U.S. stocks are on track for one of their best six-month runs in more than a decade, driven in part by the rise of mega-cap technology stocks and an alignment of investors' interest rate cut forecasts with the Federal Reserve forecast.

And while Wall Street is forecasting further gains in the coming months, fueled by strong corporate earnings and a better-than-expected economy, some analysts suggest the current rally could lose steam, or even produce a notable correction, in the second half of the year. year.

The S&P 500, the broadest measure of the U.S. blue-chip stock market, is holding on to gains of just over 10% through the first three months of the year. That puts the index on track to post its best streak of consecutive quarterly gains since 2011, following an 11.1% advance in the fourth quarter.

The benchmark index's streak of five consecutive monthly gains also creates a strong backdrop for near-term returns, and data from Carson Investment Research suggests it should surpass historical gains for at least the next 12 months.

Improve market breadth

A broadening of the market's best-performing players also adds to the bullish consensus. About 80% of the index's stocks are trading above their 200-day moving averages, a key performance metric, and about 25% of its constituents have posted one-year highs over the past week.

The S&P 500 is up 10% in the first 60 trading days of 2024, the 14th best start to a year dating back to 1928. $SPX pic.twitter.com/It3BIAYmz0

—Charlie Bilello (@charliebilello) March 27, 2024

Adam Turnquist, chief technical strategist at LPL Financial, says that kind of breadth generally means stocks will do well, with three-month forward returns for the S&P 500 averaging 1.8%, with a positive earnings rate. close to 75% in the last 25 years. .

“The market and the Federal Reserve are finally aligned on the prospects for rate cuts this year,” he said. “This should help alleviate some volatility in the fixed income market, a welcome sign for both bond and equity investors.”

April is also traditionally one of the best months of the year for the S&P 500, posting an average gain of about 2% over the past two decades, according to Trading.biz analyst Cory Mitchell.

Earnings will be a key factor in market movements

Rob Swanke, senior equity strategist at Commonwealth Financial Network in Waltham, Massachusetts, agrees that market breadth and alignment between the market and the Federal Reserve are important, but also notes that valuations could be tested in a higher interest rate environment.

“Valuations overall remain a cause for caution as rates are much higher than in 2022, and the market will certainly look for earnings growth to support those expectations in the next reporting cycle,” he said.

Related: Fed Hints at Bank Stock Risk Due to Repo Market Crisis

Markets won't have to wait too long for that first test either, as JPMorgan claims. (JPM) will begin the first profits of the big banks on April 12. Most of the reporting season then accelerates over the next few weeks.

LSEG data suggests investors expect S&P 500 collective earnings to rise about 5% from last year to $458.6 billion on a stock-weighted basis. About a third of that growth is expected to come from the information technology and communications services sectors.

Looking at the rest of the calendar year, forecasts suggest 2024 earnings growth of about 9.8%, nearly double last year's advance, pegging S&P 500 earnings at around $243 per share.

Stock gains could be harder to come by

Analysts at RBC Capital, however, forecast S&P 500 earnings at around $237 per share. And while they raised their year-end forecast for the benchmark by 250 points, to 5,300, they suggest it will be harder to achieve further gains during the second half.

“We view our price target as a signaling mechanism for our overall message about the possible direction of the US stock market from here. “It’s a compass, not a GPS,” RBC said.

“The story we see in today's data is that the strong move seen in the S&P 500 so far this year has been deserved, and a rational case can be made for further upside from here,” even if the markets could use a break.

That pullback certainly hasn't materialized so far, and some investors are worried.

Related: Meme Stock Is Back as Trump Media Surges, GameStop Collapses and Reddit Soars

So far this year, the S&P 500's biggest daily drop has been 1.7%, the smallest since 1995, while the key indicator of market volatility, the VIX index, has averaged just $13.7, the lowest since 2017.

Goldman Sachs chief equity strategist David Kostin sees a “flat” market between now and the end of the year, with an S&P 500 price target of 5,200 points and an earnings forecast of around $241 per share.

“The stock market is pricing stocks as if the economy is growing at 4%, and it's not,” he told CNBC earlier this week. He also highlighted “net selling” by pension funds and mutual funds, in contrast to still-robust inflows from households and corporate share buybacks.

More economic analysis:

- Bond markets tell a story about Fed rates that stocks still ignore

- February inflation surprises with a modest rebound, but underlying pressures ease

- Vanguard reveals bold interest rate forecast ahead of Fed meeting

Dubravko Lakos-Bujas, chief global equity strategist at JP Morgan, believes both the market's reliance on ai-powered tech stocks like Nvidia, which is up nearly 88% for the year, and the company's rate cut projections Fed puts it at risk of a short-term correction.

“It may come out of nowhere one day. This has happened in the past; we have had sudden crises,” Lakos-Bujas said in an investment presentation reported by Bloomberg.

“One large fund starts to deleverage some positions, a second fund hears this and tries to reposition itself, the third fund basically gets caught off guard, and the next thing you know we start to get more and more momentum,” he warned. .

Waiting for Godot

However, that bearish scenario is not yet playing out, and Bank of America's March fund manager survey notes that large investors are the most exposed to stocks in two years. The survey also sees faster inflation as the market's biggest tail risk, outweighing geopolitical and electoral concerns in the United States.

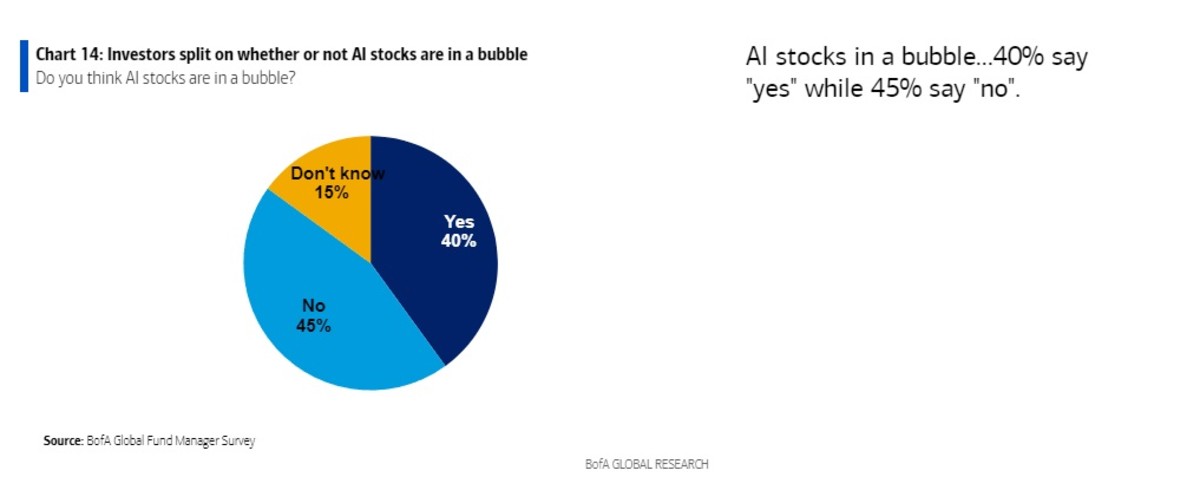

The survey noted that holding the so-called Magnificent 7 tech stocks remains the “most crowded” trade in the market, and respondents are largely divided on whether ai stocks are in a bubble.

Still, with fourth-quarter GDP pegged at 3.4% by the Commerce Department and growing at the current 2.1% according to the Atlanta Fed, investors looking for a recession catalyst to trigger a broader correction from the market they should find a comfortable chair, according to Chris. Zaccarelli, chief investment officer at Independent Advisor Alliance in Charlotte.

“As always, there will be pullbacks along the way and of course this bull market will eventually end, so we are not forecasting boom times forever,” he said.

“But it reminds us of legendary investor Peter Lynch, who said 'more money has been lost preparing for or trying to anticipate recessions than has ever been lost during recessions.'”

Related: A veteran fund manager picks his favorite stocks for 2024

NEWSLETTER

NEWSLETTER