Image source: Getty Images

The UK stock market is packed with high-yielding dividend stocks. Many have the potential to generate long-term passive income for my portfolio.

However, Legal and general (LSE:LGEN) in particular would be my top choice if I had to pick just one stock. It offers the perfect combination of high returns combined with a track record of reliability and a long track record of excellent performance.

I have held the stock in my portfolio for some time and plan to continue adding to it over time.

This is why.

Payment history

At first sight, Legal & General might not look like such an attractive option right now. Its share price plunged 12% in June after it revealed plans to reduce dividend growth from next year.

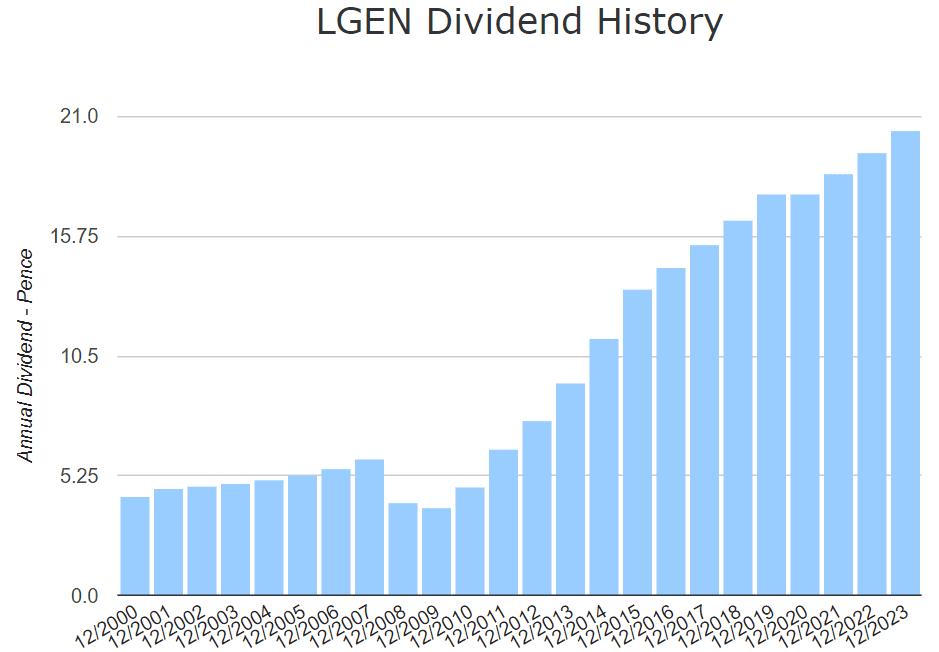

But its track record keeps me interested. Aside from a small dip after the 2008 financial crisis, dividends have risen steadily for more than 20 years. Its 15-year dividend growth rate is 11.34%, considerably higher than most other stocks.

When I invest for the long term, I try to ignore minor setbacks. History tells me that the reduction in dividend growth is unlikely to last long.

Long-term growth

Recent results aside, Legal & General shows decent growth over long periods. For example, over the past 30 years, it is up 457%, with an annualised return of 5.89%. That is slightly lower than the average annual growth of the FTSE 100, but much higher if you add dividends to the mix.

Even if L&G's average return over that period was only 5%, total returns would still be higher.

But if we work with the current yield of 9% and take into account price growth, a £10,000 investment would earn me dividends of around £930 after a year. If we leave it there for 20 years while reinvesting the dividends, it could grow to around £145,000, giving me an annual dividend of £11,800.

Now that's not bad at all!

Risks

Insurance is a competitive industry in the UK and Legal & General is not without its rivals (although I have investments in some of them too, just in case!). Its main competitors include Aviva, Prudentialand Admiral's Group.

Despite the price drop, Legal & General's price-to-earnings (P/E) ratio of 30 is much higher than most of its rivals. But with earnings expected to grow by 178% over the next 12 months, that figure could fall to 10.8. It would then be more in line with other UK insurance companies.

If earnings do not rise, further price growth will be impeded. This, combined with lower dividend growth, would significantly reduce the value of the company. With an annual dividend of 20p and earnings per share (EPS) of just 7p, the payout ratio is already almost three times that (hence the plans to reduce dividend growth).

Big boots to fill

All in all, my faith in Legal & General remains unshakeable. The new CEO, António Simões, certainly has a lot to offer. This year, he succeeded Sir Nigel Wilson, who was knighted for his outstanding work at the firm.

So far, Simões seems highly motivated to take up that role – and then some. His plans include a £200m share buyback programme, an organisational restructuring and the sale of Cala, the company's housebuilding business.

Whether his ambitions will translate into success remains to be seen, but I hope they do.

NEWSLETTER

NEWSLETTER