Nadzeya Haroshka/iStock via Getty Images

According to a recent survey by Jefferies, an overwhelming number of healthcare executives expect a resurgence of the healthcare sector in 2024, supported by merger and acquisition activity and the GLP-1 class of weight loss drugs, while the COVID-19 takes a backseat.

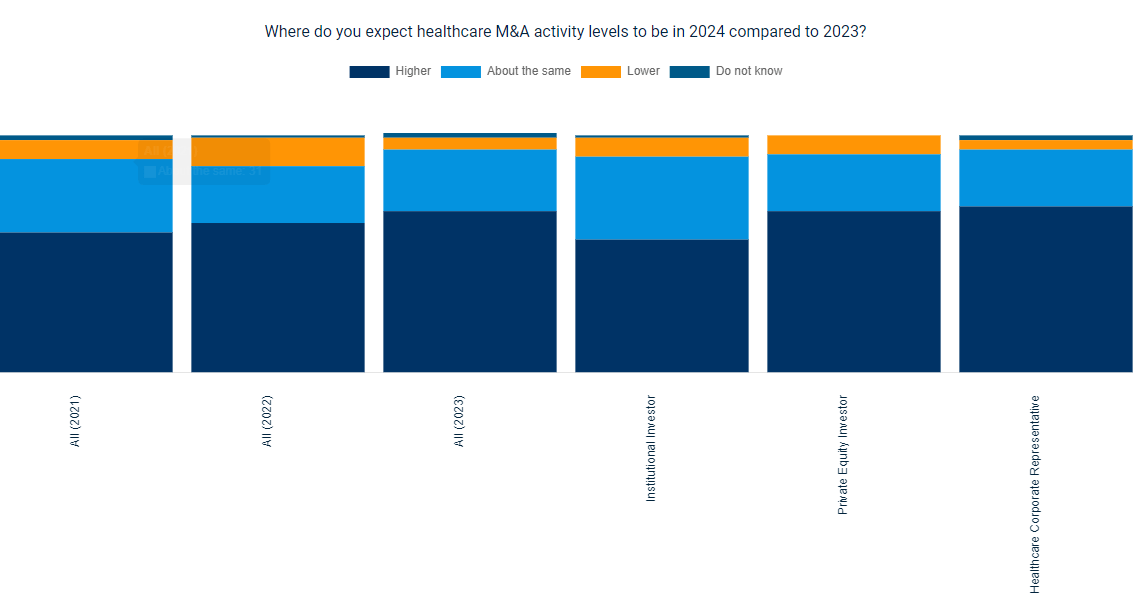

In In conjunction with its London Healthcare Conference, Jefferies said a growing proportion of healthcare executives continue to expect a rebound in mergers and acquisitions in 2024 after two years of subdued activity.

In 2022, the number and average size of global health services Mergers and acquisitions fell more than 30% and around 15%, respectively, as companies adopted a wait-and-see attitude amid market uncertainty, according to US consulting firm Bain & Company. That trend continued this year, with the global value of mergers and acquisitions falling 44% in the first five months alone.

Jefferies survey of more than 600 senior leaders and investors indicates a different view as 2023 comes to a close. 68% of respondents expect an increase in M&A deal volume in 2024, while only 5% project a lower level of deals.

According to the survey, 60% and 16% of respondents expect corporate and private equity to lead the M&A rebound in 2024, compared to 54% and 15% last year, respectively. Meanwhile, interest in public market debuts remains moderate, with 6% and 1% saying IPOs and SPAC-driven M&As will dominate the healthcare sector in 2024, respectively.

“The feeling towards Europe, in particular, is improving, with “The region is increasingly seen as a value opportunity for 2024, with private equity investors being the most optimistic,” said Tommy Erdei, global joint head of Jefferies Healthcare Investment Banking.

Other highlights from the report indicate a possible rebound in health care equity and new interest in the new class of weight-loss drugs GLP-1 as COVID-19 fades from sight.

While the MSCI World Health Care Index has lost ~6% this year through October, underperforming the broader market, 54% of respondents expect it to rise by the end of 2024, with just 15% predicting a drop .

“Institutional investors are the most optimistic: 92% believe it will remain at the same level or higher, and only 8% predict a decline,” Jefferies said.

In terms of major health issues, weight loss medications are gaining momentum at the expense of COVID-19. Despite the new variants, 84% of participants indicated that COVID-19 will no longer be a major health issue over the next twelve months.

“A big topic on everyone’s radar is the LPG-1 market, as companies across the supply chain work to position themselves within the growth opportunity it presents,” Erdei said, referring to drugs like Zepbound and Wegovy. developed by Eli Lilly (New York Stock Exchange:LLY) and Novo Nordisk (NVO).

“However, when we asked about the developing market for LPG-1, we found a divergence of opinions,” the firm said, noting that a third of respondents expect the LPG-1 market to be “very large and with long-term sustainability.” long term”.

However, the rest were not so convinced of the impact of LPG-1, with 35% pointing to “substantial risks that could deflate the market”, while 32% said there was not enough data to jump to conclusions.