Image source: Getty Images

I think packing my stocks and Shares ISA with FTSE 100 stocks are a great way to earn a second income. The steady stream of juicy dividends I have received since I began my investing journey many years ago is a testament to the success this investment strategy can have.

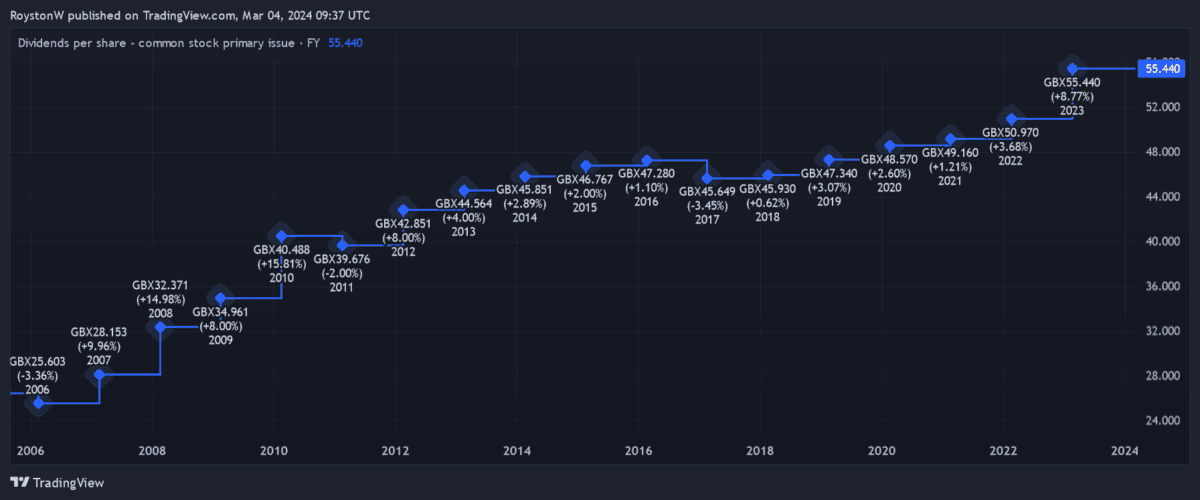

National Network (LSE:NG.) is a top stock with a strong track record of growing shareholder rewards. I must remember that large capital expenditures could derail this track record in the future. But impressive cash flows and a formidable “economic moat” still mean it could remain one of Footsie's biggest earners.

A passive income of £100

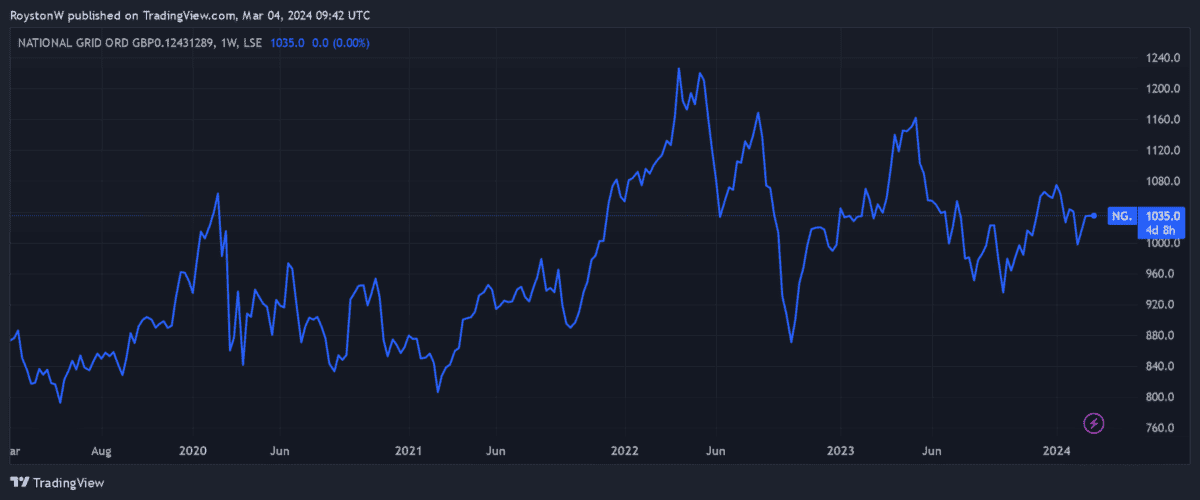

How many National Grid shares would you need to earn a three-figure monthly income? If you were aiming for a payment of £100 each month, you would have to buy 2010 actions of the company. This is based on a dividend yield of 5.8% for the fiscal year to March 2025.

With a current share price of £10.35, you would need to spend £20,803.50 to do this. In my opinion, it would be a sum worth paying.

As I say, National Grid's performance is just below 6%. To put this into context, the average return on FTSE 100 shares stands at 3.8%. The good news is that City analysts expect dividends to continue rising in fiscal 2026 as well. Therefore, the yield increases to 5.9%.

A reliable income provider

National Grid's excellent dividend record can be attributed to its ultra-defensive operations. Profits and cash flows remain stable at all points in the business cycle. It has the means and confidence to pay (almost) big dividends year after year.

It's also due to those economic moats, or competitive advantages, that I mentioned before. Regulator Ofgem has given it a monopoly over maintaining the UK's electricity grid, meaning it does not suffer its rivals taking away revenue.

Debt threat

Of course, dividends are never guaranteed. And as with any UK stock, there are potential issues I should consider before buying shares for income.

As I mentioned before, the business of keeping Britain's lights on is hugely expensive. What's more, National Grid will have to spend a lot of money in the future to decarbonize the country's electricity grid.

This will add more stress to a balance sheet that already has a lot of debt. Net debt is forecast to reach £44.5bn in March, up £3.5bn year-on-year.

Stock price rise?

Overall, though, the company appears to be in better shape than many other high-yield dividend stocks. And the company is positioning itself for further sustained dividend growth through its strategic investments. Its plan is to expand its asset base by 8% to 10% each year.

I'll look to add the stock to my own portfolio when I have extra money to invest. Once the Bank of England starts cutting interest rates, its share price could soar. In the meantime, I can console myself by receiving fairly large dividends.