funtap

REITs gained in the week ending November 17 thanks to a “likely no more rate hike scenario” and strong third-quarter earnings results.

Economic data continued to support a scenario of no further rate hikes from the Federal Reserve. Home builder, real real estate and mortgage REIT stocks, especially arose after Tuesday’s CPI report indicated that inflation continues to decline. Investors are said to be increasing bets that the Federal Reserve is done raising rates and could even begin cutting them in the second quarter of 2024.

Additionally, the sector posted better-than-expected earnings results across most real estate sectors. Among equity REITs that provided updated guidance, 82% raised their forecast.

Unlike the second quarter, which saw a handful of poor reports and unexpectedly steep dividend and forecast cuts, there were no big “bombshells” this earnings season, said Hoya Capital, author of Searching Alpha.

In particular, larger players are looking to consolidate the sector, diversify asset classes and build scale. Strategic bond mergers between publicly traded REITs are expected to take off in 2024, said corporate director at law firm Corrs Chambers Westgarth, Sandy Mak. saying in an exclusive interview with Street Talk.

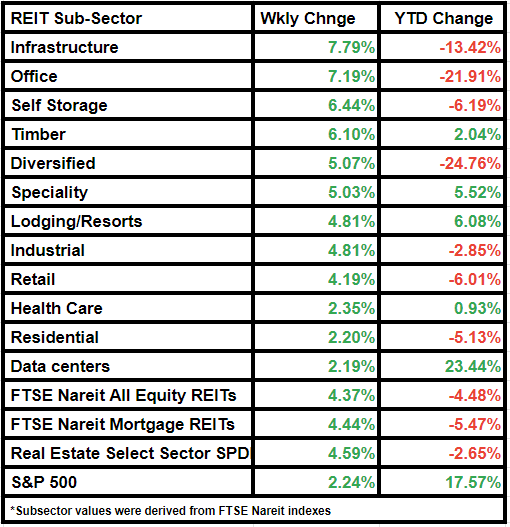

This week, the FTSE Nareit All Equity REITs Index rose 4.37% compared to last week, while the Dow Jones Equity All REIT Total Return Index rose 4.46%. The FTSE NAREIT Mortgage REITs index rose 4.44%. The Real Estate Select Sector SPDR ETF gained 4.59% weekly.

Meanwhile, the S&P 500 lagged relatively with a gain of 2.24%.

Office REIT Peakstone Realty Trust (PKST), mortgage REIT Hannon Armstrong Sustainable Infrastructure Capital (HASI) and hotel REIT Ashford Hospitality Trust (AHT) were the week’s biggest gainers.

Infrastructure REITs rose the most among subsectors, followed by office REITs. The office subsector gained especially after a research report from Fitch Ratings presented that WeWork’s bankruptcy was unlikely to put pressure on the subsector’s occupations.

Here’s a look at the subsector’s performance over the week: