Image source: Getty Images

Food inflation is now at multi-decade highs. So it came as no surprise to see supermarket stocks fall last year. With Tesco (LSE: TSCO) and j sainsbury (LSE:SBRY) being the most popular supermarket stocks in the UK, I will assess which is a better choice for my portfolio.

The Tesco case

Tesco is the UK’s largest supermarket and retailer. It has operations throughout central Europe, but most of its profits are generated locally and from its grocery division. She also earns income from her catering business (Booker), Tesco Bank, her F&F fashion range and more.

Shares of the giant retailer had fallen as much as 30% at one point last year. However, they have staged a respectable recovery since then.

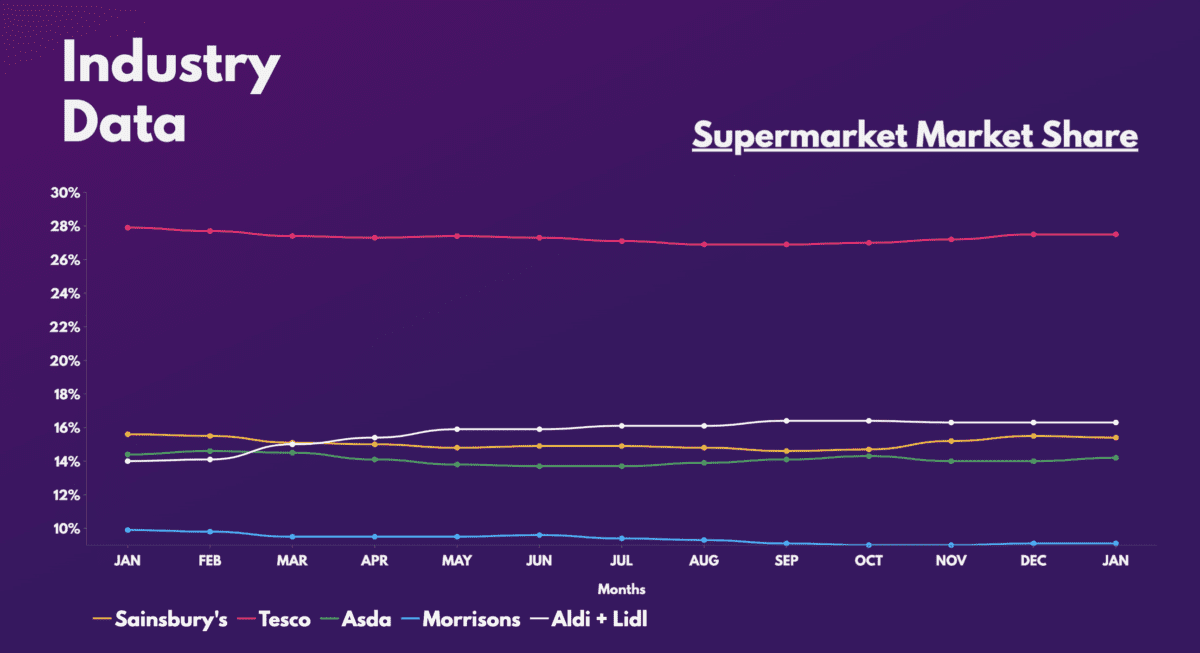

This recovery can be attributed to a number of recent positives. But the biggest would be that Tesco managed to maintain its dominant market share. This was despite the cost of living crisis and consumers flocking to budget chains. In fact, the company is the only major supermarket to have increased its market share since 2019.

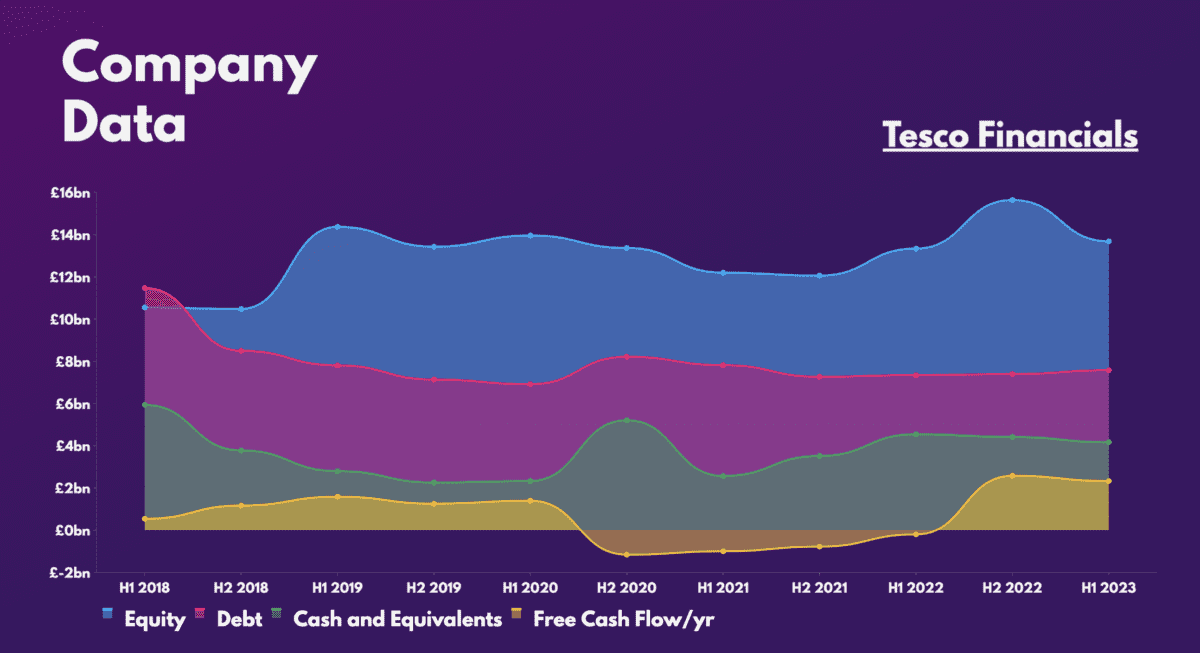

However, it is worth noting that the FTSE 100 unconditional does not have an ideal balance. Debt levels are typically higher for retailers due to their large inventories. However, Tesco’s cash levels are still below its short-term liabilities, which could affect future earnings potential if free cash flow deteriorates.

The Sainsbury’s case

The alternate stock pick is J Sainsbury. Sainsbury’s also has a variety of operations. They include Argos, Nectar, Habitat and more. And like its retail peers, the orange-branded company has staged a monumental recovery, rising 50% from its trough.

But what has set it apart from Tesco this year has been the action behind the scenes. Sainsbury’s share price began to soar as soon as Bestway, the UK’s largest independent wholesale conglomerate, revealed it was buying a substantial stake in the grocery store.

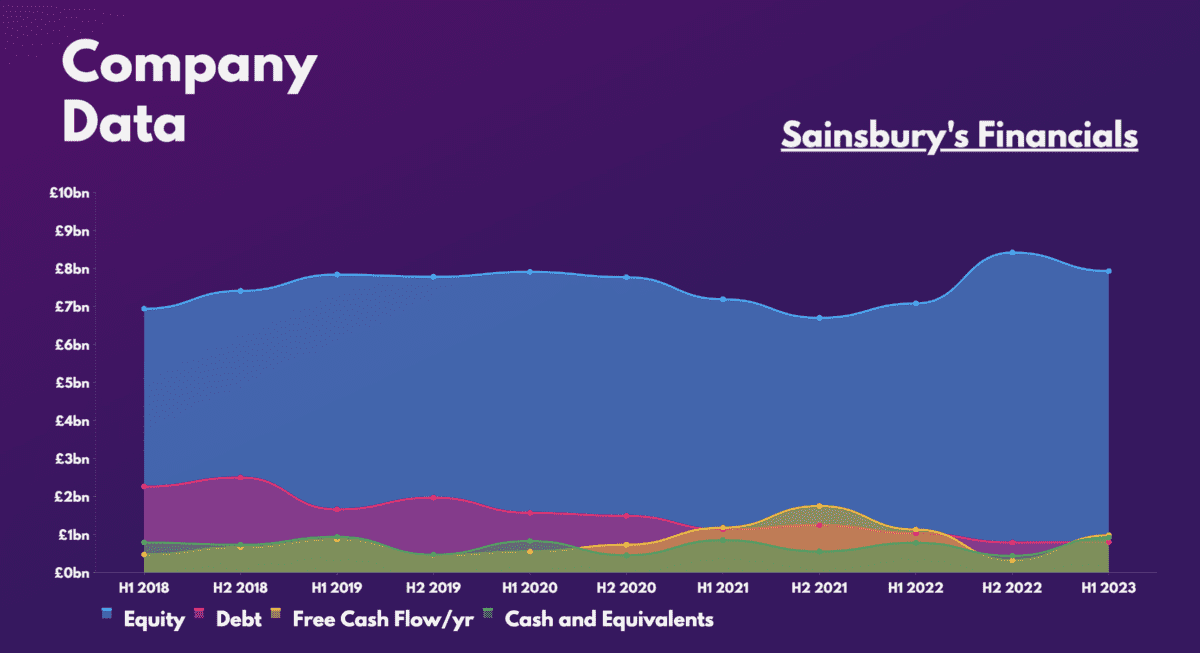

Although an acquisition is unlikely for now, the Bestway purchase certainly has investors excited. That’s because the wholesaler is known for its effective cost-saving strategies. So there is hope that he could be influential enough to help improve Sainsbury’s margins and finances. After all, the group has seen its debt levels gradually decline in recent years.

My stock pick

That being said, choosing between the two actions is not an easy task. That’s because Tesco and Sainsbury’s are excellent blue chip stocks. In addition, they have identical dividend yields (4.7%). However, the difference between the two lies in their upside potential.

Tesco offers stability and steady passive income, but limited growth. While the same is true for Sainsbury’s, it could be argued that there is more upside potential given the better opportunity to increase its market share. This is especially the case with a Bestway endorsement.

So which stock would I choose for my portfolio? Well if I were a retiree I would probably choose Tesco for its constant dividends and security from him. But as I am willing to look for more growth opportunities I would choose Sainsbury’s. After all, it currently trades at cheaper valuation multiples than its industry leader and has a better balance sheet.

| Metrics | Tesco | Sainsbury’s | industrial average |

|---|---|---|---|

| Price-to-book (P/B) ratio | 1.3 | 0.8 | 1.4 |

| Price-Sales Ratio (P/S) | 0.3 | 0.2 | 0.3 |

| Price-Earnings Ratio (P/E) | 18.6 | 10.3 | 14.1 |

| Forward price-to-sales ratio (FP/S) | 0.3 | 0.2 | 0.7 |

| Forward price-earnings (FP/E) ratio | 12.3 | 13.6 | 13.3 |

That being said, I am not a fan of investing in companies with low profit margins. And unfortunately, neither Tesco nor Sainsbury’s are showing quality gains yet. Rather, I prefer to buy stocks with higher profit margins, such as marks and spencer. Therefore, today I will not invest in any of the supermarket giants.

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);