Vertigo3d/iStock via Getty Images

Real estate stocks ended a volatile week largely unchanged, with The Real Estate Select Sector SPDR Fund ETF (NYSERCA:XLRE) going backwards 0.12% since the previous week to close at 41.81.

The ETF gained in three of the five trading sessions, with a significant gain of 2.21% recorded on tuesday after Monday Clearance.

“Last week's weak US payrolls report combined with rising unemployment claims raised fears of a US recession. At the same time, the Bank of Japan's latest rate hike raised fears of a broader unwinding of the Japanese yen carry trade that had previously been used to fund Japanese and foreign assets. The combined effect of rising US recession risk and the unwinding of the Japanese yen carry trade more broadly triggered a correction in risk assets, particularly stocks, and a rally in safe-haven assets such as government bonds, the yen and the Swiss franc,” said Nikolaos Panigirtzoglou of JPMorgan.

On Monday, the XLRE lost 2.89% to close at 40.65, recorded three S&P 500 REIT rating downgrades.

Real estate space

Jones Lang LaSalle Industrial Real Estate Company saying in a report that fundamentals such as warehouse and distribution space absorption, vacancy rates, new property deliveries and subleasing activity slowed in the second quarter.

Retailers, manufacturers and logistics providers need more clarity on the direction of the U.S. economy and consumer spending before deciding on near-term warehouse space needs, the report said.

On a positive note, mortgage rates fell to their lowest level in more than a year due to a “likely overreaction” to the recent jobs report.

“Falling mortgage rates are increasing the purchasing power of potential homebuyers and should begin to spark their interest in purchasing a home,” said Freddie Mac chief economist Sam Khater.

Notably, not many housing experts believe rates will retreat significantly in the coming months, even if the Federal Reserve cuts the benchmark rate in September, according to an Aug. 9 report from Forbes. presented.

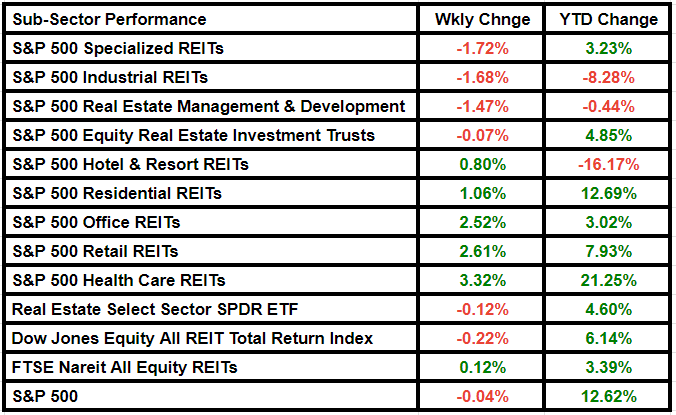

Subsector performance

Seeking Alpha's quantitative rating system maintained its Buy rating on XLRE, while SA analysts continue to rate the fund as a Hold.

Telecom tower REITs SBA Communications (SBAC), American Tower (AMT) and Crown Castle (CCI) dragged down the specialty subsector.

The subsector was the biggest loser of the week, having declined by 1.72% from the previous week.

Healthcare REITs Ventas (VTR) and Welltower (WELL) and retail REIT Simon Property Group (SPG) were notable winners, leading the healthcare and retail subsectors to post the biggest gains. Healthcare rose 3.32%while retail trade advanced 2.61%.

Simon Property and Realty Income (O) beat consensus estimates for earnings this week.

Here is a look at the subsector's performance:

NEWSLETTER

NEWSLETTER