Nvidia's spectacular earnings capped another season of headline reporting for the so-called Magnificent 7 tech stocks, underscoring its broader market dominance amid this year's record rally.

Nvidia (NVDA) The first quarter earnings tally included a five-fold increase in overall revenue, which surpassed $26 billion, and a massive increase in net income that produced a bottom line of $15.24 billion.

Related: Costco earnings and Fed inflation gauge could rock markets this week

With that final report, the collective net income of the Magnificent 7 tech stocks, which include Microsoft (MSFT) Apple (AAPL) Alphabet (GOOG) amazon (AMZN) Metaplatforms (GOAL) and tesla (TSLA) totaled $108.9 billion during the first quarter.

This represents a more than 50% gain from the same period last year and dwarfs the 5.5% gain for collective earnings growth for the entire S&P 500, according to FactSet data.

“The first quarter was the fifth consecutive quarter in which, excluding the contribution of the Magnificent 7, the remaining 493 members of the S&P500 have shown clearly negative year-over-year earnings growth,” JP Morgan strategists said in a recent note to customers.

<img src="https://www.thestreet.com/.image/c_fit%2Ch_800%2Cw_1200/MTk5NTIwMzQzMjM1MjQxNjAw/7-stocks-2-yt-lead-db-072123.jpg”>

The street/Shutterstock

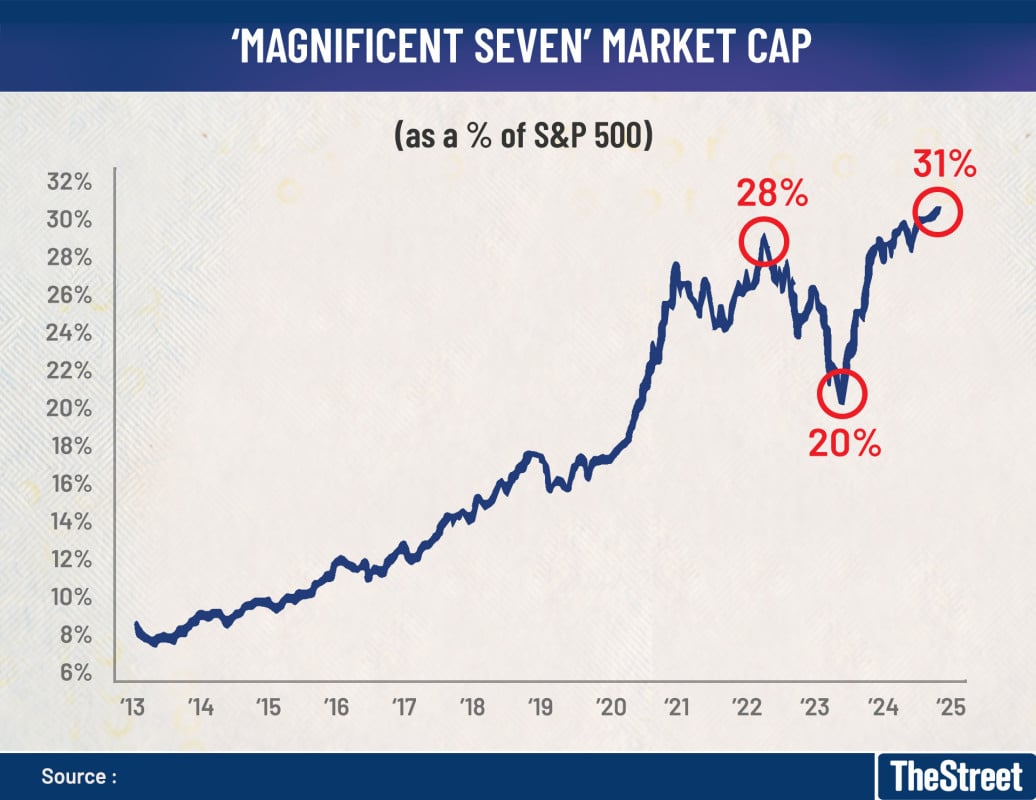

In fact, Magnificent 7 stocks have driven more than half of the S&P 500's performance so far this year, according to data from Bank of America's weekly 'Flow Show' report, even though they account for only about 31% of the total weight of the benchmark.

The bank described the profits as “monopolistic megatechnology monopolizes performance.”

The strengthening of technology in the S&P 500

Nvidia, meanwhile, has boosted nearly a quarter of the S&P 500's performance with its year-to-date advance of around 115%, a move that has lifted its market value to around $2.55 trillion.

Related: Veteran Fund Manager Revises Nvidia Stock Price Target After Earnings

The tremendous performance of the Mag 7, which together are up 24% this year, is also widening the gap between the S&P 500 and its equally weighted rival.

The largest benchmark of blue-chip U.S. stocks, which has hit 24 all-time highs this year, is up 15.56% over the past six months, compared with a 12.1% rise for the S&P 500 index. Equal Weight.

That gap has been widening since the market began recovering in early May, suggesting that Big tech's strength, rather than the broader quality of earnings, could be driving most of the gains.

A separate report from Bank of America, the closely watched monthly survey of global fund managers, noted that more than half of respondents considered the “Long Magnificent 7” stocks to be the most crowded trades in the market.

This is well ahead of the 12% worried about being “long US dollars” and 10% worried about being “short Chinese stocks.”

Mastering technological profits

technology is likely to continue to control the performance of the broader market through the summer months and beyond.

LSEG data suggests the communications services sector, including Google and Meta, and the information technology sector, including Microsoft, Apple and Nvidia, will contribute just over half of the S&P 500's $494.4 billion in second quarter earnings.

However, heading into the second half, some analysts see the dominance of the Magnificent 7 fading in favor of broader fundamental improvements developing in other sectors.

- Analysts Update Dell Stock Price Targets Following Tesla Server Win

- Nvidia Profits Will Be Crucial to stock market Zeitgeist

- Key Semiconductor stocks Plunge Despite Earnings Surge

“For example, Magnificent 7's 14% fourth-quarter 2024 earnings growth projection lags the rest of the index's 17%, as equity analysts appear to be anticipating more abundant opportunities for stock growth. gains beyond the market favorites,” said Jason Pride, head of Glenmede. investment strategy and research, in a recent report.

In fact, recent data offers some support for that view: Energy, materials and utilities firmly outperformed technology and communications services over the past three months.

But parts of that trade could also be linked to the expected rise of ai-related technologies.

“Companies supporting the expansion of electricity generation to support growing demand for cloud computing and electric vehicles are thriving,” said Louis Navellier of Navellier Calculated Investing.

“With earnings season almost over, the market will start to swing going forward and any stock that performs well will be a good buy on the dips,” he added. “I suspect energy stocks will be the best performers in June.”

Related: Best Single Trade: Wall Street Veteran Picks Palantir Stock