Image Source: Getty Images

Concerns of a housing market crash prompted actions by homebuilders such as taylor wimpey (LSE:TW) to fall last year. The company’s fourth-quarter update didn’t produce the best numbers either. However, I continue to buy the stock for its long-term growth and potential for a second income.

About Taylor Wimpey Plc

Last updated 17-01-2023, 11:12:16 am GMT

Actual Price 117.85p

Change 0.50p (0.4%)

closing price 117.35p

opening price 117.35p

Bidding 117.80p

Ask for 117.90p

interval of days 116.80p – 118.25p

year range 80.64p – 163.45p

Volume 2,882,690

average volume 13,190,013

market cap 404,252,707,100.00p

earnings per share 15.26p

Holding out against headwinds

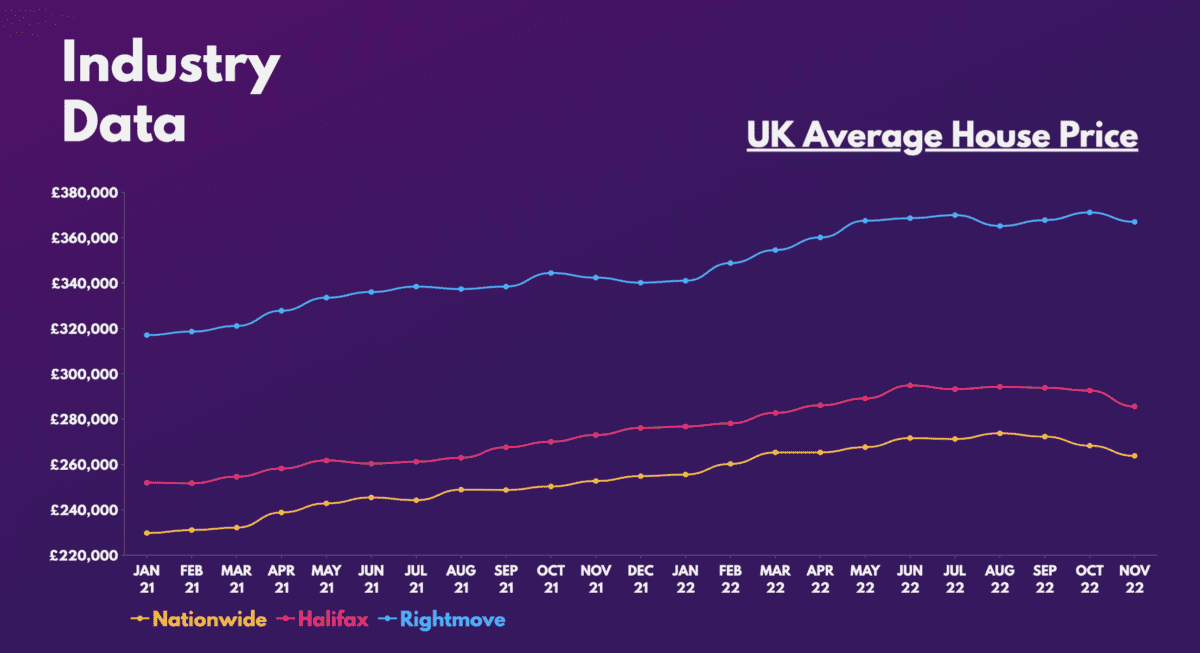

House prices are expected to drop by double-digit percentages in 2023. This does not bode well for Taylor Wimpey stock. In addition, construction Purchasing Managers’ Index (PMI) figures for December indicated a contraction with the largest decline in new orders and purchasing activity in more than two years.

Despite that, he FTSE 100 Stalwart still reported a better-than-expected set of top-line figures on Friday. Although the homebuilder’s final numbers won’t be released until March, it’s definitely a positive to see it meeting and even exceeding some of its early KPIs.

| Metrics | 2022 | 2021 | Growth |

|---|---|---|---|

| total terminations | 14,154 | 14,302 | -one% |

| Net private reserve rate | 0.68 | 0.91 | -25% |

| cancellation fee | 18% | 14% | 4% |

| The average sale price | £313k | £300k | 4% |

| Value in books | £1.94 billion | £2.55 billion | -24% |

| total terrain | 144k | 145k | -one% |

In fact, the company performed relatively well against some of its other peers. This was especially the case in areas such as the net private booking rate (sales per outlet per week).

| home builders | Net private reserve rate |

|---|---|

| taylor wimpey | 0.68 |

| barratt | 0.44 |

| Khaki | 0.69 |

solid foundation

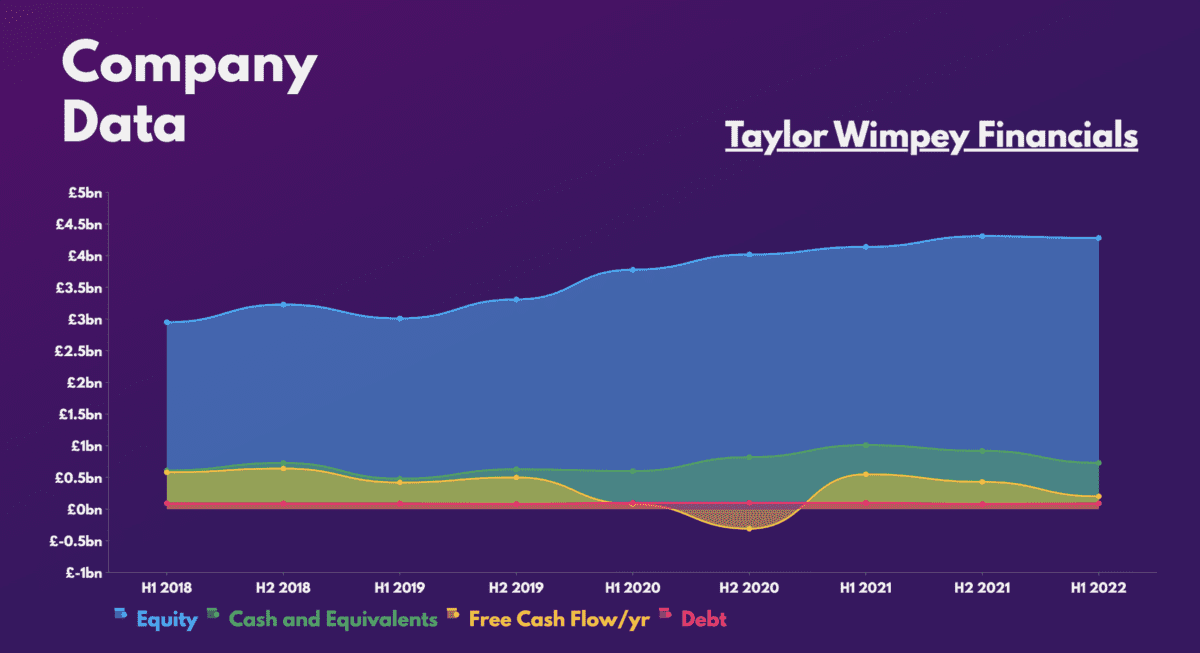

The company ended 2022 with better-than-expected net cash, and even saw its operating margin expand. With a debt-to-equity ratio of 2% and excellent dividend coverage of 2.1x, it certainly sets a solid foundation for an investment in Taylor Wimpey stock.

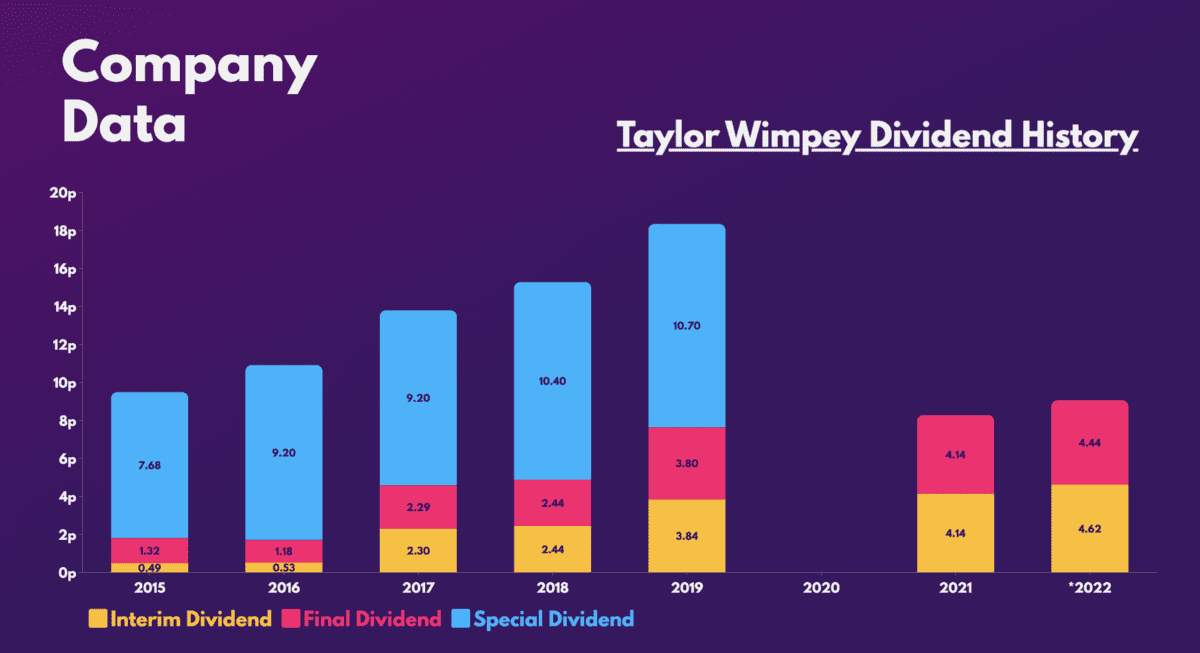

This is good news for your earnings and also for your dividends. Taylor Wimpey has a respectable track record of consistently growing dividends. And unlike his peer Khaki, management has yet to indicate any rebasing of its high pay. However, a prolonged period of lower home prices and below-average free cash flow could force the board’s decision.

However, it is worth noting that even in such a case, the developer has a safe dividend policy. The builder aims to pay a dividend worth at least 7.5% of its net assets, or at least £250m a year. Buying Taylor Wimpey stock today would still give me a minimum dividend yield of 6.1%, even in the worst case of the bunch.

build again bigger

Having said that, there are a number of things to be optimistic about. On the one hand, house prices should not fall as much as initially anticipated due to housing supply constraints. Additionally, Taylor Wimpey has a healthy exposure to second-time buyers (40%). This should allow you to hedge against your first-time buyer base (35%) declining due to affordability issues. And there’s a further £20m of cost savings to come with the leveling out of construction cost inflation. Meanwhile, mortgage rates are also falling.

These should all serve as gradual tailwinds over the next two years. And while house prices are expected to continue to fall in the near term, buying intent remains strong, according to CEO Jennie Daly. With construction activity often being the first sector to benefit when an economy recovers, Taylor Wimpey shares are in a prime position to capitalize on this, provided their buying intent remains strong.

It doesn’t surprise me that people like jefferies and the Liberum Taylor Wimpey share a ‘buy’, with the latter even suggesting a 25% rise this year. So given its decent valuation multiples and strong dividend yield, I’ll buy the stock once my preferred broker launches UK stocks on his platform.

| Metrics | valuation multiples | industrial average |

|---|---|---|

| Price-Earnings Ratio (P/E) | 7.2 | 10.7 |

| Price-Sales Ratio (P/S) | 1.0 | 0.8 |

| Price-to-book (P/B) ratio | 1.0 | 0.9 |