Image source: Getty Images

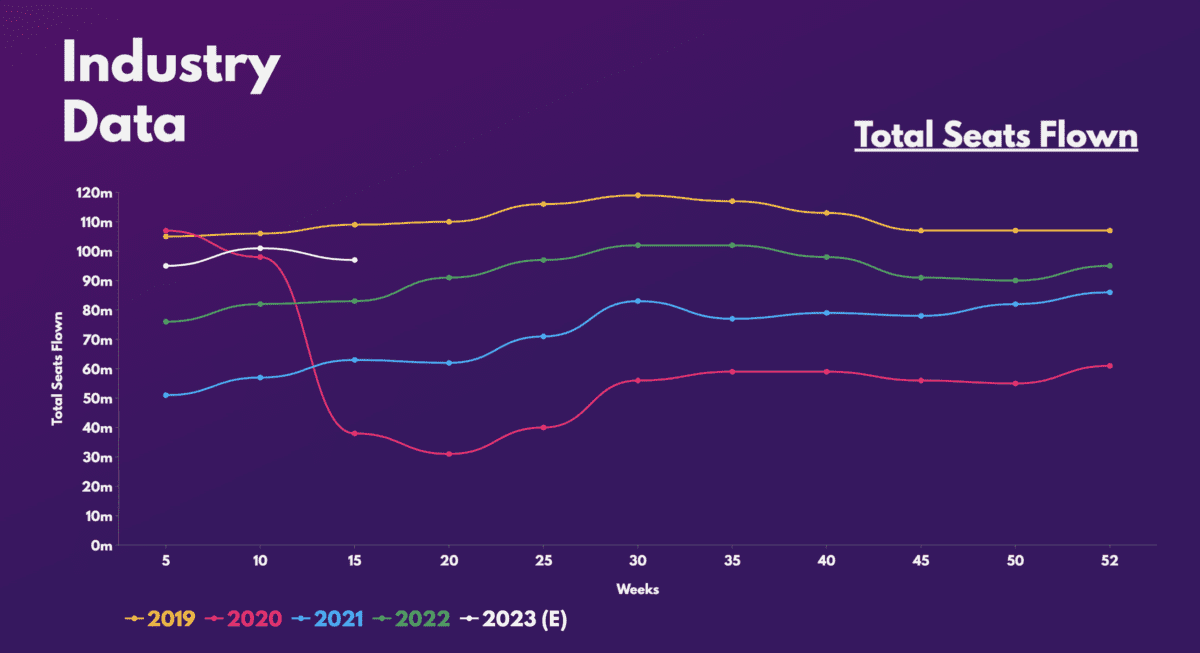

Despite fears of a recession, the travel industry shows no signs of cooling off. Many FTSE Airline shares have taken off since bottoming out last year. With IAG (LSE:IAG) and easyJet (LSE:EZJ) being the most popular airline stocks in the UK, I will assess which is a better fit for my portfolio.

The IAG case

IAG is a group of established airlines. These include the likes of British Airways, Iberia, Aer Lingus, Vueling and Level. With travel demand remaining strong, it’s no surprise to see IAG shares are already up 20% this year with the potential to fly even higher.

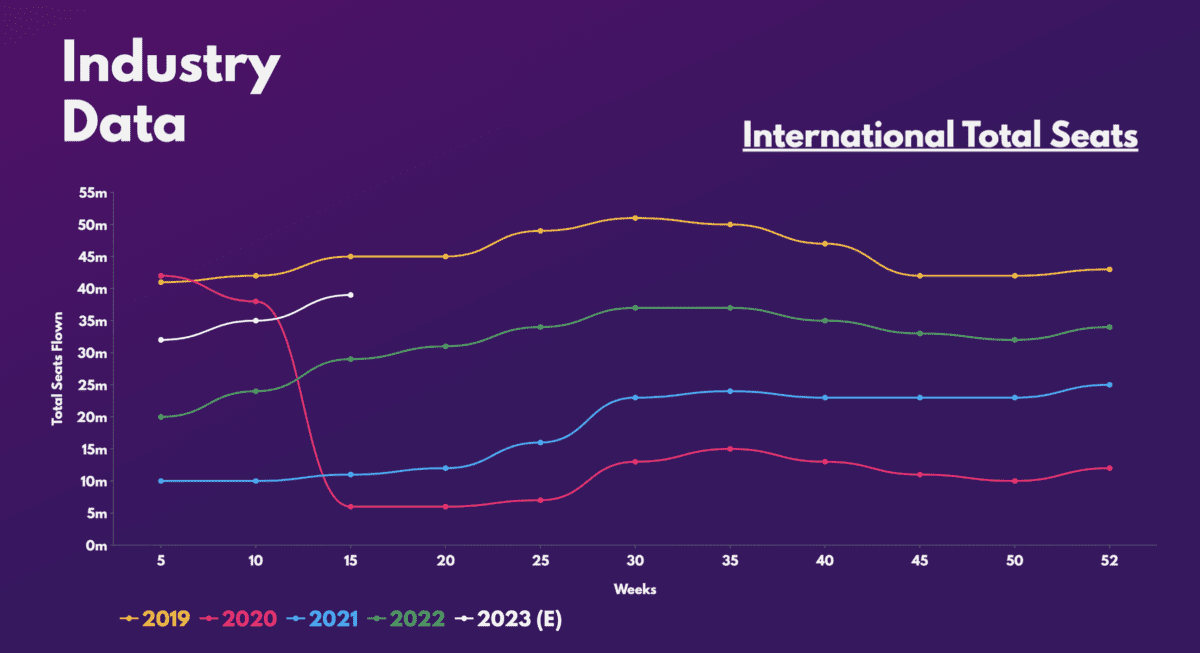

Its capacity and load factors are still below pre-pandemic levels, especially with its Asian routes. As such, there is still potential for the FTSE 100 stalwart to continue to grow your revenue as international travel continues to recover. In addition, longhaul routes are more profitable, which should boost IAG’s results over time.

Additionally, IAG’s premium products such as First and Business Class are only at 75% of 2019 levels. This leaves room for margin expansion as these products are more profitable. This would be one of the stock’s unique selling propositions, given its exposure to the premium and long distance market.

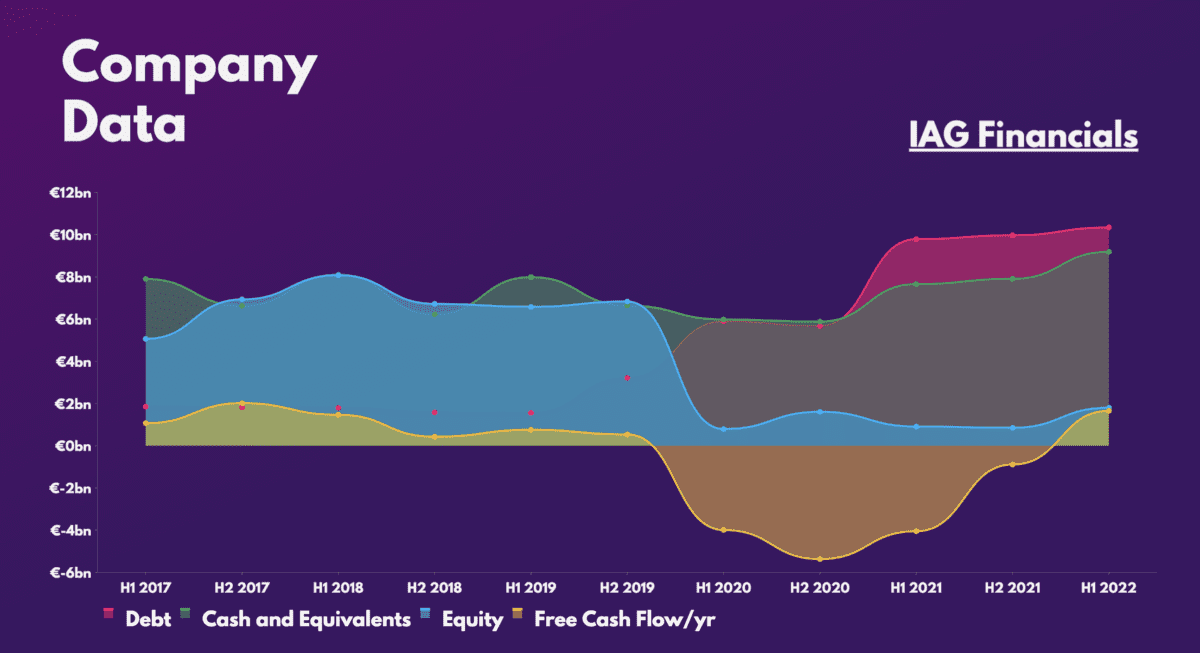

However, it is worth noting that IAG’s financials are not ideal. Sitting on a 576% debt to equity ratio (excluding deferred income liabilities) will most likely impact future earnings potential and dividends due to debt payments.

The easyJet case

The alternative choice is the easyJet action. The Luton-based airline has also performed admirably so far this year, with its shares up 40%.

Unlike IAG, easyJet has a slightly different business model. Due to the highly competitive nature of the short-haul market, the budget airline operates more on a volume-focused model. The goal is to fit as many seats on a flight as possible to maximize revenue and economies of scale.

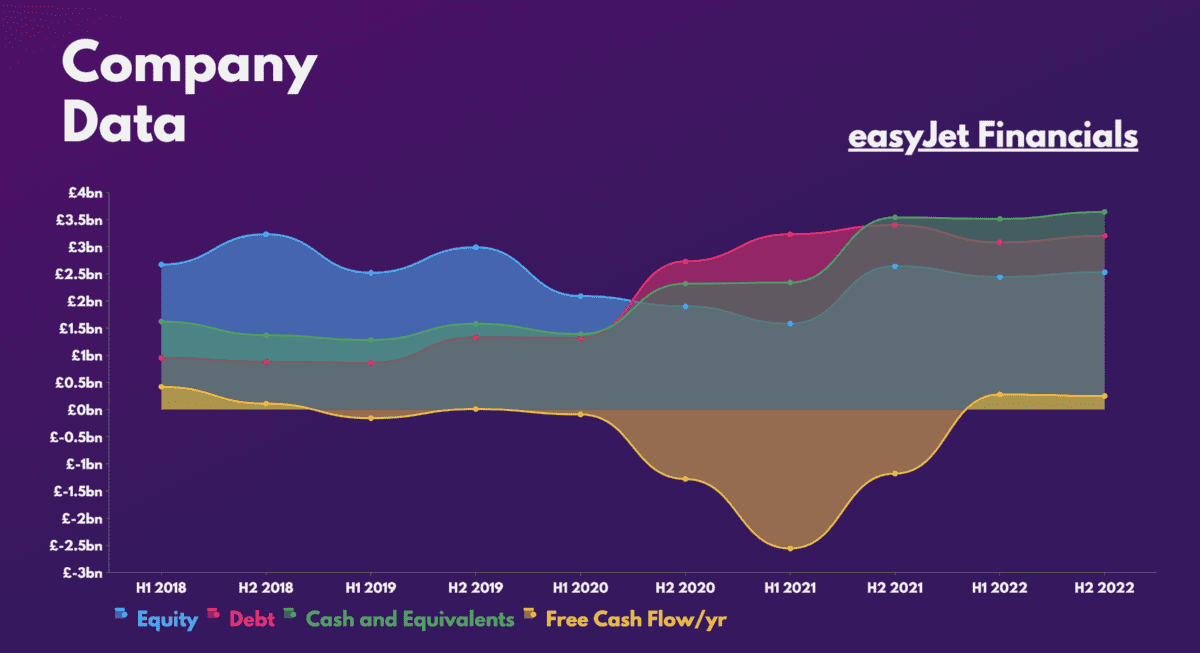

That being said, this strategy does have its drawbacks as it tends to lead to lower margins. So easyJet and its other low-cost peers have yet to achieve profitability since the pandemic. But where easyJet loses on margins, it makes up for on bottom line. Unlike its larger competitors, the profitable business has a much stronger balance sheet, giving it a much greater margin of safety.

As a result, the FTSE 250 The firm expects to reach profitability in September with strong reserves going forward. And with total seats flown still below pre-pandemic levels, there’s still room for easyJet to increase their number.

What is my choice?

That said, there’s no question that both IAG and easyJet shares are excellent picks to capitalize on the travel rebound. The fact that both stocks are also trading at similar valuation multiples doesn’t make choosing a better buy any easier either.

| Metrics | IAG | easyJet | industrial average |

|---|---|---|---|

| Price-to-book (P/B) ratio | 5.0 | 1.4 | 1.8 |

| Price-Sales Ratio (P/S) | 0.4 | 0.6 | 0.8 |

| Forward price-to-sales ratio (FP/S) | 0.4 | 0.5 | 0.7 |

| Forward price-earnings (FP/E) ratio | 12.9 | 19.9 | 29.1 |

But if I had to choose, I would choose easyJet stock for two main reasons. The first would be its future dividends, as they seem more secure due to its stronger balance sheet. The second would be its new Holidays segment, which allows passengers to book travel packages. This is anticipated to be a growth giant for the company and allow it to expand its profit margins into double digits, which I am a huge fan of. Therefore, I will be buying more easyJet shares soon for future growth.

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);