Image source: Getty Images

I can't wait to start topping up this year's ISA and now seems like a great time to do so as I can see cheap stocks everywhere.

Last week they got a little cheaper, with the FTSE 100 Index On Friday, they fell 1.18% and closed at 8,155.72. That only makes me want to buy more.

I won't be able to reach the £20,000 maximum I'm entitled to in my stocks and shares ISA this year. However, I'll be investing as much as I can. Over time, I think it's possible I could start from scratch and save a large sum, like £275,000. That would make my retirement look a lot brighter.

FTSE 100 Index buying spree

I'm not putting a penny into a cash ISA. I have an easily accessible savings account for short-term emergencies, but shares are the best way I know to build long-term wealth. While it's possible to get 5% in cash today, that percentage will drop once the Bank of England cuts interest rates.

By contrast, these two FTSE 100 stocks pay income of around 7% and can hopefully continue to do so regardless of what happens to base rates.

FTSE 100 Index mining giant Rio Tinto (LSE:RIO) looks really cheap today, trading at just 8.8 times earnings, well below the FTSE 100 average of 12.7 times.

It has a cumulative return of 6.9% per year, decently covered by earnings at 1.7 times. It is also projected to return 6.9% next year.

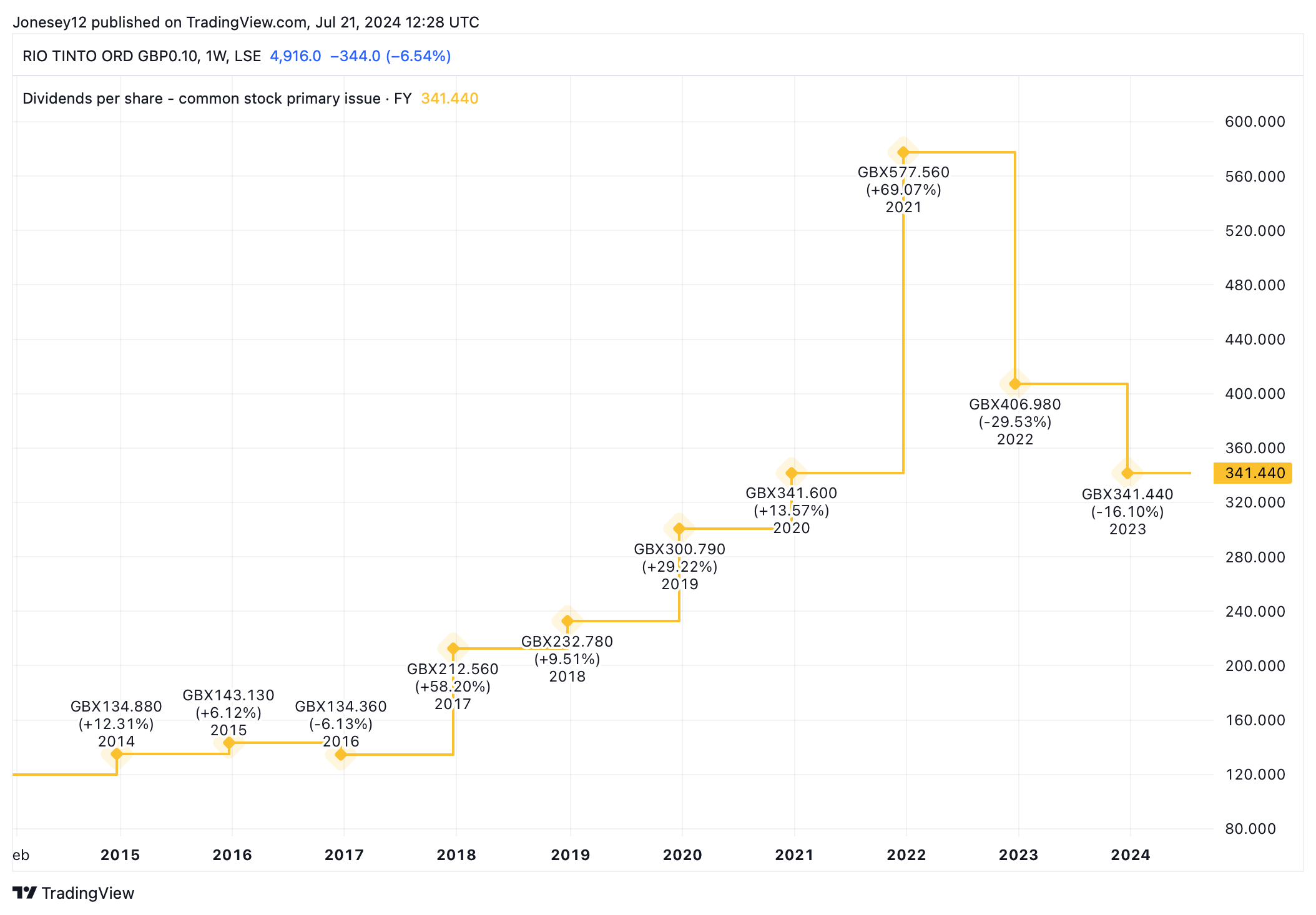

Dividends are never guaranteed. As this table shows, Rio Tinto's board has recently cut its payout to shareholders.

TradingView Chart

Like all mining stocks, Rio Tinto has been hit by the slowdown in China. Revenue hit $63.5 billion in 2021, but fell to $55.6 billion in 2022 and $54 billion in 2023.

Sales are projected to continue to slow to $53.1 billion in 2024 and $53.7 billion in 2025. So there's a reason it's cheap.

<h2 class="wp-block-heading" id="h-great-value-stocks“>High value stocks

Rio Tinto's share price plunged 6.54% last week and is down 3.53% in a year. However, taking a long-term view, the current low valuation offers a brilliant entry price. I'll buy it as soon as I have the cash and then wait for it to recover.

Now, let's say I have £10,000 to invest in my ISA this tax year and I put £5,000 into Rio Tinto and £5,000 into a FTSE 100 insurer. Avivawhose yield is expected to be 7.2%.

All in all, that would give me an average forward return of 7.05%. With a £10,000 stake, I would get an income of £705 in the first year.

If these shares offered an average total return of 7% per year, it would take me 49 years to reach my target of £250,000. That's too long.

However, if I put £10,000 more into an ISA each year, I'll get to that level in just over 14 years. And if my stock picks perform well and give me a total annual return of 9%, I'll get to that level in less than eight years. Of course, there's a risk that it won't happen and that I could lose money too. But that's my strategy and I'll stick to it over the summer, filling my ISA with cheap UK shares.

NEWSLETTER

NEWSLETTER