Image source: Getty Images

Despite its reputation for slow movement, FTSE 100 stocks can sometimes gallop.

And that’s what’s happening with right movement (LSE: RMV) today (27 November), following the release of a positive trading update.

The company describes itself as the UK’s largest property portal. And I guess a lot of people have probably heard of it even if they haven’t used the website.

However, a threat has emerged that could upset Rightmove’s strong position.

A great player is approaching

In October, Rightmove’s newer, smaller rival In the market received a takeover offer. And the suitor is a deep-pocketed American company called Co-star.

The problem here is that CoStar’s £27bn-plus market capitalization makes Rightmove’s almost £5bn look minuscule. And CoStar is keen to enter the UK property market to build on its previous success.

CoStar acknowledges that it has previously invested billions in building the world’s leading online real estate marketplaces. “generating hundreds of millions of leads, resulting in millions of successful commercial and residential property transactions for their clients”.

It looks like OnTheMarket, with its modest market capitalization of around £87m, may be on the verge of transforming into a well-funded powerhouse. And it could seriously challenge Rightmove’s dominance in the UK in the coming years.

Shareholders’ Wild Ride

In October, when news of the acquisition broke, Rightmove’s share price plummeted. However, he has been recovering well since then.

Today’s update has fueled the stock’s resurgence and as I write, the price is up around 6% since the stock market opened.

Directors said trading remains strong and they have a “clear” investment plan for “speed up”revenue and profit growth.

CEO Johan Svanstrom said business momentum has continued into the third quarter and beyond.

For now, the popularity of the platform continues to drive sales. And Svanstrom believes there is “significant” growth opportunities ahead.

Stable performance and rich valuation

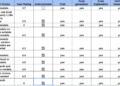

However, City analysts have made projections that appear modest. Shareholder earnings and dividends look set to increase by mid-single digit percentages throughout the 2023 business year and into 2024.

Rightmove has been a steady performer, but it doesn’t look like a high-growth proposition. And that’s even before any threat from CoStar develops.

If it’s not rapid growth, it must be income, right?

Sadly not. With the share price close to 541 pence, the expected dividend yield is just 1.75% for 2024. And the main reason is the high projected earnings multiple for that year, close to 21.

The Rightmove business has a long history of reliable progress and that could continue in the future.

However, for my taste, the risks accumulate too much here. Rightmove’s long-term position in the market may be threatened. And the stock has additional vulnerability due to its apparently high valuation.

So I choose to ignore the stock for now and will consider other stock opportunities instead.