Image source: Getty Images

When I started saving a little from my first job, I didn't even know a stocks and Shares ISA existed. I entertained myself for years with bad investments. I don't even want to calculate how much my lack of knowledge and action cost me

If I were to start over today with £3,000, it would be a very simple investment. It's something that some people would consider “risky” and “boring” to others. But a simple calculation proves it. could will lead to £52,000, as I'll explain in a second.

And the first investment is vital. I know this very well because my first attempts at making my money work for me were miserable. I don't think I've made a single good move in years.

wasted

For example, my first attempt at investing was with a savings account. The first month I didn't even get £1 interest.

Property was another investment I looked at. Putting down a deposit on a house probably would have been lucrative, but a permanent abode would have been a chain around my neck.

My next step was even worse. I didn't invest in anything. I figured getting a good return on my money was impossible for a small saver, so I gave up.

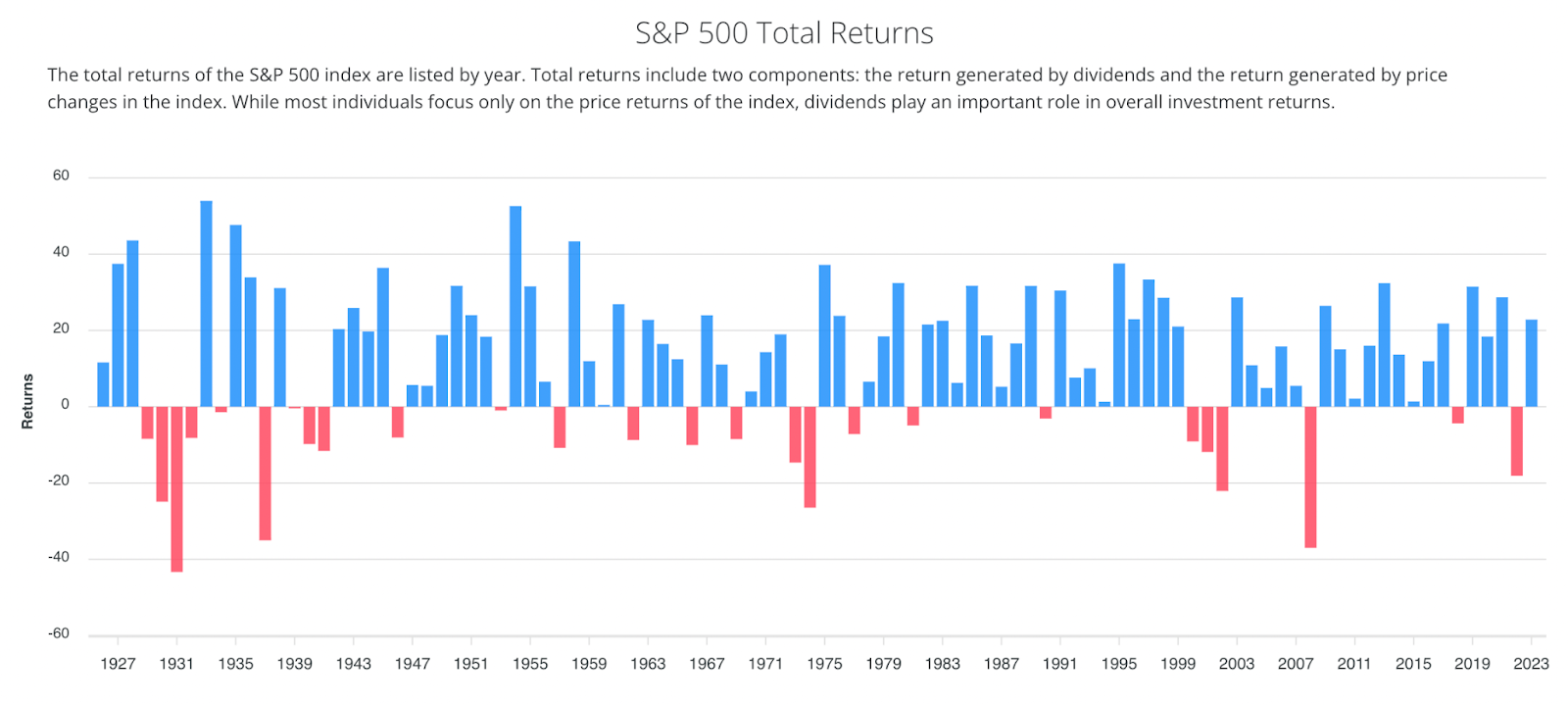

The turning point was when I was exposed to the past performance of the stock markets. For example, here is the long-term track record of one of the most popular markets to invest in a stocks and shares ISA: the US. S&P 500.

That market has an average annual return of more than 10%. Such a high rate would make even a small sum like £3,000 grow enormously, if it were given time to compound.

After 30 years it is worth £52,348. After 40 years it is worth £135,778. Does that seem correct to you? Maybe not. Let's look at the table below to show how a 10% increase breaks down year over year.

| Year | Total | Year | Total | Year | Total | Year | Total |

| 1 | £3,300 | eleven | £8,559 | twenty-one | £22,201 | 31 | £57,583 |

| 2 | £3,630 | 12 | £9,415 | 22 | £24,421 | 32 | £63,341 |

| 3 | £3,993 | 13 | £10,357 | 23 | £26,863 | 33 | £69,675 |

| 4 | £4,392 | 14 | £11,392 | 24 | £29,549 | 3. 4 | £76,643 |

| 5 | £4,832 | fifteen | £12,532 | 25 | £32,504 | 35 | £84,307 |

| 6 | £5,315 | sixteen | £13,785 | 26 | £35,755 | 36 | £92,738 |

| 7 | £5,846 | 17 | £15,163 | 27 | £39,330 | 37 | £102,012 |

| 8 | £6,431 | 18 | £16,680 | 28 | £43,263 | 38 | £112,213 |

| 9 | £7,074 | 19 | £18,348 | 29 | £47,589 | 39 | £123,434 |

| 10 | £7,781 | twenty | £20,182 | 30 | £52,348 | 40 | £135,778 |

And if I want this kind of growth, a large market index fund is an obvious choice for a first investment. I can invest in the S&P 500 as I mentioned above. He FTSE 100 is the closest equivalent in the UK.

My first investment was a world tracker. I was attracted to diversifying around the world. I still have the fund today and it has been very lucrative.

Which country's economy will perform better over the next decade or two? Will it be China? Or the UK? India? Or maybe the United States? I don't mind. I have exposure to all of them.

The best place

The investment generally limits the upside potential. I get the average return, not the extraordinary one.

Picking individual stocks is one way to increase my profitability. While I still recommend index funds as a low-risk first step, my own journey moved toward a balanced portfolio of funds and stocks. On the one hand, I like to have more control over where I invest my money. The possibility of obtaining higher returns is also a nice bonus.

Regardless of how you invest, making money is not guaranteed. The historical record is outstanding, but that is the past. The future is unknown.

However, even with these risks, I believe the stock market is not a better place for a first investment of £3,000 in an ISA.

NEWSLETTER

NEWSLETTER