Image source: Getty Images

I have seen regularly National Network (LSE:NG) stock considered an obvious buy. Maybe even the FTSE 100The definitive and obvious purchase. In fact, I have a vague memory of using that description.

In the future I will proceed with caution. It seems to tempt fate. Plus, stock picking always involves a bit of brainpower, even when buying a company as seemingly solid as this one.

There are many things I like about the National Grid energy monopoly. It is strictly regulated by Ofgem, and over 80% of its total revenue is linked to regulatory agreements. This provides clear visibility of profits.

Should I be worried about this FTSE 100 stock?

Many investors use National Grid as a portfolio construction element. They assume that their shares won't be particularly volatile, while dividends should continue to come. I guess that's where the obvious comes into play.

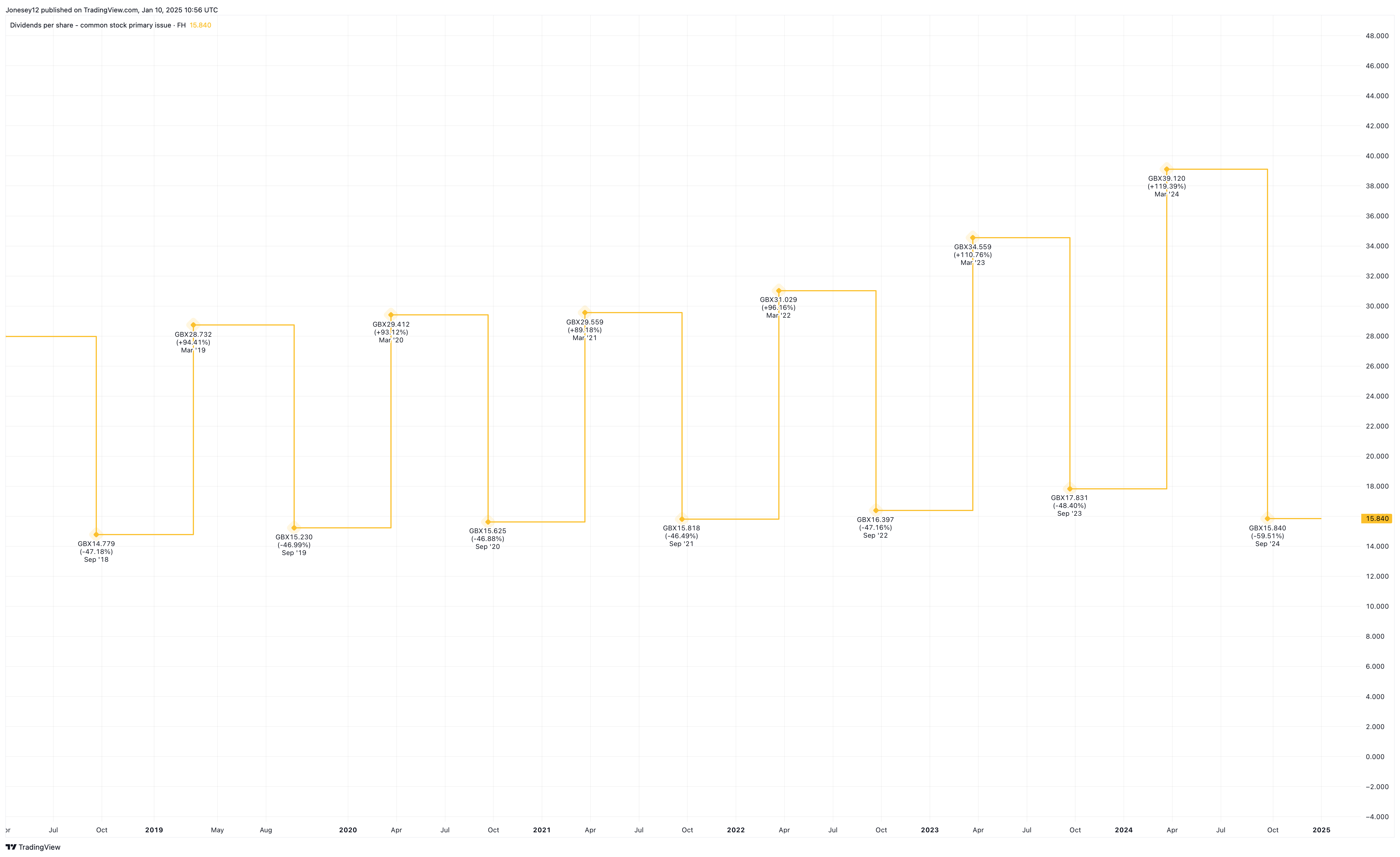

So far, they've been right about revenue. Payments to board shareholders increased steadily over time, as this chart shows.

Chart by TradingView

Unlike many FTSE 100 dividend stalwarts, National Grid maintained dividends throughout the pandemic. Today, it has an extraordinary yield of 6.1%. That's well above the FTSE 100 average of around 3.5%.

However, the yield is expected to fall to 4.9% in 2025. At least you will be well covered, about 1.6 times earnings. But what is happening?

For a supposedly obvious purchase, National Grid has some concerns in mind. It faces high operating and maintenance costs and invests huge sums in network upgrades and renewable energy projects.

The UK's fragile energy infrastructure requires massive investment. The upgrades cost National Grid billions and the bill can only rise with the green transition. This reduces the funds available for expansion or innovation.

I will activate my brain to select stocks next time

In May, shares plunged more than 6% after the board announced a major rights issue to raise around £7bn to fund future investments. It also announced it would cut the dividend from 53.1p to 45.3p per share starting this year. Hence that drop in forward performance.

While National Grid's share price recovered quickly, it is still down 5.3% in the last 12 months. In five years it has increased a modest 8.5%. Combined with five years of reinvested dividends, that brings the total return up to a respectable 35%.

I can't help but cast nervous glances at its massive £42bn debt. Especially since it is expected to reach £46 billion next year.

However, analysts remain optimistic. The 15 offering one-year share price forecasts have produced an average target of just over 1,137p from the current 930p. If correct, that represents an increase of about 22% from today. Combined with that return, this would yield a total return of 27%, if true. We'll see.

Eleven brokers rate National Grid as a Strong Buy, one a Buy and six say Hold. None recommend selling.

But I won't buy it. Yes, the returns are good, but I can find plenty of stocks in the FTSE 100 yielding 5% or more and also with better capital growth prospects. Although I wouldn't call them obvious actions. As National Grid shows, there are always risks.<a target="_blank" href="https://markets.businessinsider.com/news/stocks/ftse-100-national-grid-shares-fall-after-major-uk-rights-issue-mixed-results-1033419164?utm_source=chatgpt.com” target=”_blank” rel=”noreferrer noopener”/>

NEWSLETTER

NEWSLETTER