Image Source: Getty Images

An investor that opens an ISA action and shares before the deadline of April 5 has a golden opportunity to overcome its wealth, taking advantage of the power of tax free composition. With platforms such as Hargreaves Lansdown and I BellEstablishing an ISA is fast, and finance it before the end of the fiscal year ensures that some, or all, of the annual assignment of £ 20,000 are operated. Once the clock attacks at midnight on April 5, any unused portion has gone forever.

How to get going

The cultivation of a wallet is intelligent options and patience. Rookie investors are often advised to choose a combination of global shares, indices and investment trusts that disseminate the risk while capturing market profits. The most experienced investors may prefer to invest in individual shares. This is a more risky approach, but a diverse portfolio of well chosen actions can grow much faster than the average index. It is simply worth conducting thorough investigation and avoiding common difficulties such as throwing good money after a bad and emotional investment.

Magic occurs with the compound. This is when we invest in companies that reinvote profits for us, such as growth -oriented technological actions, and the dividends ourselves reinvirt. This leads to a constant capital appreciation, which shoots over time, turning modest investments into serious wealth.

Dream big, it can be achieved

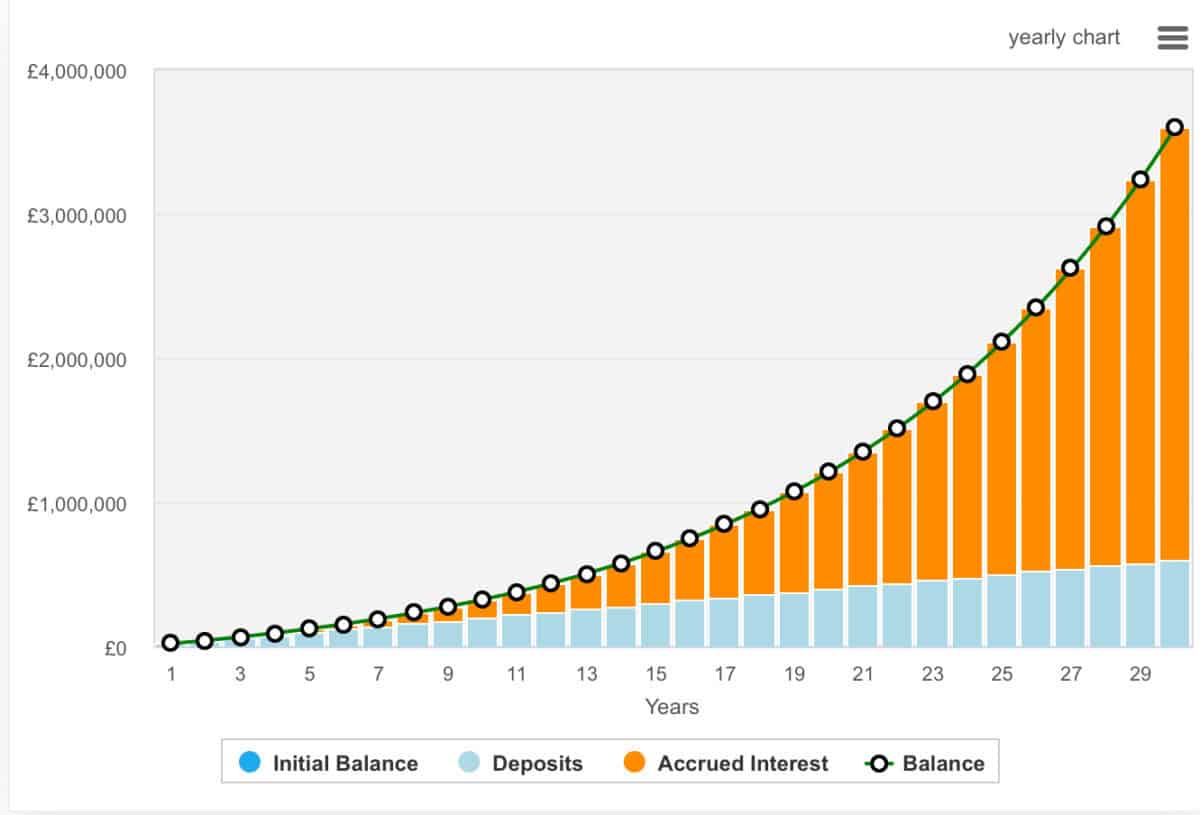

Hit the £ 1m brand is not just a dream. They are mathematics. With an average yield of 7%, a portfolio could double every 10 years. Using this formula, to the maximum the assignment of ISA every year places the millionaire state in the reach in less than 25 years. The most experienced investors can achieve two -digit yields when averaged in the long term. In fact, 10% yields would mean reaching the millionaire state in just 19 years. However, those of us making smaller contributions can also get there. It will only take a little more. Fortunately, our investment will grow faster over time, that is aggravated.

The real edge? Without taxes, never. Unlike regular investment accounts, an ISA protects each gain and tax dividend, allowing the entire growth and reinvestment force to function without interference.

Keep in mind that tax treatment depends on the individual circumstances of each client and may be subject to changes in the future. The content in this article is provided only for information purposes. It is not intended to be, it does not constitute any form of fiscal advice. Readers are responsible for carrying out their own due diligence and obtaining professional advice before making investment decisions.

The practical bit

Market drops become purchase opportunities, while diversification in sectors and regions provides stability. An investment that offers both diversification and growth potential is The Monks Investment Trust (LSE: MNK). This confidence points to the growth of long -term capital by investing worldwide in a diverse portfolio of actions mentioned. The Monks team emphasizes investment in adaptable companies that can navigate in changing market conditions, spreading investments in four growth categories: unconditional, fast, cyclical and latent.

The main properties of monks include technological giants such as Goal platforms, amazonand Microsoftwith a significant assignment to US actions.. Actually, it is a very diversified portfolio with the five main holdings that represent less than 20%: I have seen that much higher figure in other trusts. This diversification strategy has helped confidence to deliver strong returns, exceeding its reference index in recent periods.

However, investors must be aware of the use of the gear trust, which stood at 4.96% from the latest data. While the gear can amplify profits in favorable market conditions, it can also increase losses during recessions, which can lead to greater volatility in trust performance and the price of shares.

Despite this gear, it is an action that interests me a lot. In fact, it is one that I have added to my daughter's sipp.

(Tagstotranslate) category. Investing

NEWSLETTER

NEWSLETTER