Image Source: Getty Images

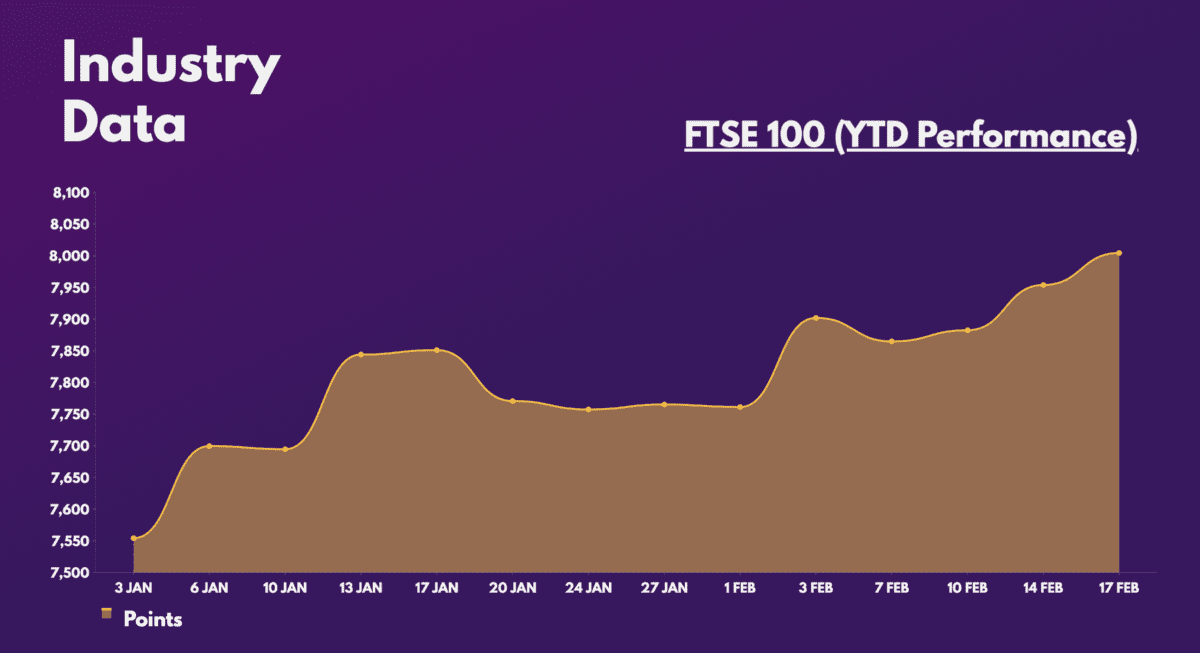

As Warren Buffett once said, “It is much better to buy a wonderful company at a fair price than a fair company at a wonderful price”. Although FTSE 100 recently hit an all-time high, it’s still full of wonderful companies at cheap prices, and some UK stocks can be bargains.

For all the talk about Britain’s flagship index disappointing, it has been the exact opposite over the past year. The index is up nearly 25% since December 2020 and has performed admirably. Investors have flocked to consumer staples, financials and commodities, sectors where the index is heavily weighted, in tough times.

| Sector | % of FTSE 100 |

|---|---|

| Consumer Staples | 17.9% |

| Finance | 17.8% |

| Materials | 13.4% |

| industrial stocks | 12.2% |

| Health care | 11.7% |

| Energy | 9.5% |

| discretionary consumption | 6.9% |

| communications | 4.3% |

| Real estate | 1.4% |

| Technology | 1.4% |

And bad times make strong companies shine. Over the past decade, the FTSE 100’s lack of exposure to growth and technology names has caused investors to flock to US stocks for better prospects, thus painting a bearish picture of UK stocks. However, this has also resulted in a significant opportunity to capitalize on undervalued stocks.

Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.

Sir John Templeton

All in blue chips

The British economy could very well slip into a recession soon. But this shouldn’t affect the headline rate too much. This is because only a quarter of their income comes from local sources, with the majority coming from emerging markets and the US. As such, this presents a very lucrative opportunity to invest in FTSE 100 shares.

China’s exit from its pandemic crisis could also help grease the wheels. This is especially the case for commodity stocks, such as miners and oil explorers. And with interest rates expected to remain elevated throughout 2023, financial and consumer staples should perform well.

Most lucratively, UK stocks are currently trading at relatively low valuation multiples. With an average price-earnings (P/E) ratio of 14 and a forward P/E of 11, the multiples of the main index remain historically very low. Also, Footsie’s dividend yield averages about 4%, which is quite attractive. And with shareholder returns expected to soar in the coming years, there’s no better time to buy than today.

That being said, not all FTSE 100 stocks are equal or have bargains. Indeed, some are reeling on prices, given the UK’s remarkable recovery since October. However, I have three favorites that are worth mentioning.

The first is IAG. The airline group continues to take advantage of the tailwinds from a strong travel industry and is on track to return to full-year profitability. And with load factors still below pre-pandemic levels, there’s still plenty of upside potential for the travel stock.

The second is a builder of houses, taylor wimpey (LSE:TW) as developer shares slowly pick up from the bottom. The housing market may not return to its highs any time soon, but the strong financials and mega dividend (7.5%) of the stalwart FTSE 100 present a lucrative investment opportunity for long-term growth while They earn passive income.

Finally, lloyds (LSE:LLOY) is a great value to take advantage of the current rate hike cycle. The bank is forecast to continue generating high levels of income from its interest-bearing assets. This could result in shareholders receiving higher dividends while earnings continue to grow.

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);