- After the support of the dollar index at the 100.60 level, we only managed to see a recovery to the 100.90 level.

Dollar Index Chart Analysis

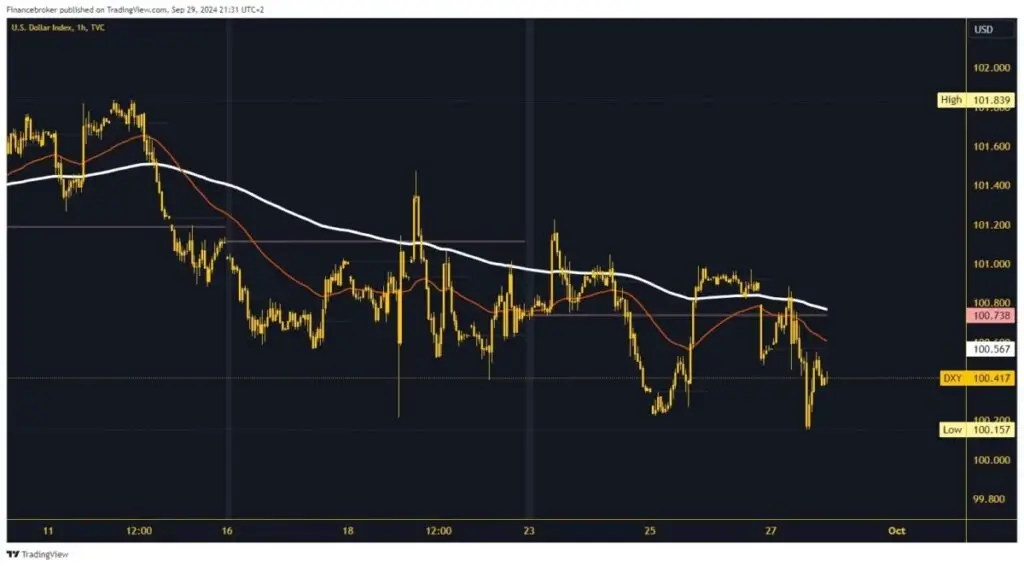

After the support of the dollar index at the 100.60 level, we could only see a recovery up to the 100.90 level. There, the index found new resistance and began a new bearish consolidation to 100.15, forming a new yearly low. Shortly after, we saw new support at that level and a recovery to the 100.40 level. The market closed in that area, leaving the dollar index under pressure at the opening of this week's session.

For another attempt to stay on the bullish side, we need to break back above 100.80 and the 200 EMA. So, the dollar needs to hold there before the bullish consolidation continues. A break above the 101.00 level gives hope that the Dollar Index has enough upside to trigger a larger recovery and visit higher levels. The highest potential targets are the 101.20 and 101.40 levels.

The index continues to move under the pressure of the 200 EMA moving average

The inability of the index to return above the 200 EMA will negatively affect the future movement of the dollar. Expect further negative consolidation and fresh pressure on Friday's low of 100.15. If a new low forms, we could see the dollar in the 100.00 area. The lowest possible targets are the 99.80 and 99.60 levels.

On Monday we will have a lot of solid and hard-hitting economic news. First, China's manufacturing PMI data will be released in the Asian session. According to forecasts, better data than those of August are expected. At the beginning of the EU session, we have the British GDP and later the German CPI. In the afternoon, data on the Chicago PMI will be published in the US session and at the end of the day Jerome Powell, Chairman of the FED, will give his speech. Powell's speech could have a decisive impact on the future movement of the dollar index.

!function (f, b, e, v, n, t, s) {

if (f.fbq) return;

n = f.fbq = function () {

n.callMethod ?

n.callMethod.apply(n, arguments) : n.queue.push(arguments)

};

if (!f._fbq) f._fbq = n;

n.push = n;

n.loaded = !0;

n.version = ‘2.0’;

n.queue = ();

t = b.createElement(e);

t.async = !0;

t.src = v;

s = b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t, s)

}(window, document, ‘script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘504526293689977’);

fbq(‘track’, ‘PageView’);

NEWSLETTER

NEWSLETTER