Several companies disclosed late Friday the amount of cash they did not have on deposit at the failed Silicon Valley Bank.

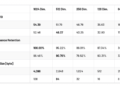

Roku streaming company (YEAR) – Get a free reportdisclosed Friday that it holds 26% of its total cash and cash equivalents in Silicon Valley Bank, which was shut down by the FDIC.

Roku said it had $487 million in cash out of a total of S$1.9 billion in uninsured deposits at SVB that was placed in federal receivership on Friday, according to an SEC. presentation.

DON’T MISS: Silicon Valley Bank Collapse: Big Account Holders Are Unsecured Depositors

The FDIC only insures up to $250,000 of deposits. Additional deposits are considered uninsured.

Roku shares fell 3.65% in e-commerce.

Roku said it was unknown how much of its cash would be accessible.

“At this time, the Company does not know to what extent it will be able to recover its cash deposited with SVB,” the company said in a statement.

The company said that since it has another $1.4 billion in cash reserves “at multiple large financial institutions,” Roku’s “existing balance of cash and cash equivalents and cash flow from operations will be sufficient to meet its working capital, capital expenditures and material cash requirements”. of known contractual obligations for the next twelve months and beyond”.

Other companies disclosed that they had little or no exposure to SVB, either in deposits or loans made at the bank.

SoFi Lender (SOFI) – Get a free reporthe said in a tweet that he has no money on deposit with SVB and that his only exposure was a small loan.

“We have no assets with SVB. Our only exposure is a very small credit facility provided to us for less than $40 million that is unaffected by the FDIC receivership of Silicon Valley Bank. Your money is safe with SoFi,” the company tweeted. .

Rocket Lab US space company (RKLB) – Get a free reportsaid in an SEC filing that it had $38 million in cash or 7.9% of its cash as of December 31 with SVB. The company had no other comment in the filing and did not address where the rest of its cash was being kept. Rocket Lab shares fell 2.3% in after-hours trading.

Roblox (RBLX) – Get a free reporta gaming platform company, saw its shares fall only slightly at 0.62% in after-hours trading.

The company said only 5% of its $3 billion cash and securities balance as of February 28 was deposited with SVB.

Vimeo video platform company (VMEO) – Get a free reportHe said his account balance was below the $250,000 threshold.

“Therefore, the company believes that it has no exposure to any liquidity problems at SVB,” the company said in a statement. “The Company has a diverse and well-structured set of banking partners with no one bank holding more than 25% of its total cash.”

Sports broadcasting company Fubo (FUBO) – Get a free reporthe said that he “does not have any deposit in SVB nor does he have any other direct investment in SVB.”

Start-ups that had Silicon Valley Bank accounts with more than the $250,000 maximum insured by the FDIC have become unsecured creditors, banking experts said.

Most account holders at SVB, which on Friday was closed by regulators and taken over by the FDIC, had balances in excess of $250,000, Gary Zimmerman, chief executive of MaxMyInterest, the New York fintech company, told TheStreet. .

The FDIC said Friday it would take over Silicon Valley Bank (BLIMS) – Get a free reportand created the National Deposit Insurance Bank of Santa Clara.

It is unknown whether the companies will receive 100% of their account balances or just a percentage, Anthony Chan, a former JP Morgan Chase economist, told TheStreet.

“It doesn’t mean that people above that $250,000 level will lose all their money,” he said. “It’s not a clear destruction of all deposits.”

RKLB did not address whether it expects to recover the uninsured portion of the deposit balances.

Shares in SVB Financial were suspended by Nasdaq officials on Friday following a liquidity crisis that triggered an emergency capital raise and raised concerns about the value of billions in Treasury bonds in bank portfolios across the country.

The bank lost $1.8 billion in part from losses on a $21 billion Treasury bond portfolio.

NEWSLETTER

NEWSLETTER