Image Source: Getty Images

Sainsbury’s (LSE:SBRY) is one of the FTSE 100The most popular actions of . This is because it is one of the few UK supermarket stocks available to trade on the public market. With that in mind, how much better off would you be if you had bought the shares earlier this year?

A whole basket of returns

If I had invested £1,000 just under three months ago, retail stocks would have returned about 17% of my investment. This translates to roughly a £117 profit, excluding broker’s fees and/or capital gains tax.

| Metrics | sainsbury shares |

|---|---|

| amount invested | £1,000 |

| stock growth | 17% |

| total dividends | N/A |

| trotting return | £1,170 |

Given the time frame and broader stock market performance, Sainsbury’s shares actually generated quite a large return. The FTSE 100 is flat, while the S&P 500 it’s only up 3% since January. However, there are several reasons for the recent rally in stocks.

The first is that undervalued stocks got a lot of attention earlier in the year, as UK stocks were recovering from the mini-budget events in October. Sainsbury’s share price received a further boost when Bestway bought a large £250m worth of stake in the company.

Investors hope Bestway’s position could benefit JS given the former’s experience in cutting costs. And with a strong Christmas update too, sentiment remained positive for the orange-labeled supermarket.

| Metrics | Q3 2023 | Q3 2022 |

|---|---|---|

| Grocery | 5.6% | 12.5% |

| General merchandise | 4.6% | -6.9% |

| Comparable sales (for example, fuel) | 5.9% | -4.5% |

| Comparable sales (including fuel) | 6.8% | 0.6% |

Will there be a difference?

Having said that, Sainsbury’s shares may struggle to make such large gains in the future, at least in the short term. The stock has been trading sideways since late January. Investors are wary that the grocery store may not deliver on its upgraded outlook given the continued rise in food inflation.

| Metrics | Outlook for FY23 |

|---|---|

| Profit Before Taxes (PBT) | £630 million to £690 million |

| Free cash flow | £600 million |

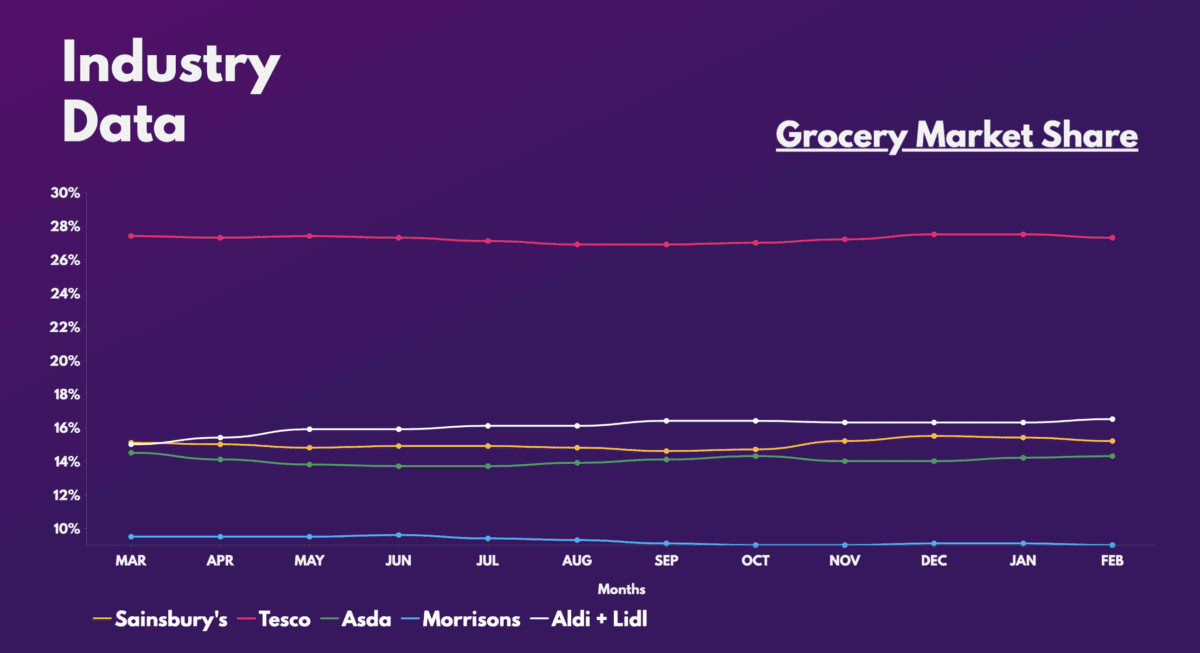

The instability surrounding the company’s market share is also not entirely convincing. This could indicate that customers are fleeing to discounters Aldi and Lidl, thereby depressing sales at Sainsbury’s.

Is it worth buying Sainsbury’s shares?

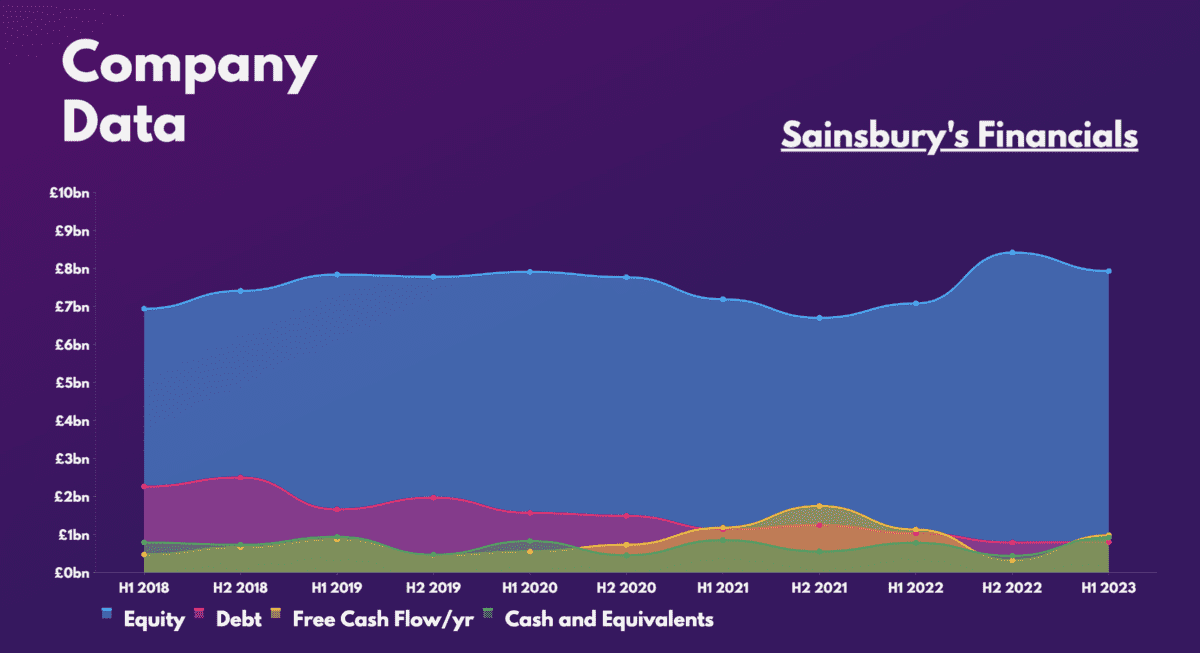

Putting that side, it must be said that the conglomerate has a stellar balance sheet, especially when compared to Tesco. Combine that with a healthy dividend yield of 4.1% and it can be argued that Sainsbury’s shares may be a better investment than its larger counterpart.

In addition, it has attractive valuation multiples, all of which are below the industry average, even after this year’s strong performance so far. That being said, the stock has an average price target of £2.48. And with Sainsbury’s share price currently at £2.63, this puts it 6% above its target price.

| Metrics | Sainsbury’s | industrial average |

|---|---|---|

| Price-to-book (P/B) ratio | 0.8 | 1.4 |

| Price-Sales Ratio (P/S) | 0.2 | 0.3 |

| Price-Earnings Ratio (P/E) | 10.5 | 13.4 |

| Forward price-to-sales ratio (FP/S) | 0.2 | 0.4 |

| Forward price-earnings (FP/E) ratio | 13.7 | 12.4 |

This could mean that stocks are more likely to go down rather than keep going up. Therefore, it is not surprising to see that the brokers of jefferies and JP Morgan remain ‘underweight’ the stock.

The group could very well see further share price gains in the medium term through better and more efficient cost savings, especially now that Bestway is on board. In addition, the retailer’s Argos division could successfully expand and generate a strong and growing revenue stream while expanding margins.

However, I don’t see this happening anytime soon. There appear to be no catalysts pointing to significant market share or earnings growth. As such, if you had bought the Sainsbury’s shares earlier in the year, you would be looking to sell them for a profit given the limited growth potential and reinvest in a different UK stock to buy and hold for the long term.

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);

NEWSLETTER

NEWSLETTER