Image source: Getty Images

Getting its share price back above the 50p mark was something lloyds (LSE:LLOY) struggled to do so throughout 2022. However, it found a breakthrough in January as the bank’s shares are now up more than 10% this year. With that in mind, I will be buying more Lloyds shares in the coming days.

interest increases

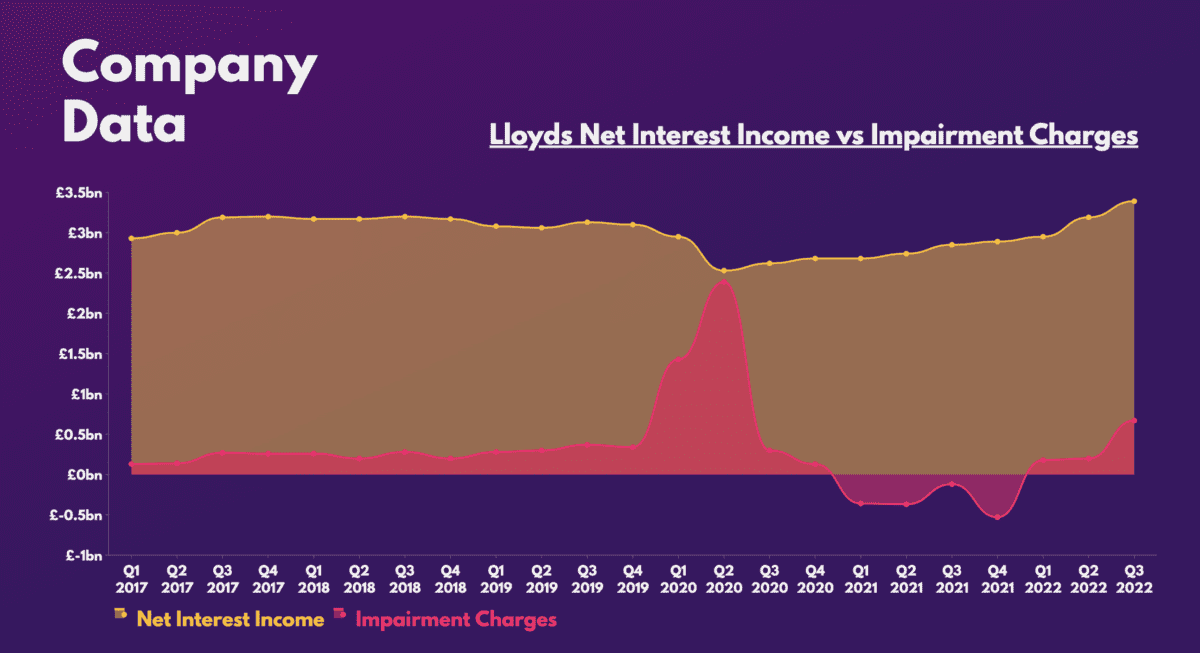

This week the Bank of England (BoE) raised interest rates another 0.5%, bringing the bank rate to 4%. This is good news for the FTSE 100 unconditional as you continue to expand your net interest income due to higher rates. That’s because Lloyds’ assets continue to generate more income than its liabilities.

The institution has approximately £80bn in assets stored at the central bank, meaning the recent rate hike will add another £400m to its income. Consequently, its bottom line should see improvements this year, which could result in higher dividends.

Before the current rate cycle, Black Horse Bank was not famous for its giant dividends. But given its recent advance, analysts are now forecasting payments to rise 13% this year. This would take your dividend yield to 5.2% if you bought Lloyds shares today, which could make you a decent passive income generator.

Banking on a soft landing

However, higher interest rates can also be a double-edged sword, as customers are more likely to default on their loans. This could result in the bank having to set aside a fraction of its earnings to cover those impairment charges. However, deteriorations should peak soon, as the BoE hinted at a possible pause in its rising cycle with inflation starting to ease.

More importantly, BoE Governor Andrew Bailey now anticipates that the impending recession will be shorter and less severe than expected. This should ease the upward pressure on impairment charges.

highest ratings

These tailwinds have resulted in several runners improving their qualifications for the action. Goldman Sachs in particular, he is very bullish on the group with a 76p price target. This would present a 46% advantage if you were to buy Lloyds shares today. What’s more, this optimism is echoed by other investment banks, with Red blood cells tagging it as apreferred stock“, and UBS calling it a”buy out of conviction“.

This optimism is not unfounded either. There are the company’s already cheap valuation multiples, and it also has a strong balance sheet to complement this. With a CET1 ratio of 15% and a liquidity coverage ratio of 146%, the conglomerate has enough cash to hand over in the event of mass withdrawals.

| Metrics | valuation multiples | industrial average |

|---|---|---|

| Price-Earnings Ratio (P/E) | 8.8 | 10.0 |

| Price at tangible book value (P/TBV) | 0.9 | 0.9 |

For those reasons, I will be buying more Lloyds shares to capitalize on its upside potential and before it becomes too expensive.

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);