Image source: Getty Images

The majority of my portfolio is invested in individual UK stocks, but I also have exposure to the US through the Vanguard S&P 500 UCITS ETF.

individual purchase FTSE 100 companies in hopes of generating more dividends and growth than I would gain by simply following the index, but I don't feel as confident about buying individual US stocks. Hence the tracker.

I have a tracker from the UK, the Vanguard UK All-Share Index Unit Trustwhich I bought after transferring some legacy business schemes into a self-invested personal pension (SIPP).

This gave me instant exposure to the stock market while I set about the task of populating my SIPP with UK shares. My timing was good as the FTSE All-Share fell when I bought my tracker on July 7th. So far I am up 16.45%.

Should I continue following the FTSE All-Share?

I'm happy with that, but I'm even happier with the Vanguard S&P 500 UCITS ETFwhich I bought on September 22 of last year. It has increased by 33.24%.

As a point of reference, the FTSE All-Share is up 9.03% in 12 months, while the S&P 500 is up 35.54% over the same period.

This is not surprising. The US stock market contains the world's most exciting companies, led by the Magnificent Seven tech giants like Apple, NVIDIAand microsoft. However, this past stellar performance makes me wary.

Today, the S&P 500 trades with a high P/E ratio of 38.16. That's more than double the FTSE All-Share's modest P/E of 14.2.

Carrying out this operation would imply selling low and buying high, when normally I try to do the opposite. So this is what I'm going to do instead.

I will continue to sell my FTSE All-Share tracker. Because? Because I'm totally invested and I need some cash. And the last 18 months have shown that my biggest successes have not come from trackers but from individual UK stocks.

For example, the actions of Group only (LSE: JUST) are up 70.25% since I bought the FTSE 250 insurance company almost a year ago. I found this particularly gratifying because I carefully reviewed the rule about stocks before purchasing them.

Just Group's share price plunged in July 2018 after a Prudential Regulation Authority inquiry into the share release market forced the board to set aside additional capital to cover its lifetime mortgage products.

Just Group shares beat the US index

The consultation failed, as consultations often do. However, Just's share price failed to come to life. So I took my chance.

In August, it posted an excellent first half with a 44% rise in underlying operating profit to £249m, amid higher new business sales, higher recurring profits and improved operational efficiency. Just's balance sheet looks strong with a capital coverage ratio of 196%.

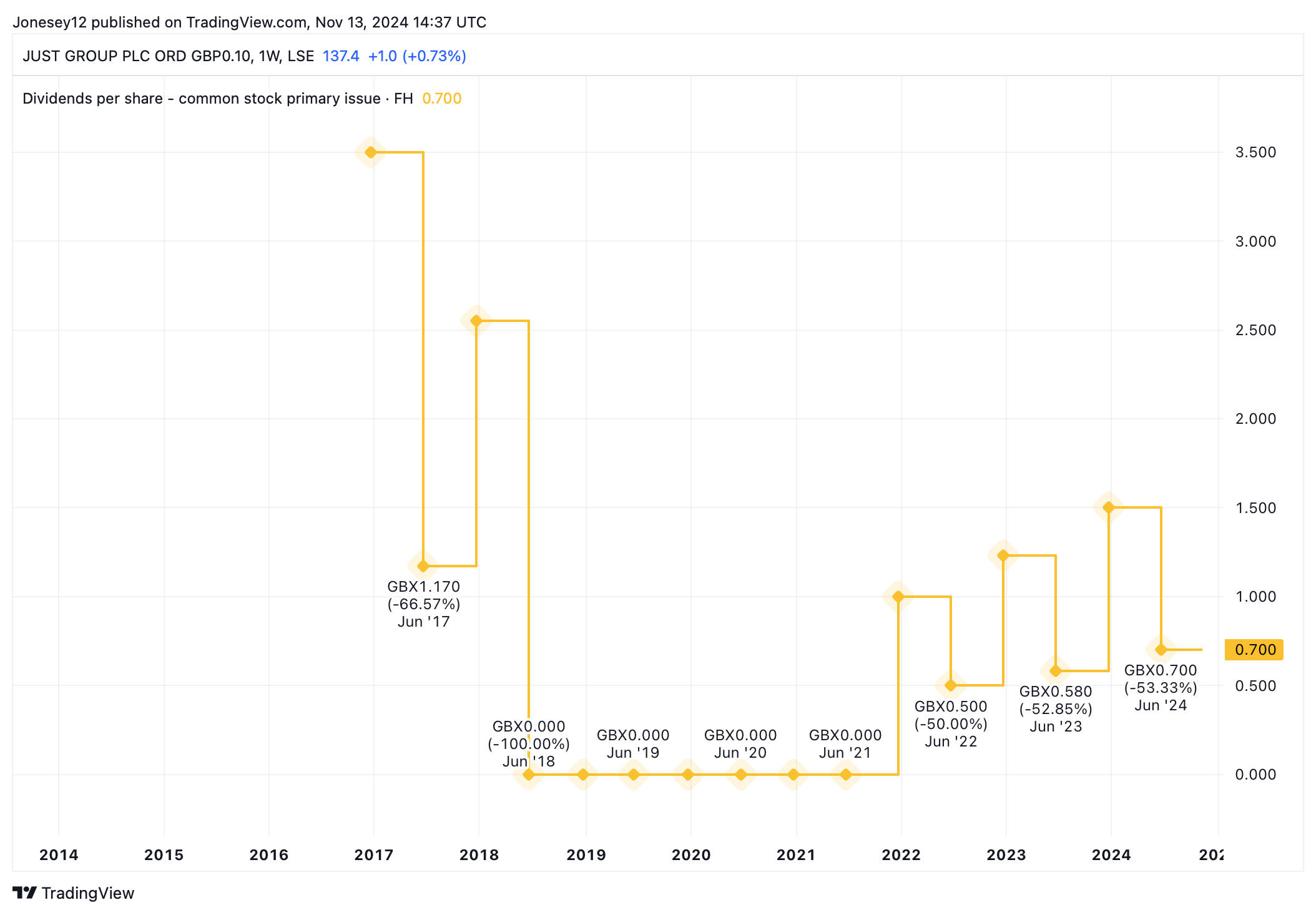

As with all actions, there are risks. Just Group sells annuities and sales have soared as rising interest rates mean they pay more income. Once rates drop, sales may reverse. The stock has a low trailing yield of just 1.51% and dividends have been spotty, as this chart shows.

Chart by TradingView

It still looks incredibly cheap, with a P/E ratio of just 4.88. I'd rather use the proceeds from my sale of the FTSE All-Share tracker to buy great value British shares like this one, than a potentially overvalued S&P 500 tracker.

NEWSLETTER

NEWSLETTER