May Lim/iStock via Getty Images

REITs finished lower than last week in the absence of a positive catalyst, underperforming broader markets for the second consecutive week.

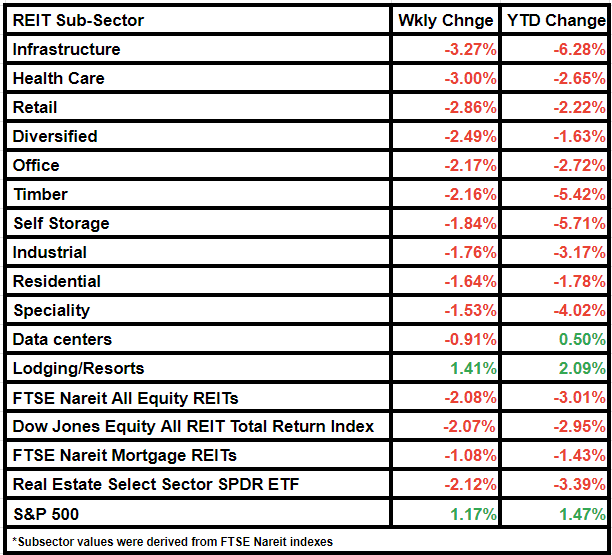

The FTSE Nareit All Equity REITs Index fell 2.08%, while the Dow Jones Equity All REITs Total Return Index fell 2.07%. FTSE mortgage REITs NAREIT fell 1.08%.

The broader Real Estate Select Sector SPDR ETF was also down 2.12%.

Meanwhile, the S&P 500 gained 1.17%.

Short interest on equity REITs continued to decline, with the sector posting an average short interest of 3.3% of the total float in December, a report according to S&P Global Market Intelligence. The figure He stood at 3.6% in November.

Industrial REIT Prologis (PLD) kicked off the REIT earnings season with a not-so-impressive financial result. The company's fourth-quarter earnings failed to beat the average analyst estimate, while its 2024 guidance range indicated it might fall short of the Wall Street consensus.

Mortgage REIT AGNC Investment (AGNC) is also expected to post a decline in fourth-quarter earnings next week.

The announcement of the deal between Blackstone and Tricon Residential helped the rental housing segment rise on Friday, but the residential subsector fell 1.64% over the course of the week.

Among subsectors, Infrastructure saw the steepest decline, followed by Healthcare. The former decreased by 3.27% and the latter by 3.00%.

A notable outlier during the week was Lodging/Resorts, which gained 1.41%. A major hotel REIT, Pebblebrook Hotel Trust (PEB), today announced strong December results and said fourth-quarter adjusted FFO per share is expected to exceed its previous outlook.

Power REIT (PW) was a major laggard among companies, down ~13% this week in value. Net Lease Office Properties (NLOP) was the biggest gainer, up ~22% from last week.

Here's a look at the subsector's performance over the week: