Nadzeya Haroshka

Leading pharmaceutical lobbying group PhRMA and drug brokers known as pharmacy benefit managers (PBMs) have resumed their long-running battle over who is to blame for rising drug costs in the United States. , amid increasing public scrutiny.

The Biden Administration implemented Inflation Reduction Act (IRA) this year, which allows the Centers for Medicare and Medicaid Services (CMS) to negotiate drug prices for the first time in history.

The US Congress has also stepped up efforts to rein in PBMs, which serve as middlemen between health plans, pharmaceutical manufacturers and pharmacies.

With its industry under pressure amid rising healthcare costs in the US, PhRMA, too known as the Pharmaceutical Research and Manufacturers of America, blamed PBMs for rising drug prices and praised the country’s patent system for supporting innovation.

“Our intellectual property (IP) and patent system support a competitive market,” PhRMA said in a blog post in September, noting that cheaper versions of brand-name drugs have accounted for more than 90% of drug prescriptions.

Off-patent drugs, commonly known as generics and biosimilars, have saved the U.S. healthcare system $2.9 trillion over the past decade, the group said in a recent blog post.

“It is clear that patents do not prevent biosimilar and generic drugs from being developed and coming to market,” the group added, accusing PBMs of working together to keep generics and biosimilars off their formularies.

Major health insurers like UnitedHealth Group (New York Stock Exchange: UNH), Cigna (New York Stock Exchange:CI), CVS health (New York Stock Exchange:CVS) and Elevance Health (ELV) operate PBMs.

Citing a report from drug distributor Cencora (COR), PhRMA notes that since 2018, the three largest U.S. PBMs have excluded generics and biosimilars from formularies, a list of medications they maintain to indicate coverage for patients with commercial insurance.

This practice has gained momentum since then, with at least one from the three largest PBMs, excluding 14 biosimilars in total for a minimum of one year from 2020 to 2022.

“PBMs have excluded coverage of other medications that would lead to lower out-of-pocket costs for patients, including authorized generic and biosimilar insulins,” PhRMA wrote, adding that “it is the PBMs that decide which medications patients can get and what people pay”. pocket-size.”

Founded in 1958, PhRMA represents companies such as Amgen (AMGN), Pfizer (PFE), Bristol Myers (BMY), Gilead (GILD), J&J (JNJ), Eli Lilly (LLY), and Merck (MRK). Generic drug maker Teva Pharmaceutical (TEVA) left the group earlier this year following a similar move by AbbVie (ABBV).

PhRMA continues to represent Novartis (OTCPK:NVSEF), which recently divested its generics unit, Sandoz (OTC:SDZNY) (OTC:SDZXF), as well as others European pharmaceutical majors like Roche (OTCQX:RHHBY), GSK (GSK), Sanofi (SNY) and Novo Nordisk (NVO).

In a follow-up post, the group noted that rebates and fees charged by PBMs to manufacturers, pharmacies, health insurers and employers represent up to 42% of every dollar spent on brand name drugs.

According to PhRMA, PBMs are increasingly relying less on the rebates they receive from manufacturers for giving their drugs prominent placement on a plan’s formulary.

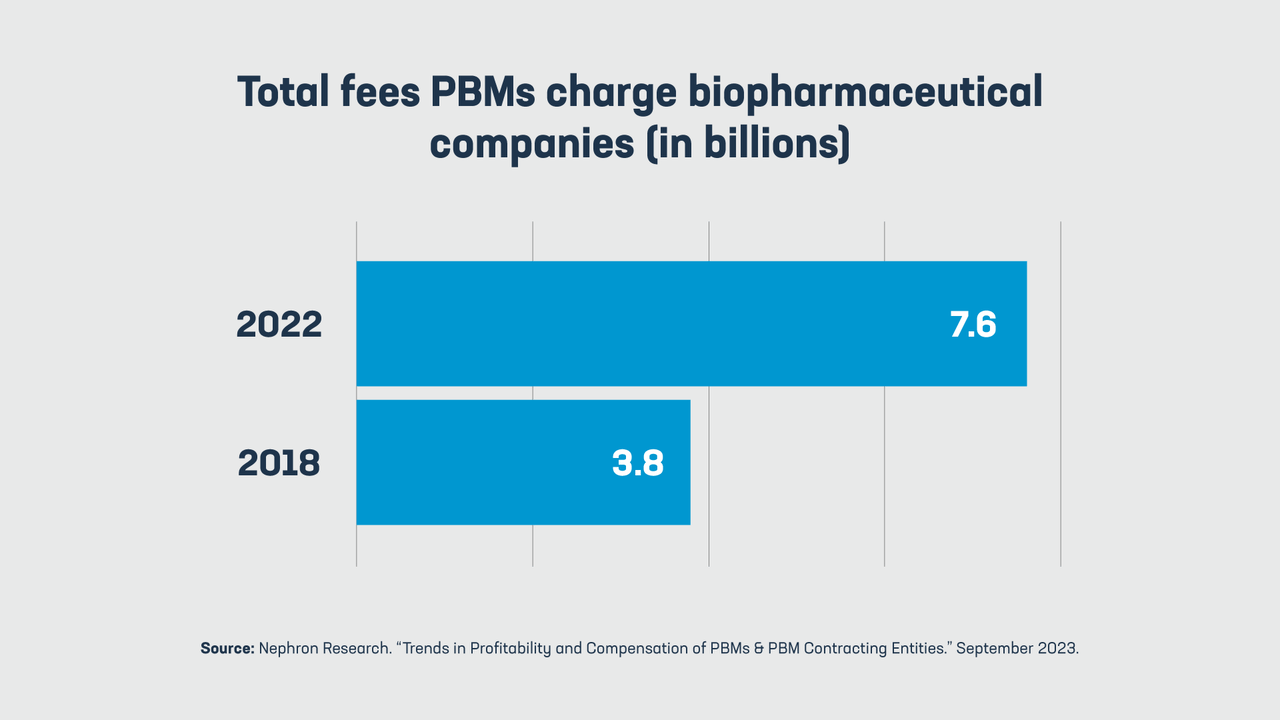

The trade group said that over the past five years, the fees PBMs charge drugmakers have doubled from $3.8 billion in 2018 to $7.6 billion in 2022.

Meanwhile, the Pharmaceutical Care Management Association (PCMA), the group representing PBMs, blamed Big Pharma for keeping prescription drug prices high through “egregious exploitation of pricing power.”

In response to a recent Senate Finance Committee bill targeting PBMs, the PCMA said the Proposed legislation “It allows Big Pharma to benefit immensely from the high list prices that Big Pharma companies set and raise, often without correlation to drug effectiveness, medical needs, or R&D costs.”

NEWSLETTER

NEWSLETTER