividend yield.

The company averaged more than £1m a day in after-tax profits last year, but currently has a market capitalization of less than £4bn.

With investor sentiment on FTSE 100 stocks seemingly lukewarm, I think it may fall further from here.

But as a long-term investor, I think it looks undervalued relative to how I expect the business to perform over the next five to ten years.