Image source: Getty Images

Ocado Group (LSE:OCDO) is a FTSE 100 shares that are in danger of being relegated from the prestigious index of the UK's largest listed companies. This is because its share price is down 30% since April 2023. And it is 85% lower than its all-time high reached in September 2020.

The company now has the second-lowest market capitalization on Footsie, trailing only Santiago Square. But despite this drop, I still think the online food retailer is hugely overvalued.

Some numbers

To illustrate this, the table below contains some key financial metrics for the company extracted from its accounts for the 53 weeks ending December 3, 2023 (FY23). I have also included some important valuation measures. For comparison, I have added the same data for Port energy (LSE:HBR) as disclosed in its 2023 accounts.

| Extent | Ocado Group | Port energy |

|---|---|---|

| Revenue (£million) | 2,825 | 2,925 |

| Profit/(loss) before taxes (£million) | (403) | 470 |

| Dividend yield (%) | – | 6.7 |

| Price-to-book ratio (PTB) | 1.99 | 1.86 |

| Assets (£million) | 4,429 | 7,793 |

| Loans (£million) | 1,462 | 401 |

To me, the latter seems to be in a much better financial situation. And yet Ocado has a stock market valuation of £3bn. Incredibly, this is 25% higher than Harbor Energy.

I should point out that the oil and gas producer has its own problems. In 2022, the government imposed a 25% energy profits tax on the industry. A year later, it was increased to 35%. Combined with other taxes, this resulted in the company having an effective tax rate of 95% in 2023. Not surprisingly, this has acted as a drag on its share price performance.

But there are many other examples I could have chosen and all of which – I believe – show that Ocado shares are very expensive. And for that reason alone I would not like to invest.

Am I missing something?

However, stock market valuations must look forward. They are supposed to reflect a company's potential rather than its historical performance.

But in my view, Ocado is far from profitable, although its management remains optimistic about its future prospects.

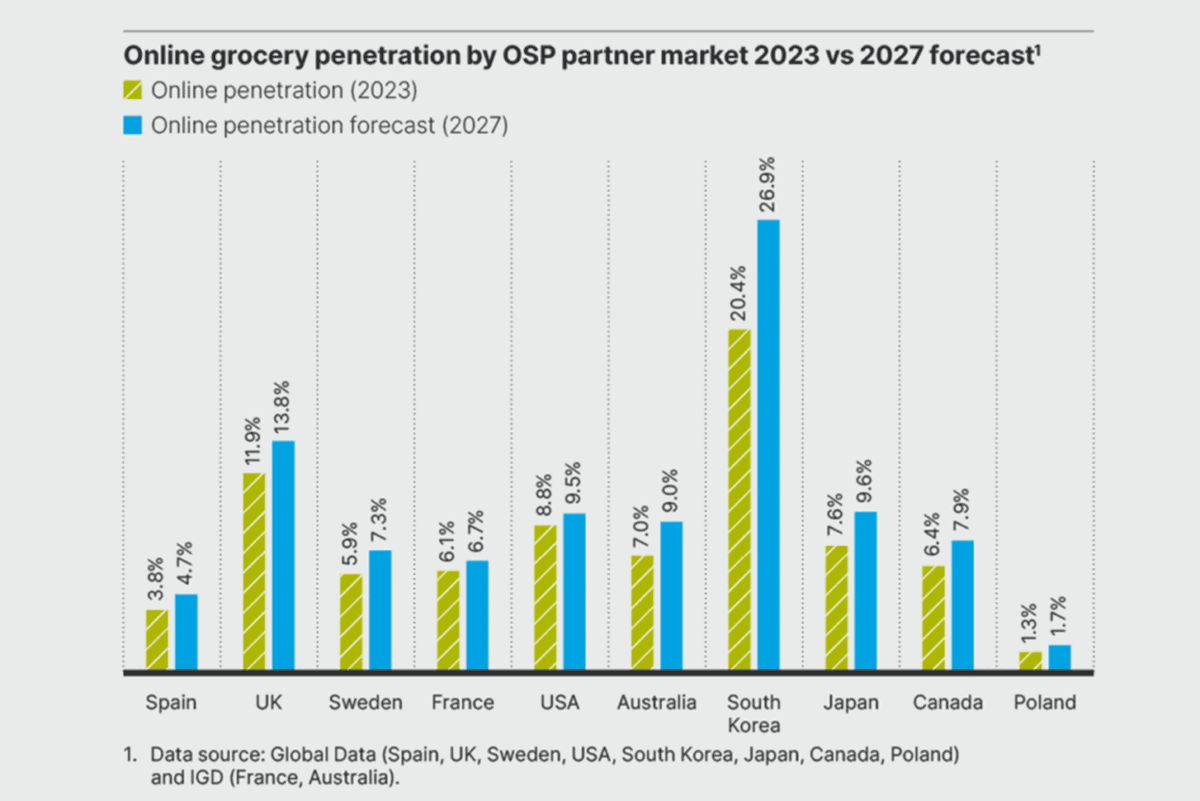

They claim their core market is large and growing. As the chart below shows, the share of food purchased online is forecast to grow over the next four years across all its key territories.

This should help boost the retail side of your business.

But it will also create more opportunities to license its automated warehouse technology. The company also sees potential to allow other retailers to use its ordering platform which it says is “battle tested”and protected by more than 2,600 patents.

According to their website, allowing third parties to use their software and technology will further accelerate their “virtuous circle of growth, investment and innovation”.

All of this makes Ocado look like a technology company. And I guess that's the point. By establishing itself as a smart technology company, it will be able to attract a higher valuation multiple than a traditional retailer.

But since 85% of its FY23 revenue comes from its joint venture with Marks and SpencerIn my opinion it is an online grocery store.

Final thoughts

The company claims that it has the “Operational knowledge to enable our partners and customers to achieve scalability and success.”. Cynics (like me) will wonder why Ocado has failed to do this after more than two decades of trading.

And surprisingly, the company's 2022 report states: “We are just beginning our growth journey in the grocery sector and beyond.”.

If I were a shareholder, my patience would have run out long ago.

NEWSLETTER

NEWSLETTER