Image source: Getty Image

At the end of each month, I make time to review the market and pick the dividend-yielding heroes that will boost my portfolio.

Once a month is enough to perform a review. It keeps me from obsessing over small price changes each day. Instead, I focus on the long-term trends that are the key to a great trading strategy.

Here are my top picks for February.

building growth

A fluctuating share price has generated some surprising dividend yield figures in Khaki (LSE: PSN), most recently over 16%, but I’m taking a realistic approach in choosing the homebuilder as an investment.

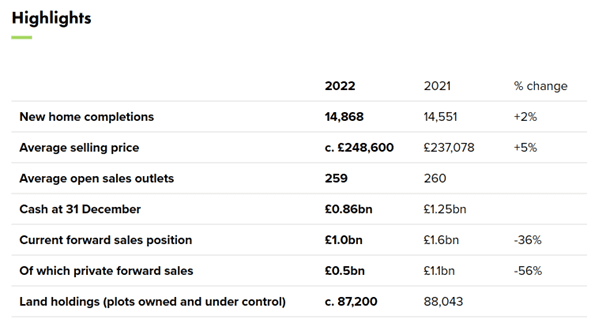

A business update on 2022 performance said new home completions were up 5% year-over-year and median sales price was up 5%.

Group chief executive David Finch said the year had been a good one, despite “headwinds”. These include supply constraints and a more challenging sales environment, with rising interest rates, mortgage rates, inflation and weaker consumer confidence.

These are short-term issues that will influence future sales, but he is confident that long-term demand for new homes will remain strong.

I tend to agree, especially since there is a national housing shortage of over a million homes. More housing is needed and I think this will continue to drive demand in the long term.

Also, I think concerns about future economic challenges are already being reflected in the share price. It currently sits at around £14, well below the lows hit during the pandemic.

There is a risk that the stock price will fall further as the housing market cools off during 2023. Also, in the global economic crisis of 2008, dividend yields collapsed to almost nothing.

However, I do believe that there are significant gains to be made over the long term in both stock price and performance. If the dividend yield is around 4-8%, based on the current share price, I’ll be happy.

Digging for diamonds

In October of last year, Royston Wild of The Motley Fool chose Anglo-American (LSE: AAL) as high-value stocks he was interested in after their price plunged.

He chose well, as an investment at the time would have jumped 30% now. I think there is still more good news to come, particularly in terms of its strong dividend yield of over 5%.

There is a risk, because pre-Covid dividend yields were much lower. If I look at the 2018 performance as a portion of today’s stock price, it would be 2%.

However, I believe there are some key factors that will fuel its growth, with a wide-ranging mining portfolio covering in-demand commodities including platinum and diamonds (Anglo American owns 85% of De Beers Group, the global diamond company). . It is also involved in crop nutrients.

A key to growth will be the Quellaveco copper mine in Peru, one of the largest undeveloped copper deposits in the world. As production increases, world production is expected to increase by 10%. This, in turn, should boost future earnings and dividends.