Andranik Akobian

The IPO market has experienced a roller coaster ride in recent months, with volatility becoming the norm. October ended on a shaky note, with several IPOs delayed or canceled due to market conditions. Investors now look ahead to November to see what’s new. month will bring.

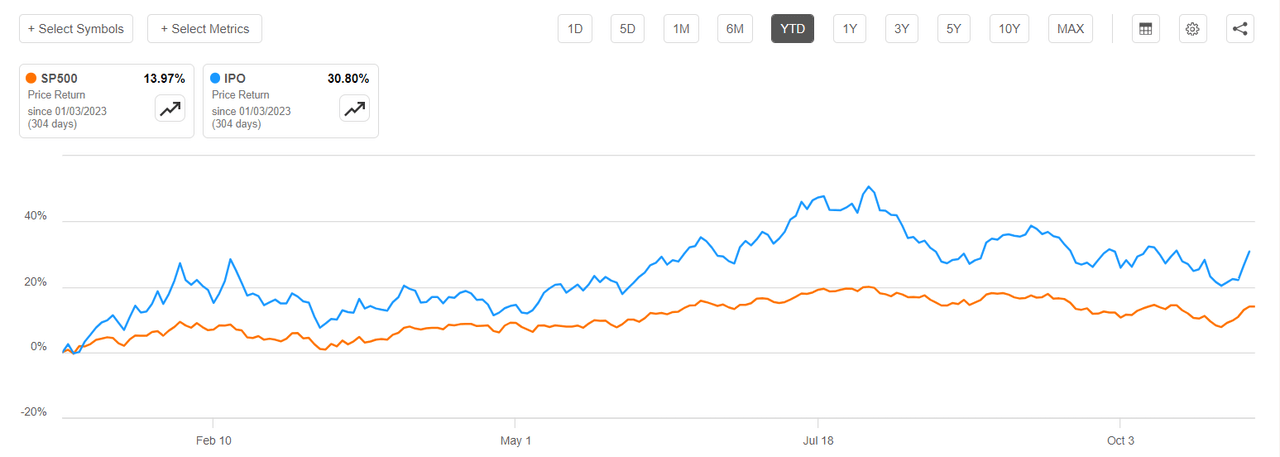

In particular, the Renaissance IPO ETF (NYSERCA: IPO) is up more than 30% year to date, outperforming the S&P 500 (SP500) by 14%.

In a noteworthy development, Arm Holdings (ARM), WK Kellogg (KLG), Instacart (CART), and Klaviyo (KVYO) will reveal their financial results this week for the first time since going public. This marks an important milestone for the companies, and their inaugural public financial performance will be closely scrutinized by the market.

Here are some of the other major headlines in the IPO market:

Upcoming IPOs expected to list this week

Shimmick (NASDAQ: WEDGE) is raising up to $50.1 million in an initial public offering by offering 4.6 million shares at an estimated price between $10 and $12 per share. Description: A California-based construction company specializes in public water infrastructure.

NYIAX (NYX) is raising $7.5 million by issuing 1.9 million shares at a price of $4 per share. Description: An advertising technology platform.

Globavend Holdings (GVH) is raising $8.4 million by issuing 1.9 million shares, which are expected to be priced between $4 and $5 per share. Description: Provider of e-commerce logistics solutions.

Trident Digital tech Holdings (TDTH) is raising up to $16.9 million by issuing 1.9 million shares, which are expected to be priced between $8 and $10 per share. Description: Consulting company based in Singapore.

Elate Group (ELGP) is raising up to $5.8 million at a price of $4 per share. Description: Moving service provider.

Hamilton Insurance Group (HG) is raising about $255 million by issuing 15 million shares, which are expected to be priced between $16 and $18 per share. Description: Insurance provider.

Wetouch technology (WETH) is raising $44.8 million by offering 4 million shares at $11.20. Description: China-based company specialized in large format touch screens.

Ryde Group (RYDE) is raising $10.1 million by issuing 2.3 million shares, which are expected to be priced between $4 and $5 per share. Description: A ride-hailing and ride-hailing services platform in Singapore.

NYIAX (NYX) is raising $7.5 million by issuing 1.9 million shares at a price of $4 per share. Description: An advertising technology platform.

First person (NASDAQ:FP) is raising $13.1 million by issuing 2.9 million shares, which are expected to be priced between $4 and $5 per share. Description: Psychedelic mushroom producer.

EV Mobility (EVMO) is raising $9 million by offering 1.8 million shares, which are expected to be priced between $4 and $6 per share.

Note: Many IPOs have been delayed recently and there could be last-minute debut changes or cancellations.

Notable new presentations

Neo-Concept International Group Holdings (NCI) has filed to raise up to $9 million in an initial public offering by offering 2 million shares at a price range of $4 to $5. The company, which generates revenue primarily through the sale of private label apparel and its own brand knitwear, plans to list on the Nasdaq under the symbol NCI. Description: A Hong Kong-based clothing retailer and supply chain services provider.

Ten-League International Holdings (TLIH) has filed with the SEC to raise up to $32 million in an initial public offering. It plans to list on the Nasdaq under the symbol TLIH. Description: A Singapore-based heavy equipment and engineering consulting services provider.

Baiya International Group (BIYA) has filed with the SEC to raise up to $15 million in an initial public offering. The company plans to offer 3M shares at a price range of $4 to $6 and list on the Nasdaq under the symbol BIYA. Baiya International Group filed confidentially on November 14, 2022. Description: A Chinese human resources platform that connects companies and labor employment agencies.

Terms and changes

Richtech Robotics (RR) has reduced the proposed deal size by 33% for its upcoming initial public offering. The company now plans to raise $10 million by offering 2 million shares at $5, a 33% decline from the previous range of $4 to $6. The company plans to list on Nasdaq under the symbol RR.

Planet Image International (YIBO), a Chinese toner cartridge manufacturer, has reduced its stock offerings in its upcoming US IPO. The company now plans to raise $6 million by offering 1.3 million shares at a price range of $4 to $5, a 69% decrease from its previous offering of 4 million shares. The company plans to list on Nasdaq under the symbol YIBO.

Impact BioMedical has set the terms of its initial public offering and plans to raise $8 million by offering 2 million shares at a price range of $3 to $5. The company plans to list on the NYSE American, but has not yet selected a symbol.

IN the comment

“I think the environment ahead will be good for the company’s focus, so my outlook for Hamilton Insurance Group, Ltd.’s IPO is a buy up to $17.00 per share,” the leader writes of the Donovan Jones investment group.

NEWSLETTER

NEWSLETTER