Image source: Getty Images

As interest rates continue their upward trajectory, so too lloyds (LSE:LLOY) shares, apparently. The bank’s shares are already up more than 10% this year and could rise even more if the company is ready to report its fourth-quarter numbers next week. With that in mind, I will expand my position.

An ATM

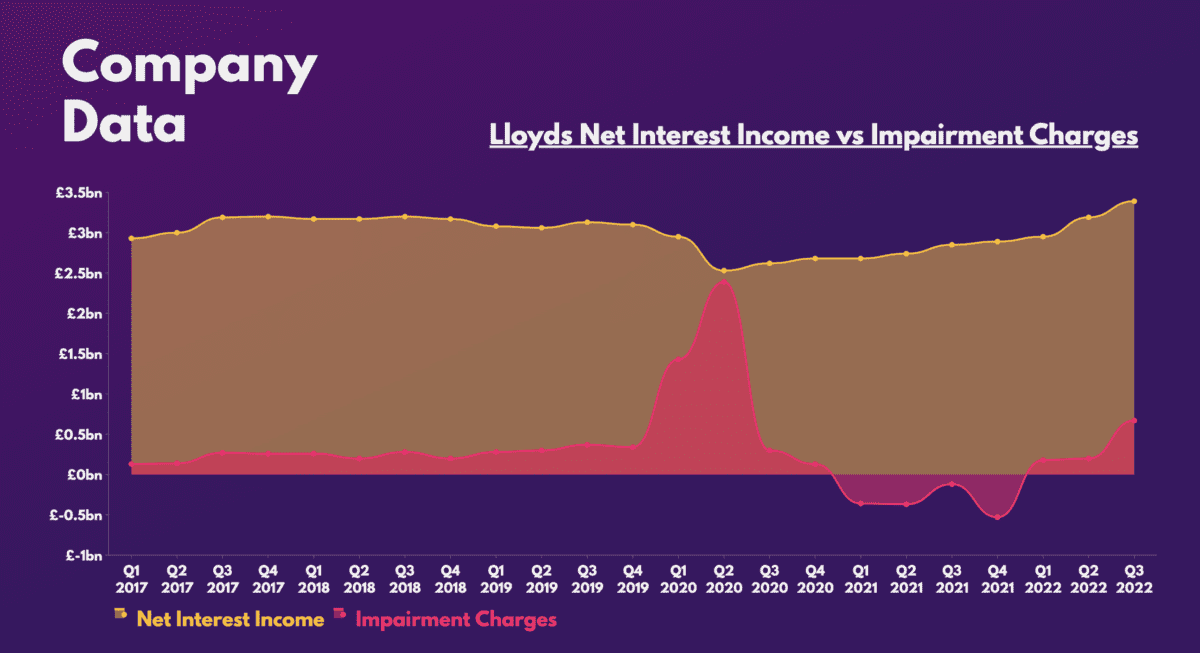

The recent strength of Lloyds’ performance can mainly be attributed to rising net interest income (NII). That is the interest the bank earns on financial assets, minus the interest it pays on its liabilities. And with roughly £80bn in assets stored at the Bank of England (BoE), Lloyds shares have benefited greatly from interest rate hikes while generating free cash.

However, rate hikes are a double-edged sword. This is because higher rates generally result in more defaults, leading to higher impairment charges. However, the Black Horse bank has been able to offset the increase in delinquencies with a higher INI. This has resulted in headline earnings getting a big boost over the past year.

Consequently, the stock is now close to hitting a three-year high. With inflation stubbornly high, the BoE is expected to continue raising rates, which would be to the advantage of Lloyds shares.

gathering interest

This optimism is not unfounded either. When Lloyds shared its third-quarter results, the board revamped the company’s direction. As a result, more brokers became bullish on the stock. the likes of Goldman Sachs, barclaysand German all have ‘buy’ ratings on Lloyds shares, with an average price target of 72 pence. Given such levels of confidence, it is not surprising to see expectations that the fourth quarter numbers will exceed what the board initially projected.

| Metrics | Q4 2023 (Agreement) | Q4 2022 | projected growth |

|---|---|---|---|

| Interest margin (NII) | £3.55 billion | £2.89 billion | 23% |

| net interest margin | 3.16% | 2.57% | 0.59% |

| spoilage charges | £380 million | -532 million pounds sterling | 171% |

| Net profit | £1.21 billion | £420 million | 188% |

| Return on Tangible Equity (ROE) | 12.5% | 2.9% | 9.6% |

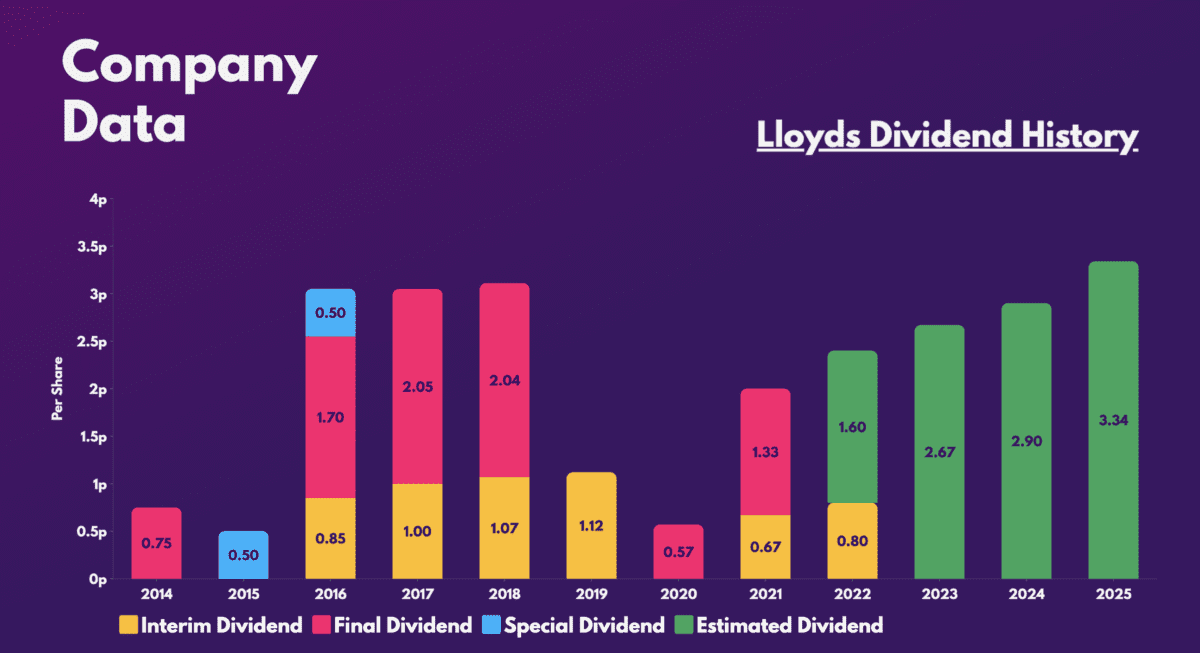

With net earnings forecast to more than double, Barclays expects Lloyds to generate “industry-leading return on capital” through the payment of dividends and the repurchase of shares in the coming years. Blue Eagle bank forecasts the company will return around 45% of its £36bn market capitalization by 2025.

Trusting in a good year

This all adds up to a strong tailwind for Lloyds shares in the short to medium term. In addition, interest rates are likely to remain high for longer, allowing the FTSE 100 firm to continue generating free cash from its assets. A shallower recession will also help expand your net interest margins, as impairment charges are lowered. Also, consumer confidence could be reaching its lowest point soon, according to the bank’s own business barometer.

| Metrics | January | December | Growth |

|---|---|---|---|

| Price expectations | 55% | 58% | -3% |

| economic optimism | 47% | 43% | 4% |

| business trust | 22% | 17% | 5% |

| Manufacturing Industry Confidence | 28% | 13% | fifteen% |

| Trust in the construction industry | 27% | 29% | -2% |

| Service Industry Confidence | 25% | 18% | 7% |

| Retail Industry Confidence | 7% | 13% | -6% |

That said, taxes on windfall profits could be back on the agenda if the profits keep coming in while the economy suffers. No doubt a hefty tax would impact the group’s bottom line and shareholder returns, halting its path to 60p and above.

However, I remain a huge fan of Lloyds. The UK’s largest lender has an excellent finance package. Its CET1 ratio (after dividends and buybacks) sits at a solid 15%, while its liquidity coverage ratio is healthy at 146%. Furthermore, its current and future valuation multiples suggest that the stock is still reasonably priced despite recent gains. So I’ll be buying more Lloyds shares ahead of next week’s earnings, for long-term growth and passive income.

| Metrics | lloyds | industrial average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.8 | 0.7 |

| Price-Earnings Ratio (P/E) | 9.0 | 10.1 |

| Forward price-earnings (FP/E) ratio | 7.7 | 7.3 |

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);

NEWSLETTER

NEWSLETTER