He Lindsell Train Global Equity The fund is a popular investment in the UK and it’s easy to see why. In the long run, it has generated great returns for investors.

But is it still a good option for ISA or SIPP investors in the future? We’ll see.

investment strategy

Lindsell Train Global Equity is a concentrated fund (it only holds 20-35 stocks) that generally invests in high-quality companies, or “composites” as they are sometimes called. These are companies that consistently generate high returns on equity and can reinvest these returns for future growth.

I like the investment strategy here. It is quite similar to Warren Buffett’s investment approach. It won’t work all the time, of course. But over the long term, I expect it to deliver strong results thanks to the power of compounding.

portfolio holdings

As for the fund’s investments, it contains an interesting mix of stocks. Here’s a look at the latest holdings data (as of the end of February).

There are some big deals in the top 10 holdings, including the likes of London Stock Exchange, Diageoand Unilever.

However, there are a few things to keep in mind here. First, the fund has a lot of exposure to the consumer staples sector (41.4%).

Second, it does not have much exposure to Health (2.5%). And third, there is no Big Tech exposure in the top 10.

Putting all this together, I would expect the fund to behave very differently to the stock market in general.

In volatile conditions, I would expect it to outperform given that significant exposure to Consumer Staples and the absence of Big Tech.

The sting in the tail, however, is that in a raging bull market, you may underperform.

Performance

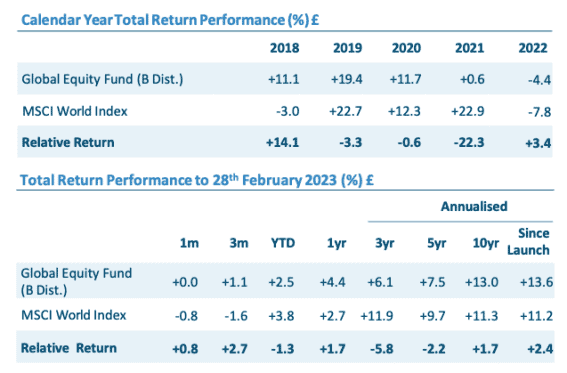

We can see this poor performance in the most recent performance table.

Over the year to end-February (which was volatile), the fund returned 4.4%, outperforming its benchmark (MSCI World Index), which returned 2.7%.

However, during the five-year period to the end of February (in which we saw a strong bull market driven by Big Tech), the fund underperformed the benchmark. Keep in mind that in 2021, when tech stocks really rose, the fund was behind its benchmark by a wide margin.

It’s still beating that benchmark from its inception, just not as much as before.

Fee

Finally, as for the fees, they are relatively low for an actively managed fund. Currently, the rate continues through Hargreaves Lansdown it is only 0.51%. I find that attractive.

My sight

Putting all this together, my opinion is that Lindsell Train Global Equity is still a good fit for an ISA or SIPP.

I see it as a good ‘defensive’ holding. In other words, I think it could help add balance to a portfolio that has a lot of growth investments.

However, I would not invest a large percentage of my portfolio in the fund.

Given the lack of exposure to some areas of the market, I would like to own many other funds/stocks for diversification.

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);

NEWSLETTER

NEWSLETTER