After a strong first quarter, the Aviva The LSE:AV. share price has declined, down 4.7% from this year's high. But over the past year, it has outperformed the Footsie and is now close to its seven-year high.

Shares are trading at £4.73, slightly below the May high of £4.97.

So where do stocks go from here?

To find out, I'm charting some key growth metrics that may reveal hidden clues.

Price-earnings ratio

I always look at the price-to-earnings (P/E) ratio first to get a rough idea of value. If the price is much higher than earnings, the stock could be overvalued, which would limit further growth. But a low P/E ratio suggests that the price has not yet caught up with earnings and further growth is expected.

The average price-to-earnings ratio on the UK market is currently 18.4, close to the highest level in several years. Aviva's price-to-earnings ratio of 12.7 is comparatively low, suggesting the stock has decent growth potential.

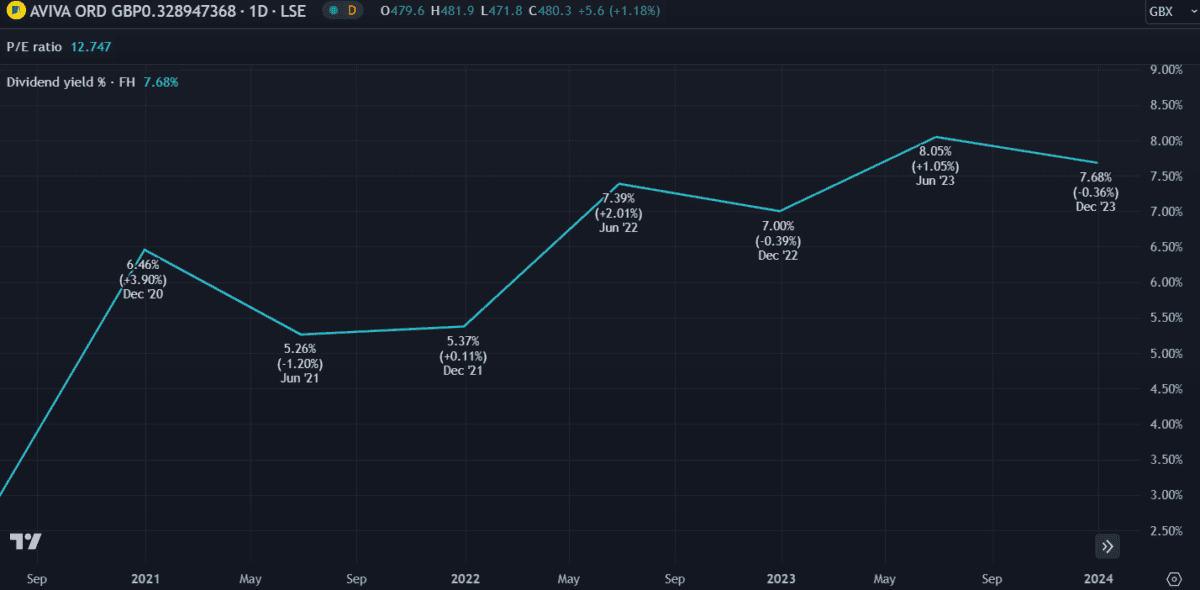

Dividend Yield

One of Aviva's key value propositions is that it is known for being a dividend-paying company. The ability to return a portion of profits to shareholders is a strong indication that a company is performing well. Over the past two decades, it has paid fluctuating annual dividends of between 15p and 30p per share. Overall, there hasn't been much growth, but the payouts have been consistent.

The dividend yield indicates what percentage of the current share price is paid out annually. Currently at 7.68%, we can see from the chart that it has been growing steadily since 2021. It is now the seventh highest dividend yield in the world. FTSE 100 Index — although slightly below the competition Legal and generalin fifth place.

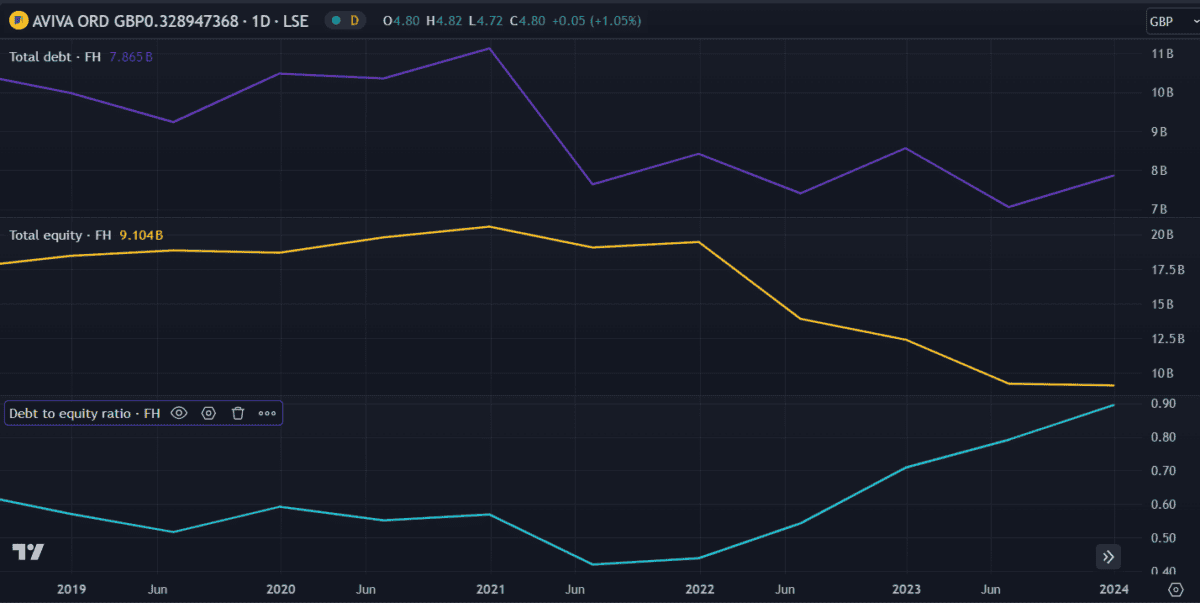

Debt

Debt can be very helpful to a company if used correctly. In fact, it is considered a critical part of any successful company’s operations. But when it is used as a lifeline, it can become a problem. The chart below shows three important metrics: debt, equity, and debt-to-equity (D/E) ratio. We can see that debt has been declining, which is a good thing. However, equity has been declining at a faster rate, leading to an increase in the D/E ratio.

Ideally, the debt-to-earnings ratio should remain below one. Now that Aviva is at 0.9, it is getting dangerously close to having more debt than equity. This is a worrying situation. If a company does not have enough equity or cash flow to cover its debt, it can default or, in the worst case, file for bankruptcy.

Fortunately, Aviva has plenty of cash and assets, so that's not a risk for now.

My verdict

Taking the above metrics into account, Aviva’s share price still looks cheap to me. This is reflected in the price-to-earnings ratio and is supported by future earnings estimates, which estimate it will trade 42% below fair value. But that doesn’t mean it will grow.

The UK insurance market is highly competitive and Aviva faces many rivals. If the economic recovery is delayed, consumers may seek cheaper alternatives, putting its profits at risk. With capital falling and debt rising, it cannot afford to lose customers at this crucial time.

On paper, things look good and I think the share price could improve from here, but I wouldn't expect huge growth. Fortunately, the high dividend yield gives the stock great value in any case.