Image source: Getty Images

I like to buy FTSE 100 companies in decline and with B.T. (LSE:BT) shares have fallen in recent weeks. Is this the opportunity you have been waiting for?

I have been waiting for the right time to add BT to my portfolio for several years, alerted by a 75% drop in its share price as revenues declined, management strategies failed and net debt headed towards £ 20 billion.

I've approached it a few times, but never had the courage to click the “buy” button.

So why is this FTSE 100 recovery play falling again?

BT fits the profile of the type of stock I like to buy. It is a blue-chip company established in the United Kingdom that has fallen on difficult times but has the potential for recovery.

It's cheap, with a price-to-earnings (P/E) ratio of just 7.45, almost exactly half the FTSE 100's current average P/E of 15.1. Additionally, it offers a dividend yield of 5.85%, comfortably above the index average of around 3.5%. It is covered 2.4 times earnings.

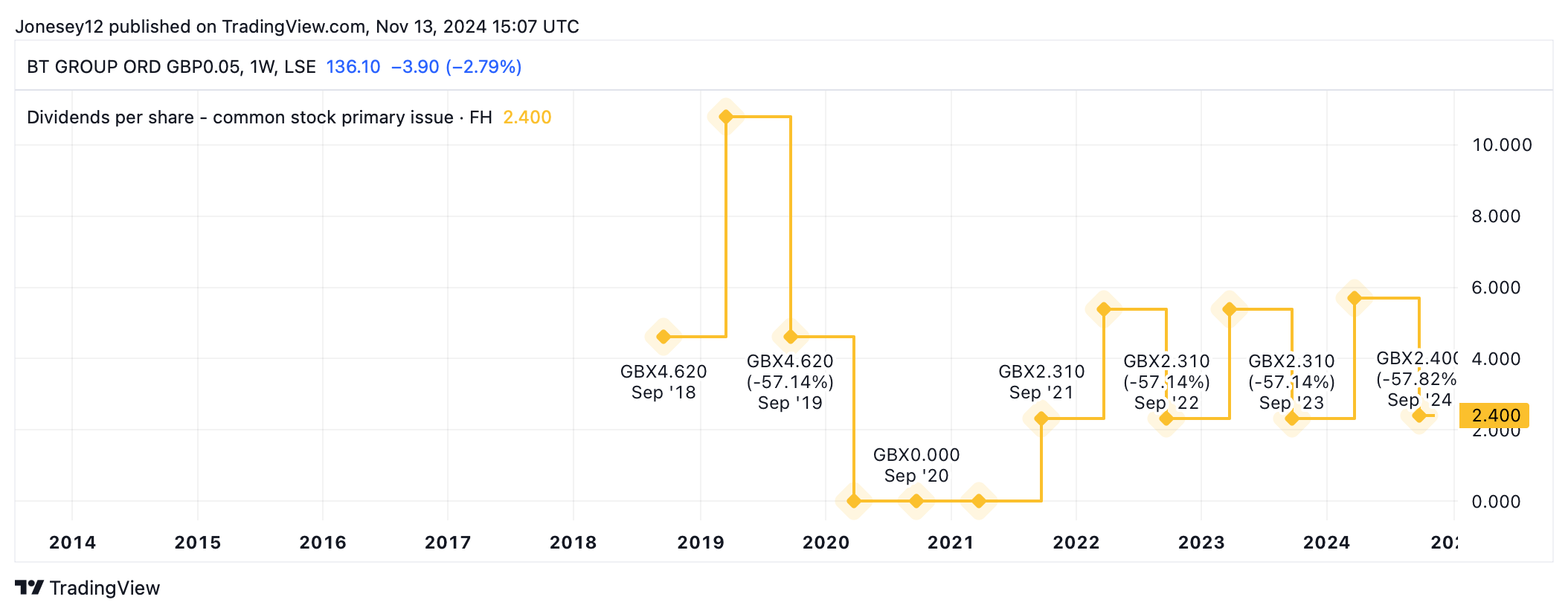

Better yet, it looks like the dividend could be sustainable. While the board suspended payments to shareholders during the pandemic, they have since increased, as this chart shows.

Chart by TradingView

Analysts estimate that BT shares will return 5.93% in 2025 and 6.06% in 2026. As always, dividends are not guaranteed, but these figures are tempting.

BT received a boost over the summer when it emerged that two telecoms billionaires were taking a stake in the company: Carlos Slim and Sunil Bharti Mittal. If they had the courage to buy the shares, surely I did?

However, I didn't and I'm glad. On November 7, BT lowered its full-year revenue guidance citing weaker trading outside the UK. “competitive retail environment”. Provisional pre-tax profits fell 10% to £967m.

High dividends at a low price.

Still, the board increased its interim dividend by 3.89% to 2.40p, while free cash flows rose 57% to £700m. This was due to higher EBITDA earnings, working capital timing and a tax refund. Executive Director Allison Kirkby stated that the group is “firmly on track to meet our long-term cost savings and cash flow objectives”. Do I feel brave?

With the market falling overall, the BT share price is down 6.48% over the last week. However, it continues to increase by 13.46% in one year.

Now comes the exciting part, for those who trust the brokers' forecasts. The 12 analysts following BT have set an average one-year price target for the stock of 199.15p. If correct, this would mark a 45% increase from the current price.

Kirkby still has many challenges, including meeting its goal of cutting 55,000 jobs by 2030, streamlining an organization that is trending toward expansion, and reducing that debt pile.

BT may have reached the “turning point” in Openreach spending but now has to retain its customers. Instead, it appears to be losing out to smaller broadband providers.

I resisted the temptation to buy BT shares after the hype over Slim and Mittal, to give it time to calm down. That has happened now. I have gathered courage and am willing to buy BT shares. All I need now is the cash.

NEWSLETTER

NEWSLETTER