Bets against energy stocks increased in late April. The average short interest among energy stocks in the S&P 500 index rose 8 basis points to 2.65% of shares floated at the end of the month since March.

He S&P 500 Energy sector (NYSERCA:XLE) is up 11.4% so far this year compared to the benchmark index (SP500), which represents an increase of 9.5% since the beginning of the year.

stocks with the largest and least short positions

Ranked by short interest as a percentage of the stock float

SLB (SLB) was the most shorted energy stock, with 30.75 million shares sold short as of April 30, or 7.26% of shares outstanding.

Halliburton (HAL) was the second most shorted energy stock with 6.50% of the share float, followed by Baker Hughes (BKR) with a short interest of 5.74%.

The two largest contributors to the energy index, Exxon Mobil (XOM) and Chevron (CVX), had short interests of 3.59% and 2.89%, respectively.

APA (APA) was the least shorted stock, with 19.49 million shares sold short, or 1.07% of shares float, followed by EQT (EQT) and Marathon Oil (MRO), with an interest short of 1.67% and 1.75%, respectively.

Industry analysis

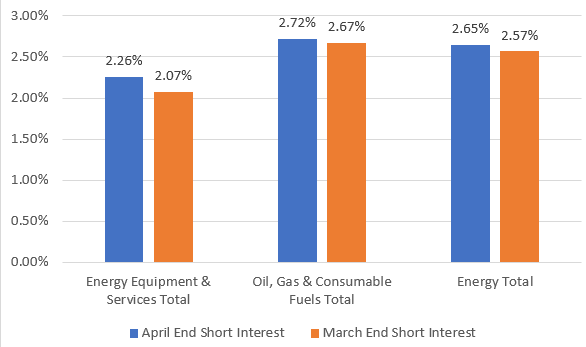

Average Short Interest as a Percentage of Float Shares

Energy Equipment and Services was the most shorted industry within the sector, with short interest of 2.26% at the end of March, up from 2.07% at the end of March. The subsector experienced the largest basis point increase within the energy sector as a whole.

Oil, gas and consumable fuels was the least shorted industry within the energy sector, with short interest of 2.72% at the end of April, up from 2.67% at the end of March.

NEWSLETTER

NEWSLETTER