Image source: Getty Images

itv (LSE: ITV) shares plunged into penny share territory in March 2022 and have yet to recover above £1. With the stock at almost 86 pence today, what would my return have been if I had invested in the stock? FTSE 250 company a year ago?

Let’s break down the numbers and explore my take on the current business outlook.

one year return

A year ago, the ITV share price stood at 114.80 pence. Despite having staged an impressive rally from its September lows, the stock is still down 25% since February 2022.

I haven’t invested in the company before, but I find it always helpful to use past performance as an investment guide, even if it doesn’t guarantee future returns.

If you had deployed a lump sum of £1,000 worth of shares 52 weeks ago, you would have been able to buy 871 shares, with 9p left over as spare change.

As I write, my shareholding would be valued at £748.19. Thanks to a good dividend yield, I was also able to add £43.55 in passive income to my total return.

So I would keep £791.83 of my original £1k investment today. That is a disappointing result. But does that mean ITV shares could be a bargain today?

The outlook for the ITV share price

I think next year could be better for the media business than the last. Using price/earnings as a valuation measure, the stock looks reasonably cheap at a multiple of 7.33.

Perhaps the most exciting development for the company is its new free streaming service ITVX. With the help of the FIFA World Cup in December, ITV broadcast hours increased by 55% year on year. ITVX also allows viewers to watch popular shows like love island and Coronation Street.

The platform offers the broadcaster multiple sources of income. CEO Carolyn McCall says the new service has “landed very well” with advertisers. Viewers can also choose to remove ads via a subscription service priced at £5.99 per month, which also includes Britbox packages.

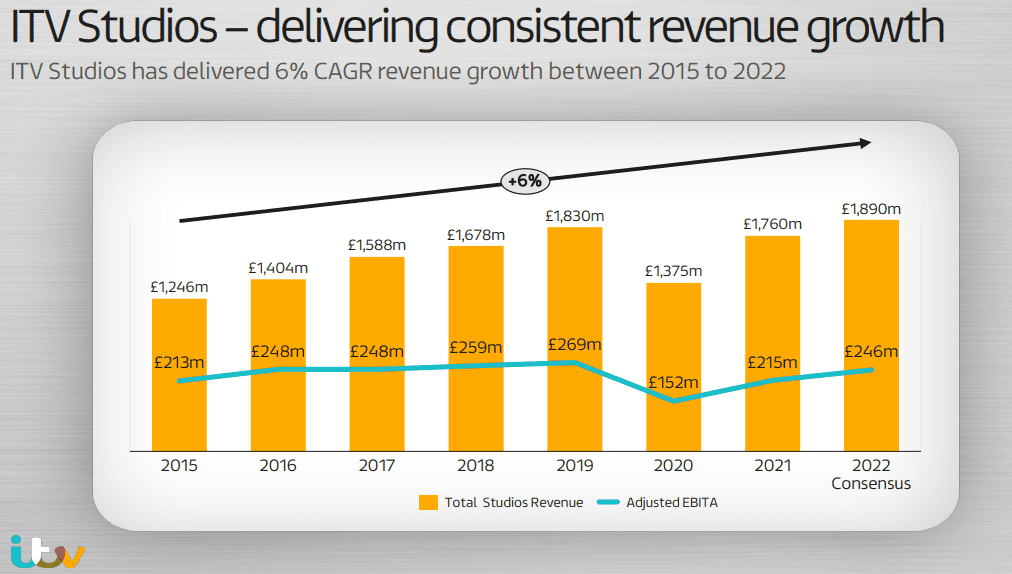

In addition, the business is showing early signs of an upturn in other divisions. Despite a big drop in revenue during the pandemic, ITV Studios, the company’s international television production and distribution arm, is forecast to generate record revenue by fiscal 2022.

There are reports that a Hollywood producer and a French production company are contemplating acquiring strategic interests in ITV Studios, which analysts valued at more than £2.5bn last year. This could translate into a positive boost to the share price if a deal is reached.

It is true that the business faces risks from possible reductions in ad spending, particularly if the UK economy slips into recession this year in line with the recent IMF forecast. With that being said, I think that stocks look oversold right now after a rough couple of years.

Would buy?

I am optimistic about the future of the ITV share price. Although the performance over the past 12 months is not pretty, the stock looks like a value investing proposition to me today.

Ultimately, if all goes well, the company could return to the FTSE 100. In this scenario, additional capital inflows from passive investors could help boost stocks.

With some extra money, I would invest in ITV today.

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);