Spencer Platt/Getty Images News

EV industry bulls, such as Cathie Wood of ARK Invest and Dan Ives of Wedbush Securities, recalled this week that the death of the EV transformation and Tesla (NASDAQ:TSLA) the story has been written many times before. the defenses came with some bearish analysts taking a victory lap about the sluggish stock price this year and the disappointing outlook provided by the company along with its fourth-quarter earnings report.

“Tesla is going through a low point right now related to the cycle,” Wood said on CNBC. “But when autonomous taxi networks and platforms come online, as we think they will in the next two years… then what we're talking about with Tesla is a reacceleration of growth and a huge increase in margins,” he added. he.

Meanwhile, Ives has criticized Elon Musk several times in recent weeks, but believes skeptics are wrong to say that electric vehicles are a fad. “We couldn't disagree more with the ultra-negative Tesla narrative that is building and forming a dark cloud over the stock,” she wrote. “While the next few months are clearly a bit cloudy for Tesla's story and overall EV demand, long-term our view is that by the end of the decade ~20% of cars will be EVs with autonomy and FSD, a reality and not a dream/aspiration,” he predicted. Key near-term questions for TSLA investors include the outlook for margins after price cuts in several markets and what lever the Tesla (TSLA) board pulls to restore investor confidence amid uncertainty on whether Elon Musk will do something drastic with the ai business if he doesn't get 25% voting control.

Ives unleashed: “In our view, the stock is generating a tremendous amount of bad news and it is now up to the Board of Directors to outline a strategy that investors can see as the foundation for Tesla's future with Musk as the heart and lungs of “We believe that the uncertainty around Musk at Tesla and overall ai initiatives has created a surplus of between $40 and $50 per share that needs to be addressed by the Board.”

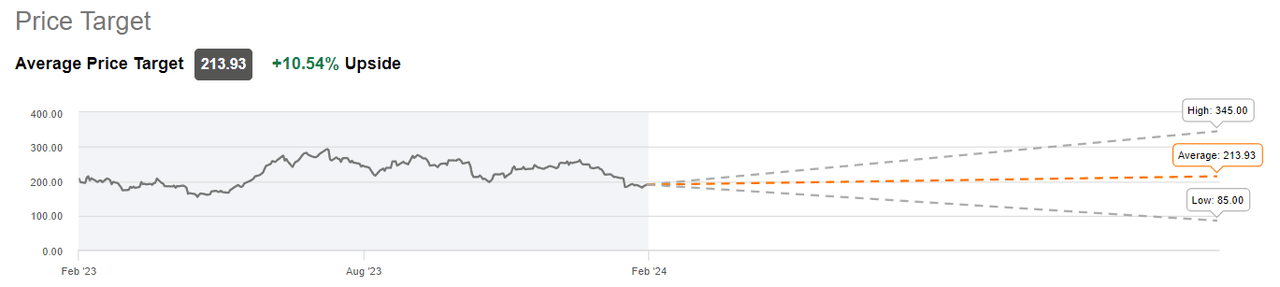

Wall Street is generally cautious on Tesla (TSLA), with 16 Buy-equivalent ratings stacking against 22 Hold-equivalent ratings and 7 Sell-equivalent ratings. Analysts can't even agree on the impact of Tesla (TSLA) introducing a sub-$30,000 vehicle to the mass market (transformative vs. negative Osbourne effect). Amid the debate, the average sell-side analyst price target on TSLA only implies a 10.5% gain in the share price over the next year.  Seeking Alpha analysts also have mixed views, with 16 Buy-equivalent ratings not far behind the 13 Hold-equivalent ratings and 13 Sell-equivalent ratings.

Seeking Alpha analysts also have mixed views, with 16 Buy-equivalent ratings not far behind the 13 Hold-equivalent ratings and 13 Sell-equivalent ratings.

Tesla (TSLA) is down about 22% so far this year and is trading below where it was a year ago and two years ago. However, the monster 2020-2022 rally is still built into Tesla's (TSLA) market cap of $614 billion and the company ranks 12th most valuable in the US by market cap. The next three EV-only stocks on the market cap list are BYD Company (OTCPK:BYDDF) with $71.6 billion, Li Auto (LI) with $25.3 billion, and Rivian Automotive ( RIVN) with 16.0 billion dollars.